Headline 1: Nassim Taleb’s Revolutionary Insights Transforming Options Trading

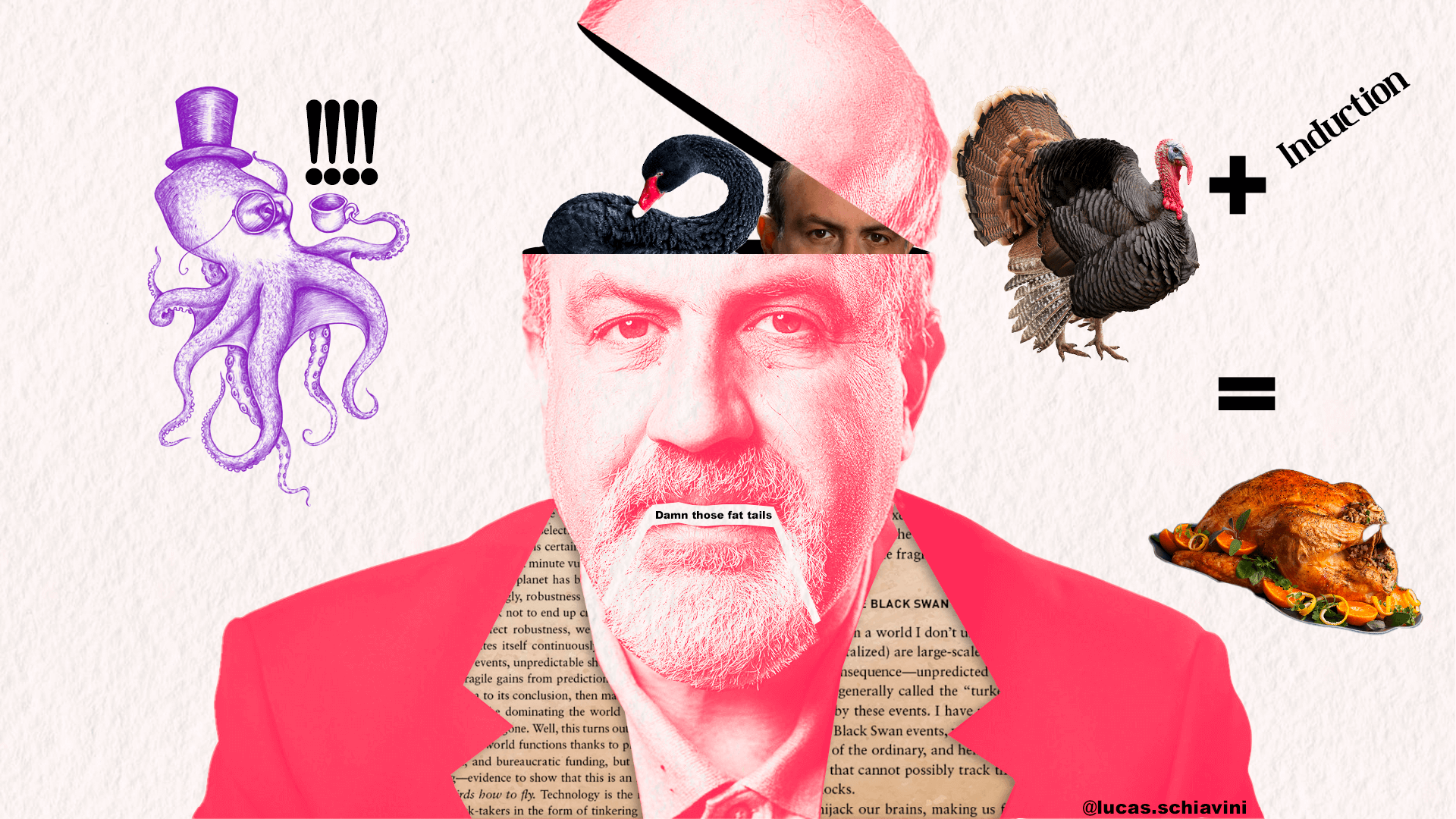

Image: lucas-schiavini.com

Headline 2: Understanding the Complexities of Options Trading Through Nassim Taleb’s Lens

Introduction:

In the labyrinthine realm of finance, where uncertainty looms like a perpetual specter, Nassim Taleb has emerged as an enigmatic figure, challenging conventional wisdom and illuminating the hidden intricacies of risk. Among his many game-changing contributions, his perspectives on options trading have left an enduring impact on both practitioners and theorists alike.

Taleb’s unique approach to options trading stems from his deep understanding of the limitations of probability theory in the face of real-world uncertainty. He argues that many financial models rely on the assumption of normality, which can lead to catastrophic losses in the event of extreme events, known as “black swans.” Options markets, with their ability to hedge against these tail risks, have become increasingly vital in the post-crisis era.

Main Body:

1. The Fallacy of Normality:

Taleb’s central premise is that the financial markets are inherently unpredictable and subject to non-linear dynamics. He dismisses the Gaussian distribution, which underlies many statistical models, as an inadequate representation of market behavior. Instead, he advocates for the concept of “fat tails,” which captures the increased probability of extreme events.

2. Options as Asymmetric Risk Tools:

Options provide a powerful tool to mitigate the impact of these extreme events. Call options offer the potential for unlimited upside with limited downside, while put options offer protection against severe price declines. Taleb emphasizes the importance of using options to hedge against “left-tail” risks, where large losses can occur with unpredictable frequency.

3. The Antifragility Principle:

In his seminal work, “Antifragile: Things That Gain from Disorder,” Taleb introduces the concept of “antifragility,” which describes systems that thrive under stress and uncertainty. He argues that overly simplistic strategies, like maximizing Sharpe ratios, can actually make portfolios more fragile. Instead, he advocates for strategies that exploit volatility and uncertainty.

4. Path Dependency and Nonlinearity:

Options trading requires a deep understanding of path dependency and nonlinear relationships between options prices and underlying assets. Taleb emphasizes the importance of considering the entire probability distribution of possible price outcomes, rather than relying solely on point estimates.

5. Tail Risk Hedging and Skewness:

Taleb stresses the importance of hedging against tail risks by purchasing options that pay off handsomely in the event of extreme events. He advocates for strategies that exploit the asymmetry between the return distributions of assets and options, which can generate a positive “skewness premium.”

6. Volatility Suppression and the Impact of Technology:

The proliferation of electronic trading and the growth of the options market over the past decade have significantly altered market dynamics. Taleb argues that these developments have suppressed volatility and made index funds more vulnerable to sudden crashes.

7. Nassim Taleb’s Investment Philosophy:

Taleb’s investment philosophy revolves around minimizing exposure to black swan events and capitalizing on extreme market conditions. He advocates for a combination of safe assets, such as Treasury bonds, with asymmetric bets, such as out-of-the-money options, to achieve a “convex” risk profile.

Conclusion:

Nassim Taleb’s insights on options trading have profoundly influenced the way investors perceive and manage risk. His emphasis on non-linearity, extreme events, and antifragility has challenged conventional models and given rise to new investment strategies. By understanding the intricate interplay between options and uncertainty, investors can harness the power of these financial instruments to protect their wealth and navigate the treacherous waters of the financial markets.

Image: holainversion.com

Nassim Taleb And Options Trading

Image: www.bloomberg.com