In the realm of finance, options present a captivating avenue to navigate market fluctuations and potentially enhance returns. However, embarking on this journey can be daunting, primarily due to the complexities inherent in options trading. This comprehensive guide unveils the gateway to understanding and mastering the art of options trading through the use of a paper trading app.

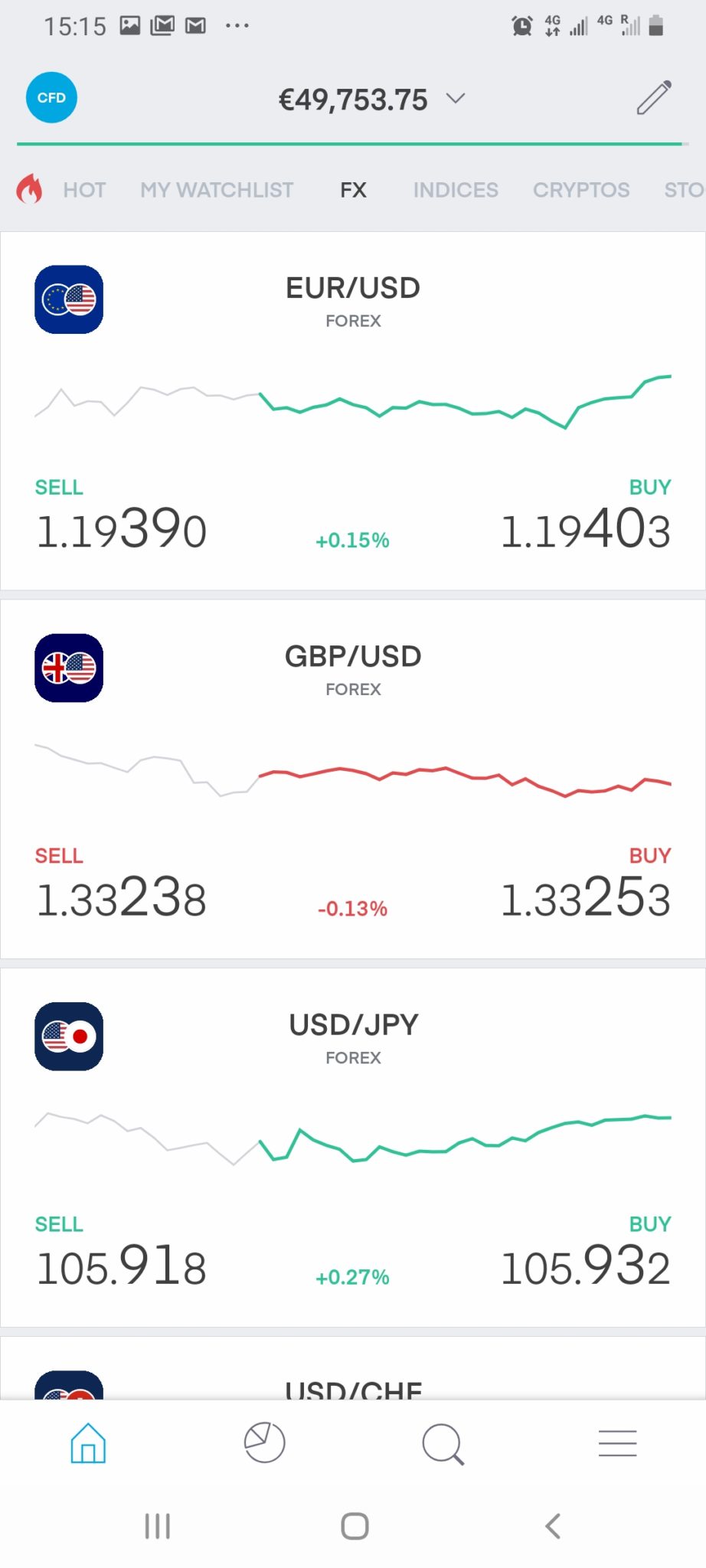

Image: front.page

Paper trading apps serve as invaluable platforms that empower traders to delve into the world of options trading without risking real capital. These simulations mirror the intricacies of live trading, providing a safe and controlled environment to hone skills, refine strategies, and gain confidence before venturing into real-world markets.

Unveiling the Symphony of Option Trading

Options, essentially, are financial instruments that bestow the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. This flexibility opens doors to an array of strategic possibilities, from hedging against potential losses to enhancing profit potential.

Option trading involves two primary types of contracts—calls and puts. Call options confer the right to purchase an asset at a future date while put options grant the right to sell. Understanding the intricate interplay between these contracts is paramount to successful option trading.

The Power of Paper Trading Apps: A Virtual Marketplace for Mastery

Paper trading apps have fundamentally revolutionized the learning curve for aspiring options traders. These digital playgrounds replicate the ebb and flow of real markets, allowing traders to navigate the complexities of options trading without the financial risks associated with live trading.

The beauty of paper trading apps lies in the opportunity to make informed decisions without the pressure of risking real capital. Traders can experiment with different strategies, gauge market movements, and develop a comprehensive understanding of options trading dynamics.

A Step-by-Step Journey to Options Trading Proficiency

-

Embark on Paper Trading: Select a reputable paper trading app that aligns with your learning objectives and trading style.

-

Familiarize Yourself: Take time to explore the platform, understand its features, and master the nuances of the simulation environment.

-

Craft a Comprehensive Trading Plan: Document your trading strategies, risk management parameters, and profit targets to guide your trading journey.

-

Execute Simulated Trades: Begin placing virtual trades to put your knowledge into practice. Monitor the performance of your trades, analyze results, and refine your strategies accordingly.

-

Seek Expert Insights: Supplement your paper trading experience by studying market commentary, consulting with experienced traders, and attending webinars or seminars.

Image: stockapps.com

Sage Advice from Seasoned Traders

- Master the Fundamentals: Ground your understanding in the fundamental concepts of options trading before dipping your toe into paper trading.

- Embrace Market Volatility: Volatility is the lifeblood of options trading. Learn to navigate market fluctuations and use them to your advantage.

- Manage Risk Prudently: Develop a robust risk management strategy to mitigate potential losses and preserve your virtual capital.

- Measure Performance Objectively: Track your paper trading performance to identify areas for improvement and refine your approach.

- Transition to Live Trading Gradually: Once you’ve gained confidence and achieved consistent profitability in paper trading, consider transitioning to live trading with small positions to mitigate risks.

Option Trading Paper Trading App

Empowering the Next Generation of Options Traders

Option trading paper trading apps are indispensable tools for aspiring options traders seeking to master the intricacies of this dynamic market. By embracing the guidance outlined in this comprehensive guide, you can embark on a transformative journey toward financial empowerment and trading success.