Introduction

Image: unbrick.id

The world of options trading can be a daunting one, with its array of complex strategies and jargon. But understanding a few key concepts can open up a world of possibilities for savvy investors. One such concept is implied volatility (IV), a measure of how much movement in the underlying asset’s price the market expects in the future. IV is typically expressed as an annualized percentage, and when it comes to assessing an option’s value, 50 IV plays a pivotal role.

In this article, we’ll delve into the significance of IV, particularly what 50 IV means in the context of options trading. We’ll explore its impact on option premiums, break down its historical trends, and highlight strategies that capitalize on the power of IV. So, whether you’re a seasoned trader or a newcomer eager to navigate the options market, let’s embark on a comprehensive journey into the world of IV and its profound implications.

Understanding Implied Volatility (IV)

Implied volatility, or IV, represents the market’s best guess about the future volatility of an underlying asset’s price. It is an extremely significant metric for options traders, as it is used to price options and serves as a barometer of market sentiment. Volatility is the measure of how much the price of the stock has moved historically, and is often measured in terms such as standard deviation.

Significance of 50 IV

When IV stands at 50%, it indicates that the market anticipates the underlying asset’s price to fluctuate significantly within the next year. This level of volatility is considered a neutral point, as it suggests the market is pricing in both bullish and bearish sentiment equally.

Impact on Option Premiums

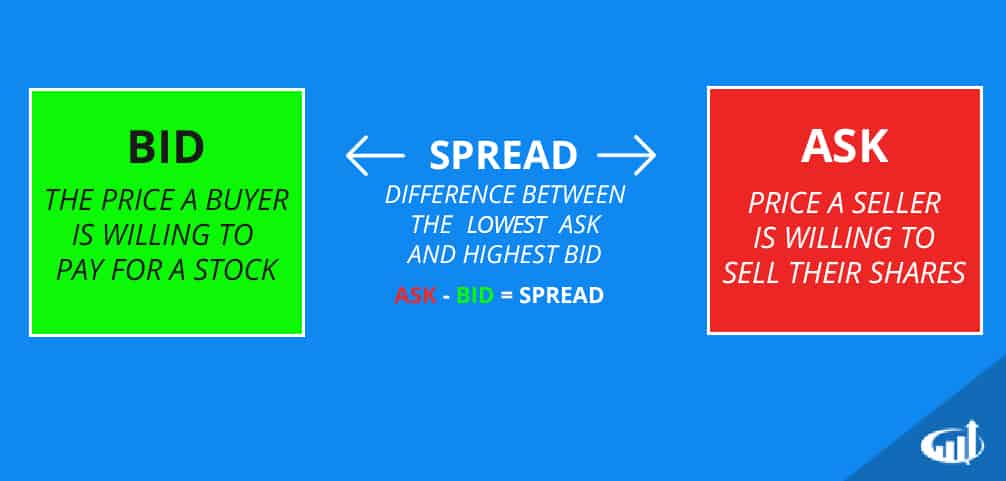

IV has a pronounced impact on option premiums. Higher levels of implied volatility result in higher option premiums, as investors are willing to pay more for the potential upside in a highly volatile market. Conversely, lower IV leads to lower option premiums, as the market views the future price movements of the underlying asset as more predictable.

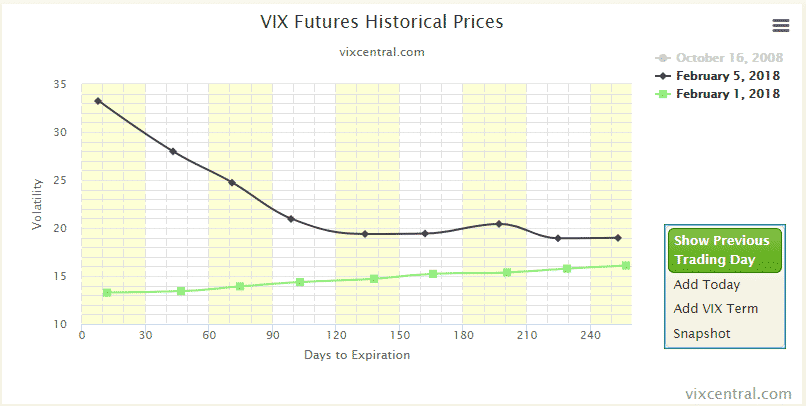

Historical Trends in IV

Implied volatility can vary widely over time, especially during periods of economic uncertainty or market events like earnings releases. The S&P 500 Index, a common benchmark for IV, has historically exhibited elevated levels of volatility during market downturns and recessions. These periods of high IV often present opportunities for traders seeking to profit from market fluctuations.

Strategies Involving 50 IV

Traders can leverage IV to devise and execute effective options strategies. These can range from simple to complex, depending on the trader’s knowledge, experience, and risk tolerance. Here are a few prominent IV-based strategies:

-

Selling Volatility: In this strategy, traders sell options when IV is high, seeking to profit from a decrease in volatility. If volatility returns to normal levels, the sold options will decline in value, resulting in a net profit for the trader.

-

Buying Volatility: The inverse of selling volatility, this strategy involves buying options when IV is low, betting that volatility will increase in the future. If volatility rises, the purchased options will increase in value, generating profits for the trader.

-

Straddle Strategies: A straddle involves the simultaneous purchase of a call option and a put option with the same strike price and expiration date. This strategy benefits from high volatility, as both the call and the put will gain value if the underlying asset’s price fluctuates widely.

Conclusion

Trading options, especially with an understanding of implied volatility, can be an effective way to potentially enhance returns and manage risk in a portfolio. By grasping the significance of 50 IV and implementing IV-based strategies, traders can optimize their options trades and tap into the opportunities that fluctuations in the market present.

Remember, the world of options trading is dynamic and ever-changing. Continuous learning and staying abreast of market trends is essential for navigating its complexities. By staying informed and trading prudently, investors can leverage IV to uncover hidden opportunities and potentially achieve their financial goals.

Image: optionstradingiq.com

Trading Options 50 Iv Means

Image: events.mirposadhotel.by