Introduction:

Image: www.spin.ph

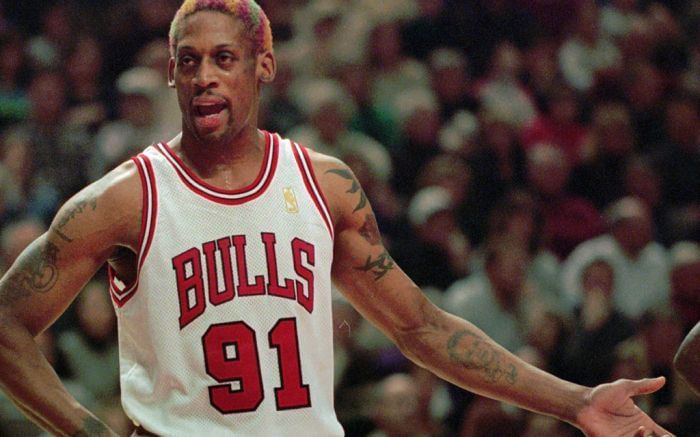

In the world of finance, Dennis Rodman, the legendary NBA star, has emerged as an unlikely yet enigmatic figure. His unconventional approach to options trading, known as the “Dennis Rodman Theory,” has sparked curiosity and controversy within the investment community.

This article delves into the fascinating realm of Dennis Rodman’s options trading theory, exploring its origins, principles, and impact on the financial markets.

Decoding the Dennis Rodman Theory

The Dennis Rodman Theory, in its essence, is a contrarian trading strategy that capitalizes on market inefficiencies and anomalies. Inspired by Rodman’s signature playstyle on the basketball court—rebounding and disrupting opponents’ rhythm—the theory seeks to identify undervalued or overvalued options and exploit price discrepancies.

Principle 1: Value Discovery through Contrarianism

Rodman’s theory hinges on the belief that markets often overreact to news and events, creating temporary price distortions. By adopting a contrarian mindset, traders can seek out options that are currently undervalued or overvalued due to excessive optimism or pessimism.

Principle 2: Exploiting Inefficiencies with Asymmetries

The theory further suggests that options offer unique asymmetries in terms of profit and loss potential. By understanding these asymmetries, traders can exploit market inefficiencies and generate returns through a combination of high-probability, low-reward trades and low-probability, high-reward trades.

Image: www.kronozio.com

The Latest Trends and Developments

The Dennis Rodman Theory has gained significant traction in recent years, sparking discussions and debates among financial analysts and traders. Various forums and social media platforms have emerged as platforms for sharing insights and experiences related to the theory.

Notable trends include the growing adoption of advanced data analytics and machine learning to identify potential trading opportunities. Additionally, the rise of mobile trading applications has made it easier for individual investors to implement the theory and capitalize on market inefficiencies.

Tips and Expert Advice for Options Traders

Based on my experience as a blogger and my understanding of the Dennis Rodman Theory, here are some valuable tips and expert advice for options traders:

1. Embracing Contrarianism: Develop a mindset that challenges conventional wisdom and enables you to identify market opportunities that others may overlook.

2. Understanding Options Asymmetries: Familiarize yourself with the unique profit and loss potential of options and how to leverage these asymmetries to your advantage.

3. Embracing Continuous Education: Stay updated with the latest trends, research, and developments in the field of options trading. Attend webinars, read industry publications, and connect with experienced traders.

Frequently Asked Questions (FAQs)

Q: Is the Dennis Rodman Theory a reliable and effective trading strategy?

A. The Dennis Rodman Theory, like any trading strategy, has no guarantees of success. However, it provides a contrarian framework for identifying undervalued or overvalued options, which can lead to profitable trades when executed with discipline and sound risk management.

Q: How does one learn more about the Dennis Rodman Theory?

A. You can access numerous online resources, including articles, webinars, books, and forums dedicated to the theory. Additionally, you can connect with experienced traders who implement the strategy and share their insights.

Dennis Rodman Theory Options Trading

Image: goldensanddubai.com

Conclusion

The Dennis Rodman Theory presents a unique and intriguing approach to options trading, challenging conventional wisdom and capitalizing on market inefficiencies. By embracing contrarianism, understanding options asymmetries, and continuously learning, traders can develop a robust framework for identifying profitable trading opportunities.

Are you intrigued by the Dennis Rodman Theory and its potential for transforming your trading journey? Share your thoughts and experiences in the comments section below.