Introduction

Image: www.paytmmoney.com

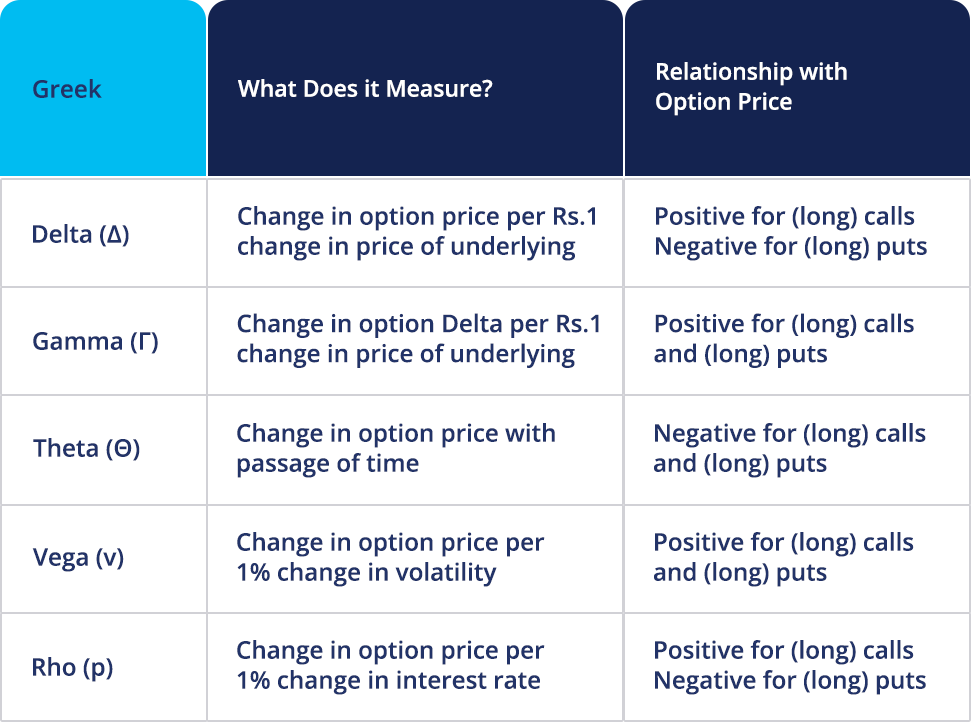

In the realm of financial markets, trading options presents a complex tapestry of possibilities, risks, and rewards. To navigate this multifaceted terrain effectively, traders often turn to a powerful tool known as the “Greeks.” These Greeks, named after Greek letters, are mathematical measures that provide insights into an option’s behavior under various market conditions.

One group of Greeks that holds particular significance is the trio of time, volatility, and probability Greeks. These measures shed light on how an option’s price and value may evolve in response to changes in time decay, market volatility, and the underlying asset’s probability of ending in-the-money.

Time Greeks: The Relentless Passage of Time

Time, the relentless force that governs all things, exerts a profound influence on option pricing. The two primary time Greeks are Theta and Gamma:

-

Theta (θ): Theta measures the rate at which an option’s value decays as time passes. As an option approaches its expiration date, Theta becomes increasingly negative, signifying the erosion of its extrinsic value due to time decay.

-

Gamma (γ): Gamma measures the sensitivity of Theta to changes in the underlying asset’s price. A positive Gamma indicates that Theta will increase (become less negative) if the underlying asset price rises, while a negative Gamma suggests the opposite.

Volatility Greeks: Capturing the Market’s Fluctuation

Market volatility, the amplitude of price swings, plays a critical role in option pricing. The two volatility Greeks are Vega and Vanna:

-

Vega (ν): Vega measures the sensitivity of an option’s price to changes in the market’s implied volatility. A positive Vega indicates that an option’s price will increase if implied volatility rises, while a negative Vega suggests the opposite.

-

Vanna (ν’ν): Vanna measures the sensitivity of Vega to changes in the underlying asset’s price. A positive Vanna indicates that Vega will increase (become more positive) if the underlying asset price rises, while a negative Vanna suggests the opposite.

Probability Greeks: Unraveling the Probabilistic Nature

The outcome of an options contract hinges on the probability of the underlying asset ending up in-the-money at expiration. The two probability Greeks are Delta and Rho:

-

Delta (Δ): Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. A Delta of 0.5 implies that a $1 increase in the underlying asset price will lead to a $0.5 increase in the option’s price.

-

Rho (ρ): Rho measures the sensitivity of an option’s price to changes in interest rates. A positive Rho indicates that an option’s price will increase if interest rates rise, while a negative Rho suggests the opposite.

Mastering the Greeks: A Toolkit for Empowerment

Understanding and utilizing the Option Greeks is an invaluable skill for options traders seeking to enhance their decision-making process. By leveraging these measures, traders can:

- Quantify the risks and potential rewards associated with different option strategies.

- Adjust their positions to optimize profitability and mitigate losses.

- Enhance their knowledge of options market dynamics to capitalize on trading opportunities.

Conclusion

The Option Greeks offer a profound understanding of the complex interplay of time, volatility, and probability in the world of options trading. By embracing the insights provided by these mathematical measures, traders can unlock a new level of proficiency, enabling them to navigate the ever-evolving landscape of financial markets with confidence and precision.

Image: www.youtube.com

Trading Option Greeks How Time Volatility Free Pdf

Image: bestmt4ea.com