Nassim Nicholas Taleb, a renowned scholar, trader, and philosopher, has revolutionized the world of risk management and investing with his unique perspective on randomness, optionality, and probability. In his magnum opus, “Dynamic Hedging,” Taleb unveils a profoundly original approach to options trading that has captivated investors, academics, and financial industry professionals.

Image: therobusttrader.com

In this comprehensive guide, we will delve into the wisdom of Nassim Taleb’s options trading strategies, unpacking his unconventional but highly effective approach to hedging and maximizing returns.

Black Swans and Fragility

Taleb’s trading philosophy is rooted in his understanding of the critical role that unpredictable events, or “Black Swans,” play in financial markets. Black Swans are rare but highly consequential events that can upend traditional risk models and devastate unwary investors.

Based on this understanding, Taleb advocates for strategies that prioritize protecting capital over maximizing profits. His options-based hedging techniques are designed to provide investors with a safety net against unforeseen market volatility and shocks.

Optionality and Asymmetry

At the core of Taleb’s approach lies his astute understanding of optionality. Options provide investors with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and time. This asymmetry gives investors the potential to participate in market upswings while limiting their downside risk.

Taleb leverages optionality to create highly asymmetric trading strategies. He employs out-of-the-money options, which confer the option to participate in market gains beyond a specific price, while minimizing premiums paid. This approach allows investors to reap substantial profits while protecting their portfolios from extreme losses.

Management of Tails

Taleb recognizes the importance of managing market extremes, or “fat tails” of the probability distribution. Unlike traditional models that assume a normal distribution of returns, Taleb acknowledges that risk in financial markets is often concentrated in the tails.

His hedging strategies address this risk by overweighting options that provide protection in extreme market conditions. By focusing on the outliers, Taleb ensures that his portfolios are resilient to Black Swan events and market dislocation.

Image: voi.id

Diversification and Convexity

Taleb emphasizes the importance of diversification and convexity in risk management. He advocates for hedging across multiple asset classes and uncorrelated strategies to minimize exposure to specific market risks.

Convexity, a measure of the curvature of an option’s payoff, allows investors to benefit from market volatility. Taleb seeks options with positive convexity, which means their value increases disproportionately with market fluctuations, providing additional protection and potential returns.

Barbells and Antifragility

Central to Taleb’s approach is the concept of “Barbells.” This involves allocating investments between two extremes: a core of low-risk, defensive assets and a tail of speculative, high-risk assets. The defensive core protects against financial setbacks, while the tail leverages optionality to generate potential gains.

Taleb also advocates for investing in “antifragile” assets, which thrive amid volatility and uncertainty. Options, with their ability to protect against downside risks while participating in market growth, embody this antifragile nature.

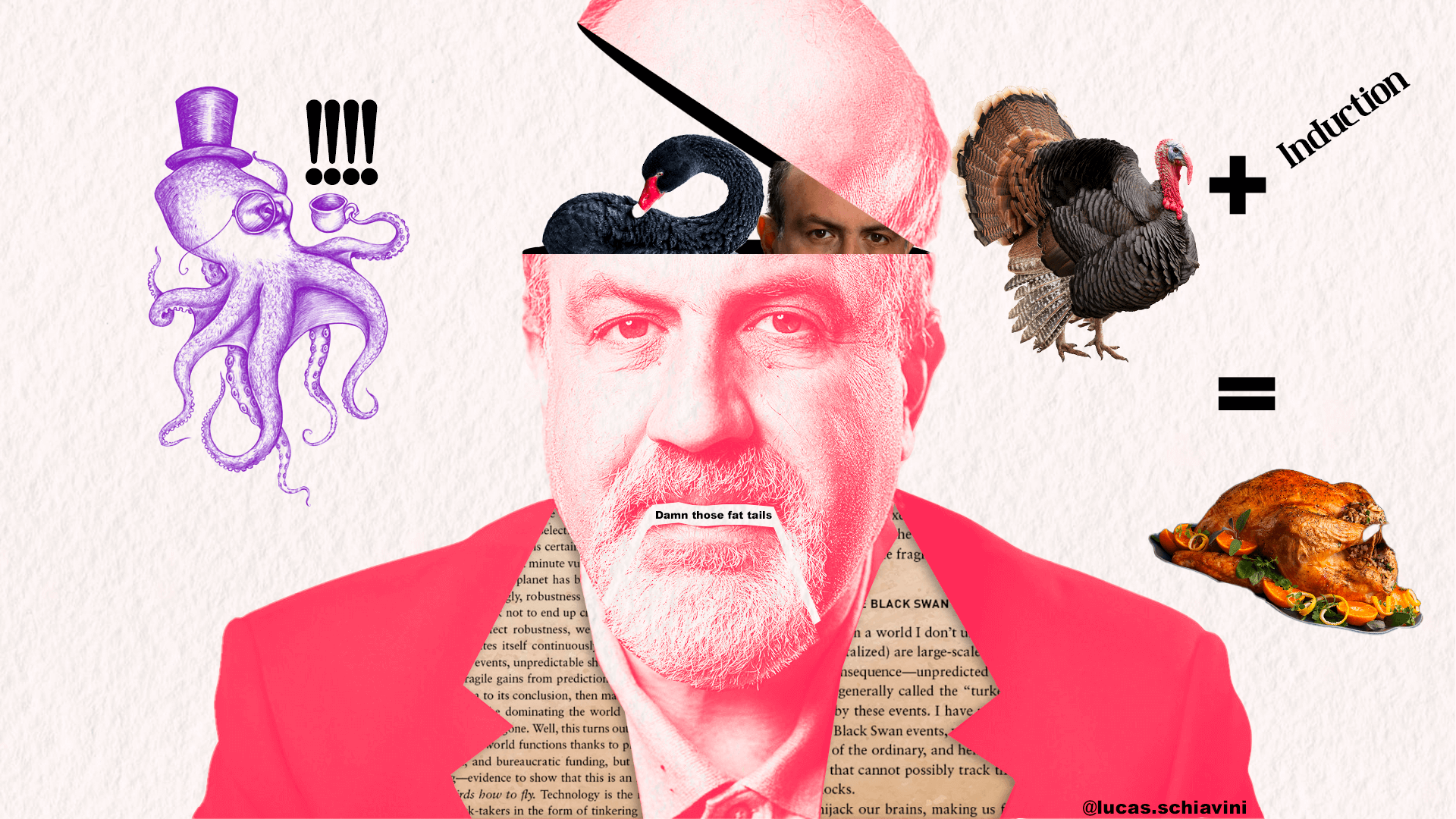

Nassim Taleb Trading Options

Image: lucas-schiavini.com

Conclusion

Nassim Taleb’s options trading strategies offer investors a sophisticated and effective approach to protecting their capital and generating profits in the face of uncertainty. By embracing optionality, managing tails, diversifying across asset classes, and seeking convexity, investors can emulate the hedge fund wizard and enhance their risk-adjusted returns.

Whether you’re an experienced trader or an investor seeking a more resilient approach to financial markets, Nassim Taleb’s wisdom on options trading is invaluable. By applying his principles, you can navigate market volatility with confidence and position yourself for long-term success.