In today’s dynamic financial landscape, the realm of trading options has emerged as a potent tool for investors seeking to enhance their portfolio performance. Smart trading options involve employing sophisticated strategies to navigate market volatility, manage risk, and seize profitable opportunities. This comprehensive guide delves into the intricacies of smart trading options, empowering investors with the knowledge and insights to excel in this complex and potentially rewarding arena.

Image: walloftraders.com

Options, in essence, confer the right to buy or sell an underlying asset at a predetermined price within a specified time frame. Understanding the mechanics of options trading is crucial for success. Calls grant the holder the right to buy, whereas puts bestow the right to sell. Familiarity with the interplay of strike prices, expiration dates, and premiums is essential to informed decision-making when trading options.

Leveraging Option Strategies for Market Advantage

Empower yourself with a repertoire of smart trading options strategies tailored to diverse market conditions. Covered calls, for example, involve selling a call option while owning the underlying asset, providing a passive income stream while preserving downside protection. Protective puts, on the other hand, safeguard against potential losses by allowing investors to sell an asset at a guaranteed price.

For those seeking leverage in their trading, spreads offer an enticing option. Bull call spreads involve buying a call at a lower strike price and simultaneously selling a call at a higher strike price, creating the potential for significant gains in rising markets. Iron condors and butterflies offer nuanced strategies for profiting from market volatility, albeit with greater risk.

Mastering Risk Management and Volatility

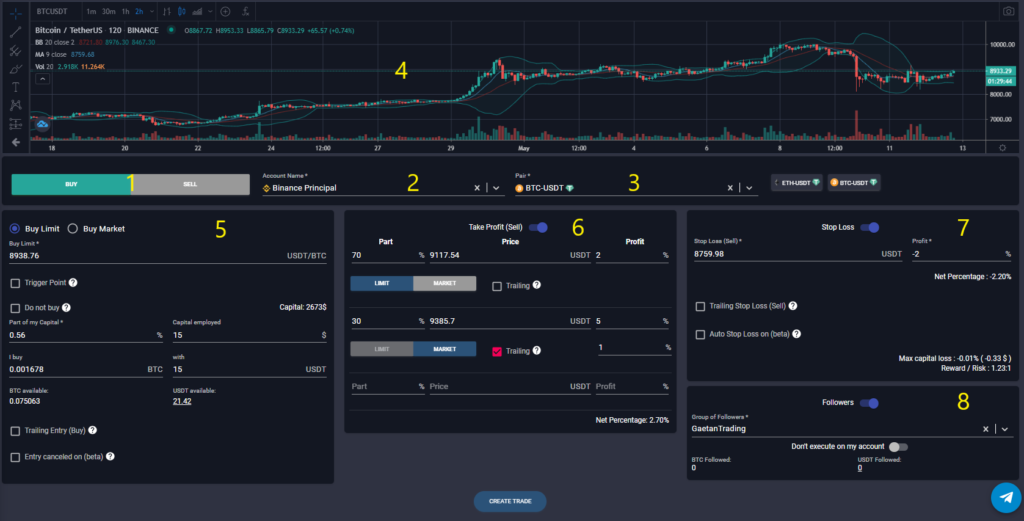

In the realm of options trading, managing risk is paramount. Employ stop-loss orders to limit potential losses and prevent catastrophic outcomes. Calculate Greeks, metrics that gauge option sensitivity to underlying asset price movements, volatility, and time decay, to fine-tune option selection and monitor portfolio risk.

Volatility, the lifeblood of options traders, can present both opportunities and challenges. Study historical volatility patterns and leverage volatility indices like the VIX to predict future market behavior. Employ hedging strategies to mitigate risk and preserve capital during volatile market conditions.

Navigating Market Dynamics in Option Trading

Stay abreast of macroeconomic factors, corporate earnings reports, and geopolitical events that can significantly impact market direction. Utilize technical analysis, including trendlines, support and resistance levels, and momentum indicators, to identify potential trading opportunities. Enhance your decision-making process by incorporating sentiment analysis, monitoring investor sentiment through surveys, news articles, and social media.

Delve into fundamental analysis, examining company financials, economic data, and industry trends, to gain a comprehensive understanding of the underlying asset’s value and growth prospects. Monitor earnings announcements and analyst reports to anticipate market reactions and adjust your trading strategies accordingly.

Image: www.youtube.com

Smart Trading Options

Conclusion

Smart trading options empower investors with an array of strategies to harness market volatility, manage risk, and unlock potential profits. Thorough understanding of option types, strategies, and risk management techniques is essential for success in this dynamic arena. By leveraging the knowledge and insights provided in this guide, investors can navigate market fluctuations with greater confidence and position themselves for enhanced portfolio performance in the ever-evolving world of financial markets.