Introduction

In the realm of investing, maximizing returns while minimizing risk is a constant pursuit. Option trading and short selling emerge as two alternative strategies that offer distinct approaches to navigating market fluctuations. Understanding the nuances of these strategies is crucial for informed decision-making and successful investing. This article delves into the concepts, advantages, and limitations of option trading versus short selling, empowering you to make strategic choices that align with your investment goals.

Image: fintrakk.com

Option Trading: A Flexible Way to Speculate and Hedge

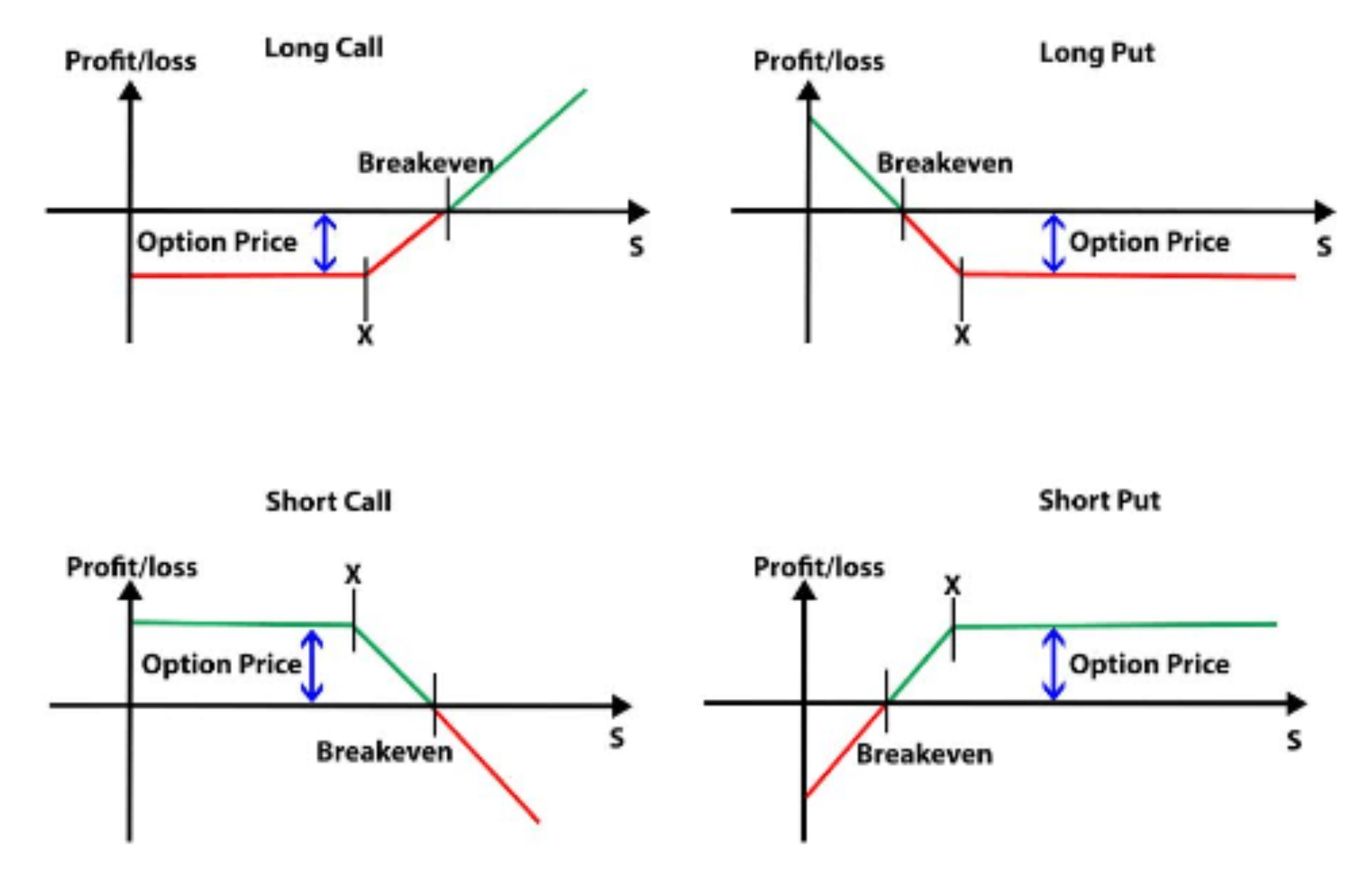

Option trading involves the exchange of standardized financial contracts that provide the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a predetermined date (expiration date). Unlike stocks, options do not represent ownership in an underlying company; instead, they convey the right to exercise the option to buy or sell. This flexibility offers investors diverse opportunities to speculate on future price movements, generate income, and hedge against potential losses.

Short Selling: Betting Against the Market

Short selling entails borrowing and selling a security, hoping to buy it back later at a lower price. This strategy essentially involves betting against the market’s direction. If the security’s price declines, the short seller profits; however, if it increases, losses are incurred. Short selling magnifies both potential gains and losses, making it a high-risk, high-return strategy best suited for sophisticated investors with a high tolerance for volatility.

Advantages and Disadvantages of Option Trading

Image: tme.net

Advantages:

- Leverage: Options offer significant leverage, allowing investors to control a larger position with a smaller upfront investment.

- Flexibility: Options provide unparalleled flexibility through various strategies, enabling investors to tailor their positions to specific market scenarios.

- Income Generation: Selling options can generate income, even if the underlying asset experiences modest price movements.

- Risk Mitigation: Options can be used to hedge against existing portfolio positions, reducing overall risk exposure.

Disadvantages:

- Premium Cost: Purchasing options requires paying a premium to the option seller, which can limit potential returns.

- Expiration Dates: Options have finite lifespans, and unexercised options expire worthless at expiration, resulting in a total loss of premium.

- Complexity: Option trading involves a steep learning curve and requires a thorough understanding of option pricing and strategy selection.

Advantages and Disadvantages of Short Selling

Advantages:

- Unlimited Profit Potential: Short sellers can theoretically profit indefinitely if the security’s price continues to decline.

- Leverage: Short selling provides an inherent leverage, magnifying potential gains.

- Income Generation: Short selling can generate interest income while the short position is open, regardless of market direction.

Disadvantages:

- Unlimited Loss Potential: Short sellers can incur unlimited losses if the security’s price rises, posing a significant financial risk.

- Margin Requirements: Short selling typically requires margin accounts, which may entail stricter eligibility criteria and higher interest charges.

- Borrowing Constraints: The availability of shares for short selling can be limited, restricting trading activity.

- Negative Impact on Market Sentiment: Short selling can negatively impact market sentiment, as it represents a bet against a company’s performance.

Choosing Between Option Trading and Short Selling

The choice between option trading and short selling depends on several factors, including investment objectives, risk tolerance, and trading experience. Option trading offers greater flexibility, while short selling provides potentially unlimited profit potential. Investors should carefully consider their respective advantages and limitations before engaging in either strategy.

Option Trading Vs Short Selling

Conclusion

Option trading and short selling offer distinct approaches to market participation, each with unique advantages and drawbacks. Understanding these strategies enables investors to make informed decisions and tailor their investment strategies to their risk appetite and financial goals. By leveraging the flexibility of option trading or the risk-taking potential of short selling, investors can enhance their portfolio performance and navigate market fluctuations with greater confidence and precision. Whether seeking income generation, hedging against risk, or capturing market downtrends, option trading and short selling remain valuable tools in the investor’s arsenal.