Introduction to Robinhood and Option Trading

In the world of investing, Robinhood has revolutionized the landscape for retail investors. With its commission-free stock and option trading, it has made it easier than ever for individuals to access financial markets. Option trading, in particular, provides investors with an opportunity to hedge against risk, speculate on market movements, or even generate additional income. However, it’s crucial for beginners to understand the inherent risks and associated fees involved in option trading before diving in.

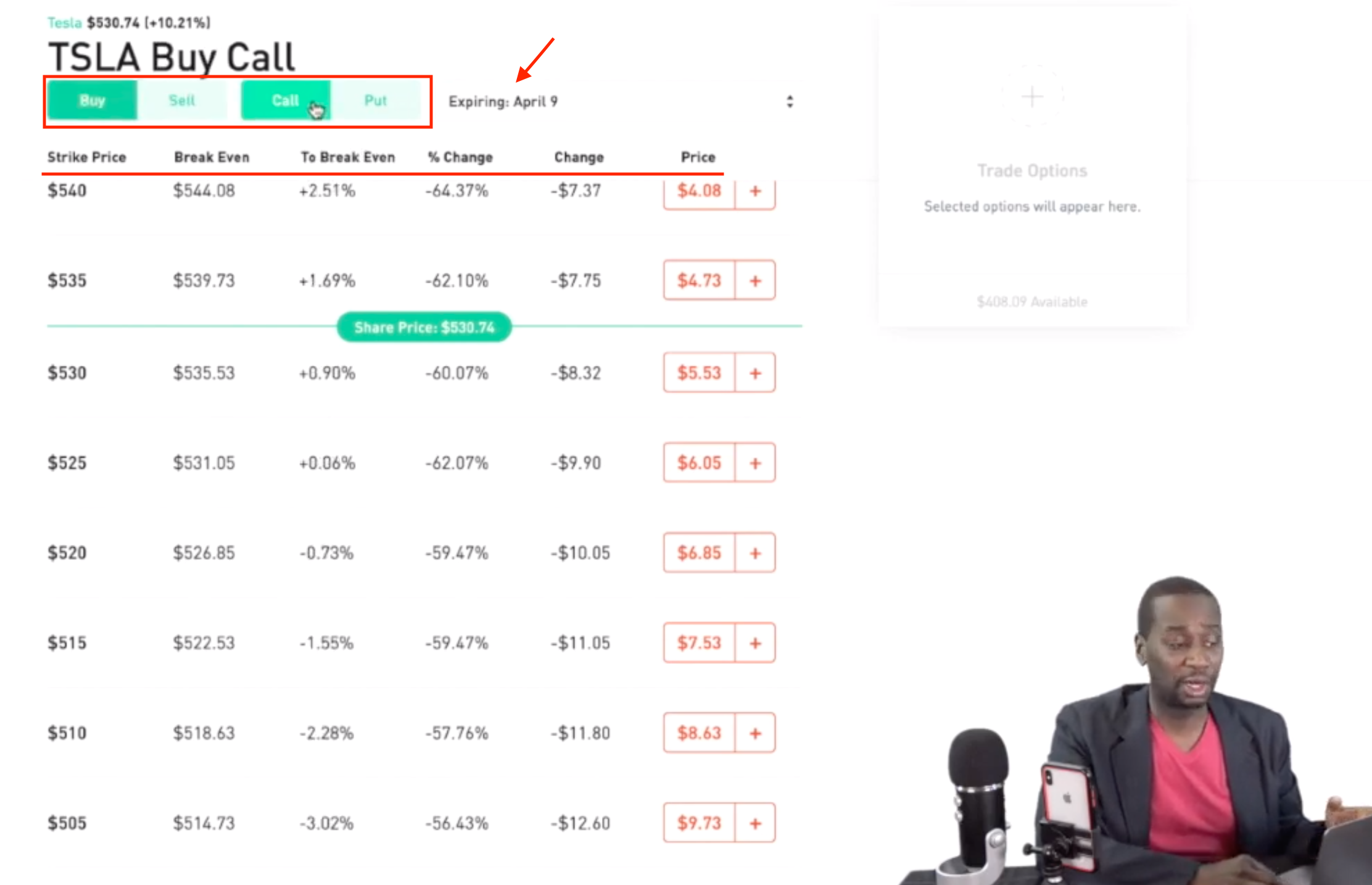

Image: thebrownreport.com

Enter Robinhood’s $0.00 option trading fees. This groundbreaking move has shattered traditional barriers and made option trading more accessible to everyday investors. However, it’s important to note that while the trading fees may be gone, other costs and nuances remain in place.

Understanding Option Trading Fees

Options are a type of derivative contract that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a predetermined date. This flexibility comes at a cost in the form of a premium, which is the price paid to the option seller for the right to exercise the option.

Unlike traditional stock trading where investors only pay a commission on each trade, option trading involves several different fees:

1. Premiums

As mentioned earlier, premiums are the fundamental cost of option trading. They represent the value of the option contract and are determined by factors such as the underlying asset’s price, volatility, time to expiration, and strike price.

2. Assignment and Exercise Fees

When an option is exercised, the contract holder has the right to either buy or sell the underlying asset at the strike price. For stock options, there are no additional fees associated with this process. However, for certain index options, there may be an assignment fee charged by the exchange.

Image: 4xpip.com

3. Margin Interest

If an investor holds an option contract that is assigned but does not have sufficient funds in their account to cover the purchase or sale of the underlying asset, they may be subject to margin interest. This interest is charged on the borrowed funds used to complete the transaction.

Robinhood’s Option Trading Fee Structure

For Robinhood users, the traditional commission fees for executing option trades have been eliminated. However, the following costs still apply:

1. Premiums

As with any option trading, the premium is still the primary cost for Robinhood users. The premium amount is determined by the aforementioned market factors and is not affected by Robinhood’s fee structure.

2. Assignment and Exercise Fees

Robinhood does not charge any additional fees for exercising or being assigned index options. However, for stock options, a $0.65 per-contract fee applies to both assignments and exercising.

3. Margin Interest

Margin interest rates vary and are subject to change based on market conditions and individual account status.

Navigating Option Trading Fees

To make informed decisions, it’s important for beginners to understand how these fees impact their trading strategy:

1. Consider Your Objectives

If your goal is speculative trading and you plan to close out your option contracts before expiration, the premium will be your primary expense. Focus on identifying options with attractive risk-to-reward ratios to maximize potential gains.

2. Evaluate Long-Term Strategies

If you plan to hold options until expiration or exercise them, you need to factor in both the premium and potential assignment or exercise fees. Ensure that the potential profit outweighs these costs.

3. Manage Your Margin Use

If you plan to use margin to trade options, be aware of the margin interest rates and implications. Careful risk management is crucial to avoid excessive margin costs.

Tips for Lowering Trading Costs

While Robinhood offers zero commissions, there are strategies to further reduce your overall trading costs:

1. Shop Around for Better Premiums

Compare premiums offered by different brokers to secure the best deal. Some brokers may offer lower premiums, especially for high-volume traders.

2. Trade During Off-Peak Hours

Market volatility tends to be higher during peak trading hours, which can push up premiums. Consider trading during less volatile times to potentially secure lower premiums.

3. Avoid Frequent Trading

Excessive trading can accumulate unnecessary costs, such as assignment fees or frequent margin interest charges. Develop a disciplined trading plan and avoid excessive trades to minimize expenses.

Robinhood Option Trading Fees

Conclusion

Robinhood’s $0.00 option trading fees have opened up new opportunities for beginner investors. However, it’s essential to understand the remaining fees and their implications to navigate option trading effectively. By carefully considering premiums, managing margin use, and adopting cost-effective strategies, you can minimize expenses and position yourself for success in the exciting world of option trading.

Remember, knowledge is power, and it’s always advisable to consult with a financial advisor before making any investment decisions. May your trading journey be filled with informed choices and rewarding outcomes!