Introducing the World of Trading

In the realm of finance, the concepts of “futures” and “options” hold significant sway, offering both opportunities and risks to investors. Futures are essentially binding contracts to buy or sell a specific asset at a predetermined price on a specified date in the future. Options, on the other hand, grant the holder the right, but not the obligation, to buy or sell an underlying asset at a certain price before a certain deadline.

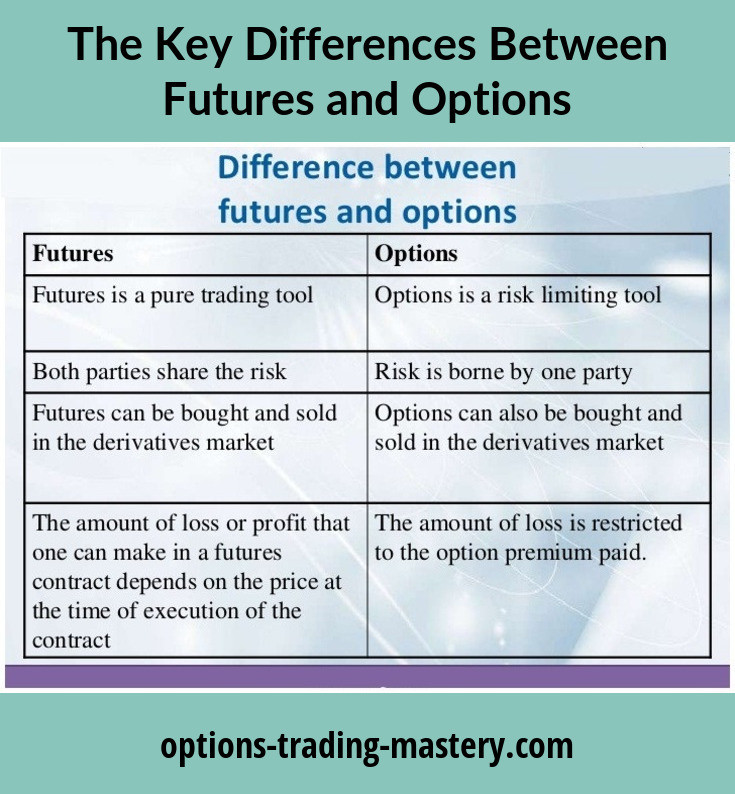

Image: www.options-trading-mastery.com

Both futures and options have their unique nuances and applications, playing vital roles in the financial landscape. In this comprehensive guide, we will delve into the intricacies of these trading instruments, empowering you with an enhanced understanding of their mechanisms, complexities, and potential impact.

What is Futures Trading?

Futures trading involves the buying and selling of standardized futures contracts, which represent an agreement between two parties to engage in a transaction at a set price in the future. These contracts are traded on regulated exchanges and are used by various participants, including hedgers, speculators, and arbitrageurs.

A fundamental characteristic of futures contracts is that they are standardized, meaning their terms, including the underlying asset, contract size, expiration date, and trading specifications, are predefined by the exchange. This standardization streamlines the trading process, allowing for greater transparency and efficiency.

Options Trading: A Closer Look

Options trading revolves around the buying and selling of options contracts, which grant the holder the right to buy or sell an underlying asset at a specific price within a specific period. Options contracts come in two primary types: “calls,” which confer the right to buy an asset, and “puts,” which confer the right to sell an asset.

The flexibility of options contracts lies in the fact that the holder is not obligated to exercise their right to buy or sell the underlying asset. This characteristic introduces an element of choice and strategy, as holders can decide whether to capitalize on potential price movements or let the options contracts expire without action.

Trends and Developments Reshaping the Trading Landscape

The realm of futures and options trading is undergoing constant evolution, driven by technological advancements, regulatory changes, and shifting market dynamics. Some of the notable trends shaping the industry include:

- Growing popularity of electronic trading platforms, enabling faster and more efficient execution of orders

- Emergence of new asset classes, such as cryptocurrencies and carbon credits, expanding the scope of trading opportunities

- Increased regulatory scrutiny, aimed at protecting investors and maintaining market integrity

Image: brokerchooser.com

Navigating the Complexities: Tips and Expert Advice

While futures and options can provide substantial financial benefits, they also carry significant risks. To navigate this complex landscape, consider the following tips from experienced traders:

- Understand your goals and risk tolerance: Determine your objectives, whether you’re seeking short-term gains or long-term investments, and align your trading strategies accordingly.

- Start small and scale gradually: Begin with a small capital commitment and gradually increase your exposure as you gain experience and confidence.

- Manage risk effectively: Implement stop-loss orders to limit potential losses and diversify your portfolio to reduce overall risk.

FAQs Demystifying Futures and Options

To clarify lingering questions, consider these frequently asked questions and concise answers:

- What is the difference between futures and options? Futures are binding contracts to buy or sell an asset at a set price on a future date, while options grant holders the right to buy or sell an asset before a certain deadline.

- What factors influence the prices of futures and options contracts? The underlying asset’s price, supply and demand, interest rates, and market sentiment all contribute to price fluctuations.

- Are futures and options suitable for all investors? No, these instruments involve significant risks and are generally recommended for experienced and knowledgeable investors.

About Future And Option Trading

https://youtube.com/watch?v=izu1tSmmIOs

Conclusion: The Way Forward

The world of futures and options trading presents a vast landscape of opportunities and challenges. By understanding the intricacies of these instruments, embracing industry trends, and adhering to sound trading strategies, you can equip yourself to navigate this complex and rewarding market. Remember that continuous learning and diligent risk management are key to achieving success in this dynamic and ever-evolving realm.

Would you like to delve deeper into the fascinating world of futures and options trading? Connect with fellow traders, explore relevant forums and social media platforms, and embark on a journey of discovery to enhance your knowledge and strategic decision-making.