Unlocking the Potential: A Journey into Options Trading ROI

Image: moneyscontents.com

Introduction:

In the realm of financial markets, options trading has emerged as a potent tool for traders seeking amplified returns. Whether you’re a seasoned investor or a novice seeking to elevate your earnings, understanding the dynamics of options trading ROI is paramount. This comprehensive exploration will delve into the intricacies of options trading, empowering you with the knowledge and strategies to maximize your profits.

Unveiling Options Trading:

Options trading involves acquiring contracts that bestow upon you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price). These contracts have a specific expiration date, determining the timeframe within which you can exercise your options. By accurately predicting market movements, traders can profit handsomely through options trading.

Quantifying ROI in Options Trading:

The return on investment (ROI) in options trading is determined by various factors, including the type of option (call or put), exercise price, premium paid, and the underlying asset’s price movement. Understanding these factors is crucial for assessing potential profits and managing risk.

Navigating Options Trading Strategies:

The nuances of options trading demand a strategic approach. From covered calls designed to generate income from premiums to advanced strategies like butterfly spreads, there are numerous options trading strategies tailored to different risk appetites and market conditions. Selecting the appropriate strategy requires careful analysis and a deep understanding of market dynamics.

Mastering Risk Management:

Risk management is the cornerstone of successful options trading. Employing strategies such as stop-loss orders and position sizing can mitigate potential losses while preserving capital. Understanding the volatility of the underlying asset and setting realistic profit targets are also vital for responsible trading.

Expert Insights for Enhanced Returns:

Seasoned options traders have accumulated invaluable wisdom over the years. Their insights provide invaluable guidance for aspiring traders. These experts emphasize the significance of thorough research, disciplined execution, and a calm mindset amidst market fluctuations. By tapping into their expertise, you can accelerate your learning curve and elevate your trading performance.

Actionable Tips for Success:

-

Embrace active learning: Continuously enhance your knowledge of options trading through books, webinars, and online resources.

-

Utilize paper trading: Practice your trading strategies in a risk-free environment before deploying capital.

-

Define your trading plan: Establish a clear roadmap outlining your objectives, risk tolerance, and trading methodology.

-

Seek guidance from experts: Leverage the experience of mentors or reputable trading firms to gain valuable insights and stay abreast of market developments.

Conclusion:

Options trading ROI unlocks a world of potential for traders seeking amplified returns. By embracing the principles and strategies outlined in this article, you can elevate your understanding of this dynamic market and harness its potential for financial success. Remember, successful options trading demands discipline, risk management, and a commitment to continuous learning. As you embark on this journey, empower yourself with knowledge, seek expert advice, and never lose sight of your financial objectives.

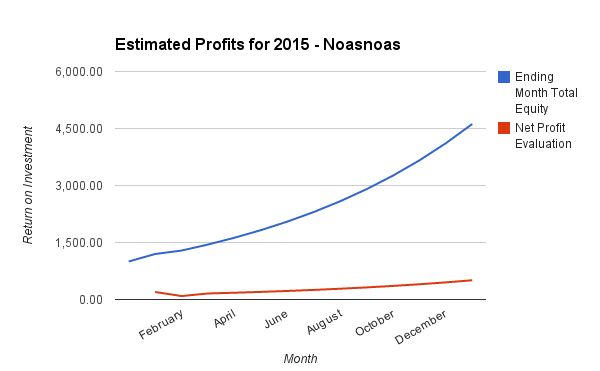

Image: www.girolamoaloe.com

Options Trading Roi

Image: www.shutterstock.com