Introduction

Image: www.youtube.com

In the ever-evolving financial landscape, option trading has emerged as a powerful tool for investors to enhance their portfolio’s potential. As the leading financial institution in India, SBI has made option trading accessible to all with its user-friendly platform, SBI Smart. This comprehensive guide will unravel the intricacies of option trading in SBI Smart, empowering you to make informed decisions and boost your trading prowess.

What is Option Trading?

An option contract grants you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) within a specified period (expiry date). This flexibility allows you to speculate on the price movement of the asset, optimize returns, or hedge against potential risks.

Benefits of Option Trading on SBI Smart

-

User-friendly interface: SBI Smart’s intuitive platform simplifies option trading, making it accessible even for beginners.

-

Wide range of options: SBI Smart offers a diverse selection of options contracts across various underlying assets, including stocks, indices, and commodities.

-

Competitive pricing: SBI Smart provides competitive brokerage fees and transparent pricing, ensuring you maximize your trading profits.

-

Advanced trading tools: Access advanced charting capabilities, technical indicators, and order entry tools to enhance your trading efficiency.

Getting Started with Option Trading on SBI Smart

-

Open an account: Create an account with SBI Smart and link it to your bank account for seamless trading.

-

Understand contract specifications: Familiarize yourself with key terms like strike price, expiry date, and contract size to avoid potential misunderstandings.

-

Choose an option strategy: Determine your trading objective and select an appropriate option strategy, such as bull call spread, bear put spread, or covered call.

-

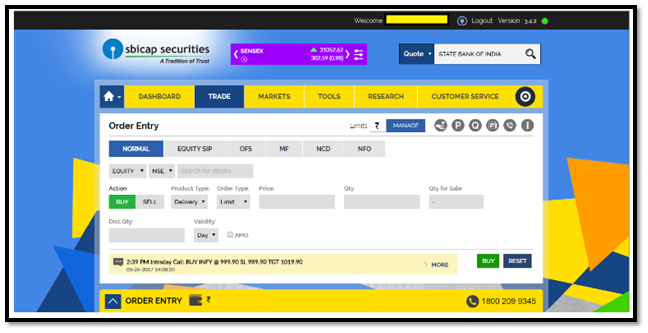

Place an order: Enter your order specifications, including the contract type, strike price, expiry date, and quantity. Consider using limit orders to set specific price triggers for execution.

-

Monitor the trade: Track the performance of your option contract regularly using SBI Smart’s advanced tracking tools. Adjust your strategy or close the position as needed.

Expert Insights and Actionable Tips

-

Start small: Begin with a modest investment amount to minimize potential losses and gain experience.

-

Seek professional advice: Consult with a financial advisor to assess your risk tolerance and develop a tailored trading plan.

-

Manage risk: Implement robust risk management techniques like hedging and stop-loss orders to protect your capital.

-

Leverage technical analysis: Utilize charting tools and technical indicators to identify potential trading opportunities.

-

Stay informed: Keep up with market news and company announcements that may impact option prices.

Conclusion

Option trading on SBI Smart empowers you to harness the potential of financial markets and augment your investment returns. Embrace the flexibility, risk management capabilities, and expert insights offered by SBI Smart to elevate your trading experience. Remember, investing involves inherent risks, so conduct thorough research, manage your risks prudently, and consult with professionals when necessary. Unlock the world of option trading today and embark on a rewarding financial journey.

Image: comparesharebrokers.com

Option Trading In Sbismart

Image: stockquantum.com