Introduction

Options trading, with its immense potential for profit and its inherent risks, has captivated the attention of investors. However, navigating the intricate landscape of option contracts requires a reliable broker, one that provides not only financial stability but also the tools and support to successfully navigate this dynamic market. This article aims to provide a comprehensive overview of brokerage on options trading, exploring essential concepts, key considerations, and the latest trends shaping this ever-evolving industry.

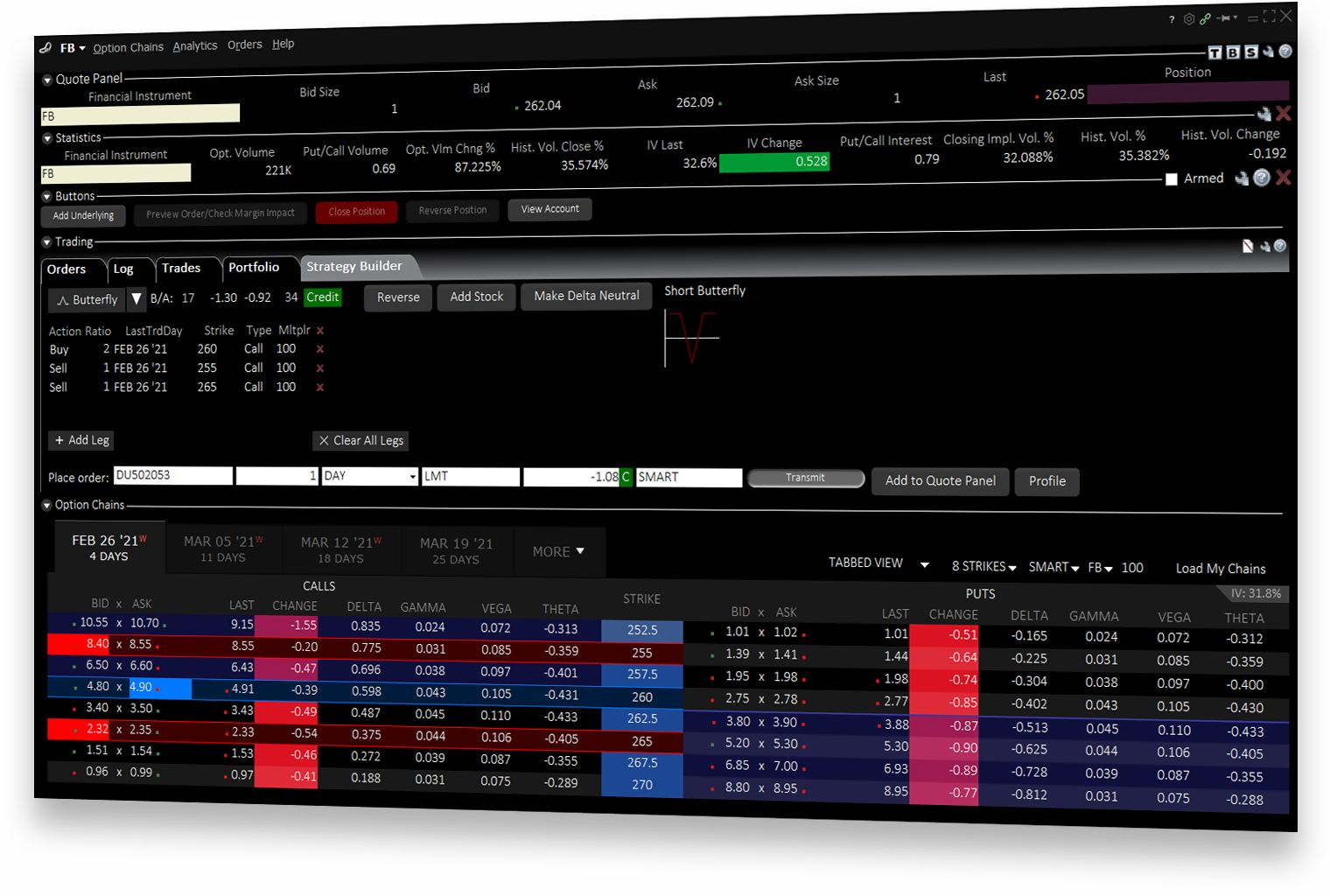

Image: www.interactivebrokers.com

Defining Brokerage in Options Trading

An options broker acts as a financial intermediary between the trader and the options exchange. They facilitate the execution of options contracts by matching buyers and sellers, clearing trades, and facilitating the settlement of premiums and proceeds. Selecting the right broker is crucial, as they determine access to trading platforms, research tools, educational materials, and customer support.

Key Considerations in Choosing an Options Broker

- Regulatory Compliance: Opt for brokers regulated by reputable financial authorities to ensure compliance, transparency, and protection of funds.

- Commissions and Fees: Understand the different cost structures offered by brokers, including commissions, trading fees, and account maintenance charges.

- Trading Platform: Evaluate the quality of the broker’s trading platform, considering factors such as user interface, charting capabilities, and execution speed.

- Research and Education: Look for brokers that offer comprehensive educational materials and research tools to empower traders with knowledge and insights.

- Customer Support: Choose brokers with highly responsive and knowledgeable customer service to assist with questions, technical issues, and trading guidance.

Understanding the Structure of Options Brokerage

Options brokers typically generate revenue through the following streams:

- Commissions: Charged on a per-trade basis, commissions vary depending on the broker’s fee structure and market conditions.

- Trading Fees: Additional fees may apply for specific trading activities such as exercising or assigning options contracts.

- Margin Interest: When using a margin account to amplify trading capital, brokers charge interest on the borrowed funds.

- Option Premiums: Some brokers may offer premium financing, allowing traders to purchase options by borrowing against their broker account balances.

Image: www.fool.com

Trends in Options Brokerage

The options brokerage industry is constantly evolving with the advent of new technologies and regulatory changes. Here are some emerging trends to watch:

- Robo-Advisors: Automated investment platforms are becoming more prevalent, offering options trading capabilities with a low-cost, algorithm-driven approach.

- Discount Brokers: With reduced fees and user-friendly platforms, discount brokers are attracting a growing number of options traders.

- Integrated Platforms: Trading platforms are becoming more sophisticated, offering not only options trading but also access to other financial instruments and advanced analytical tools.

- Focus on Education: Leading brokers prioritize education, providing comprehensive resources and tailored support to enhance trader knowledge and skills.

- Regulatory Scrutiny: Regulatory bodies are implementing stricter standards for options brokers, emphasizing transparency, conflict of interest management, and enhanced risk controls.

Brokerage On Options Trading

Image: www.youtube.com

Conclusion

Brokerage on options trading serves as a vital component in the successful navigation of this dynamic and potentially lucrative market. Understanding the key considerations, evaluating brokers based on their services, fees, and reputation, and staying abreast of evolving industry trends are essential for traders seeking a reliable and advantageous partnership. By selecting the right broker, traders can empower themselves with the tools, knowledge, and support necessary to maximize their trading potential in the options market.