**Trading Options with Limited Capital**

Embarking on the enticing world of options trading can be daunting, especially when it comes to determining the necessary capital requirements. Unlike other asset classes, options offer leverage, magnifying both potential profits and risks. This guide will provide a thorough understanding of the minimum capital needed for options trading, empowering you with the knowledge to navigate this complex market with confidence.

Image: www.chegg.com

**Understanding the Options Market**

Options contracts grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock or commodity, at a predetermined price (strike price) by a specific expiration date. The premium paid for an option represents the cost of acquiring this right.

Options offer traders the unique ability to speculate on market direction with limited capital compared to buying the underlying asset outright. This leverage makes options trading an attractive proposition for both seasoned investors and those with modest portfolios.

**Determining Minimum Capital Requirements**

Quantifying the precise minimum capital needed for options trading is subjective and depends on several factors:

- **Underlying Asset:** The value of the underlying asset directly influences the option’s premium. Trading options on highly priced stocks or indices typically mandates more capital than those on lower-priced assets.

- **Option Premium:** The intrinsic value of the option, or its difference between the strike price and the underlying asset’s current market price, determines a significant portion of the premium. Out-of-the-money (OTM) options, which have less intrinsic value, can be acquired for lower premiums than in-the-money (ITM) options.

- **Volatility:** Higher volatility in the underlying asset expands the potential for option premium gains and losses. Traders must factor in volatility when determining capital requirements, as it can impact trade size.

- Strategy:** The specific options trading strategy employed also influences capital needs. Buying options outright (naked options) requires more capital than covered options strategies, which utilize the underlying asset as collateral.

**Recommended Capital for Beginners**

Given the variables involved, it’s challenging to establish a definitive minimum capital requirement. However, industry experts generally recommend beginners allocate no more than 10% of their investment capital for options trading.

For instance, if an investor has $10,000 in their trading account, it might be prudent to earmark $1,000 for options trading. This cautious approach helps manage risk and ensures the investor has sufficient capital to cover potential losses.

Image: www.researchgate.net

**Expert Advice for Options Trading**

- **Control Risk:** Always define clear risk parameters and trade within those limits. Avoid overleveraging and ensure trade size aligns with your capital.

- **Understand Options Mechanics:** Thoroughly comprehend options terminologies and strategies before executing any trades. Attend seminars, read books, and seek guidance from reputable sources.

- **Market Monitoring:** Monitor the market continuously for news, events, and economic data that may impact options prices.

- **Paper Trading:** Practice options trading in a simulated environment before using real capital to gain practical experience.

- Conservative Approach:** Start with small trade sizes and increase them gradually as your knowledge and confidence grow.

**Q&A on Options Trading**

Q: How do I determine the profitability of an options trade?

A: The profitability is determined by the difference between the net premium collected (selling options) or paid (buying options) and the potential gain or loss from the underlying asset’s price movement.

Q: What is the difference between call and put options?

A: Call options convey the right to buy the underlying asset, while put options convey the right to sell the underlying asset.

Q: What is an “option chain”?

A: An “option chain” displays all available options contracts for a particular underlying asset on a specific expiration date.

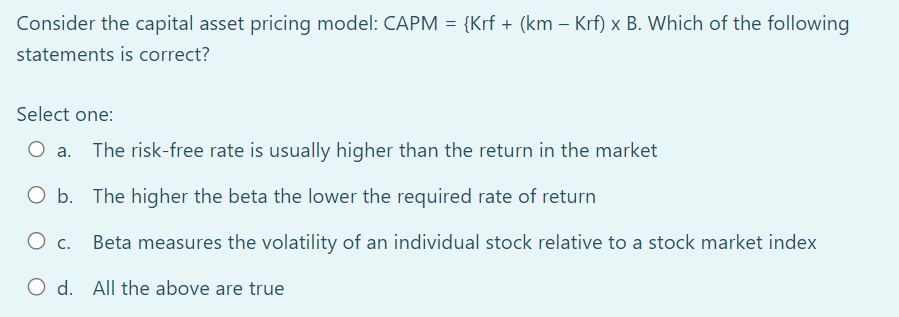

Miniumum Capital Required For Trading Option

Image: www.pdfprof.com

**Conclusion**

Options trading presents a unique opportunity for investors to enhance returns and manage risk. However, navigating this complex market requires careful consideration of capital requirements. By understanding the factors that influence minimum capital needs and following the insights provided above, you can confidently embark on your options trading journey.

Are you intrigued by the world of options trading? If so, this guide has provided essential insights to empower your investing journey. Remember, knowledge and prudent risk management are key to success. Embrace the possibilities and explore the exciting realm of options trading.