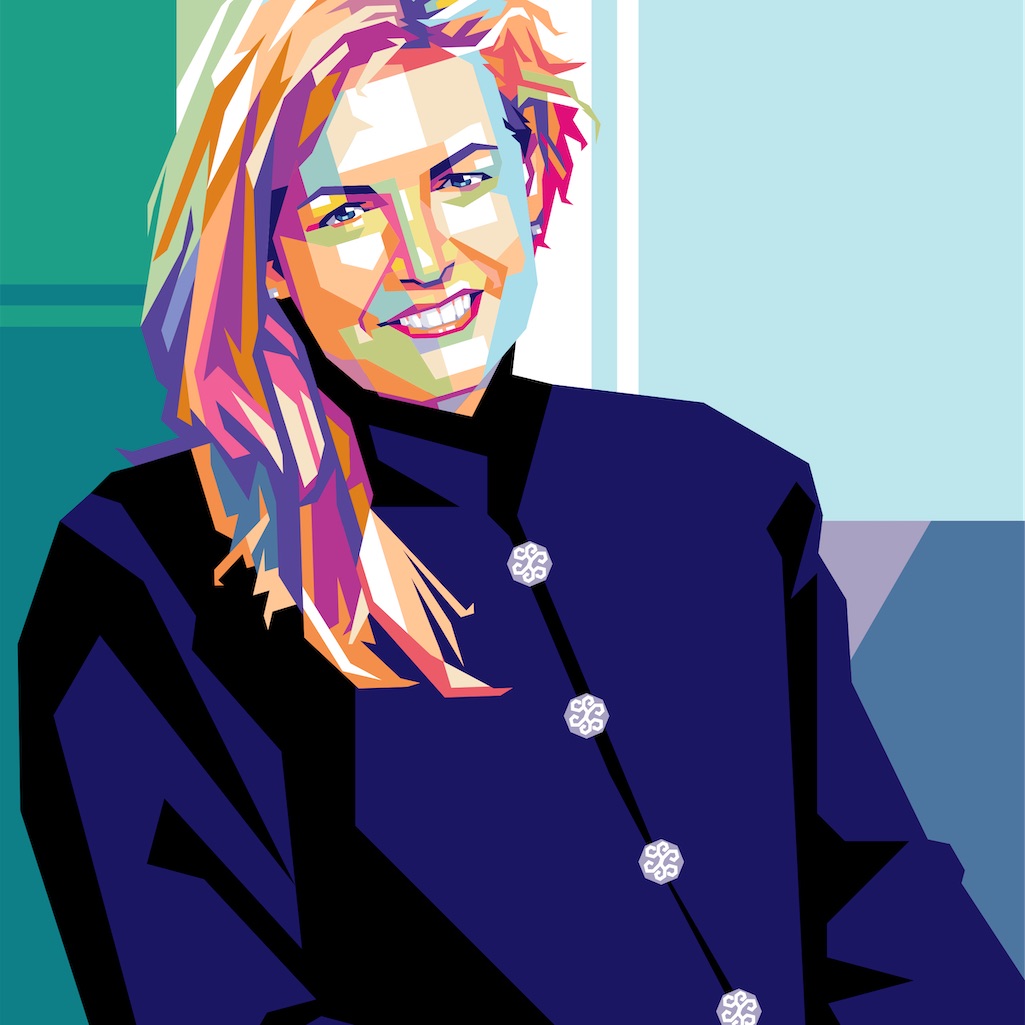

In the realm of investing, options trading has emerged as a powerful tool that can amplify both profits and losses. At the helm of this exhilarating yet complex domain sits the esteemed trader Kim Kromas, whose expertise in options has garnered widespread recognition and accolades.

Image: theridgewoodblog.net

Embarking on a journey into the labyrinthine world of options trading requires a discerning eye and a methodical approach. Kim Kromas, with her unwavering commitment to education and transparency, has generously shared her knowledge and strategies, empowering countless individuals to navigate the volatile waters of the markets.

**Deciphering Options Trading**

Options, in essence, are financial instruments that convey the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) before a specific date (expiration date).

**Understanding the Lingo**

To delve deeper into the nuances of options trading, it is imperative to grasp the jargon that permeates this realm:

- Underlying Asset: The security, such as a stock, index, or commodity, upon which the option is based.

- Option Premium: The price paid to acquire an option contract.

- Intrinsic Value: The difference between the underlying asset’s current price and the strike price.

- Time Value: The value attributed to the remaining time before the option’s expiration.

**Kim Kromas Options Strategies**

Kim Kromas has meticulously crafted a repertoire of options strategies tailored to various market conditions and risk tolerances.

Image: priceactiontradersinstitute.com

**Covered Call Writing**

This strategy involves selling (writing) a covered call option while simultaneously owning the underlying asset. It is designed to generate income from premiums while limiting potential losses.

**Vertical Spreads**

Kim Kromas advocates for vertical spreads, a strategy that involves buying and selling options with different strike prices but the same expiration date. It offers a defined risk and return profile and can be customized based on one’s risk tolerance.

**Recent Trends and Developments**

The options trading landscape is continuously evolving, with recent advances and innovations shaping its dynamics.

**Options ETFs**

Exchange-traded funds (ETFs) that track options indices have gained popularity, providing investors with diversified exposure to options and reduced volatility.

**AI and Analytics**

Artificial intelligence (AI) and advanced analytics have transformed the way options traders analyze data and make informed decisions. Tools powered by AI can sift through vast amounts of data, identify patterns, and generate insights.

**Expert Tips and Proven Advice**

Harnessing the wisdom gleaned from Kim Kromas’s experience can empower traders to navigate the complexities of options trading with greater confidence.

**Knowledge is Paramount**

Profound understanding of options trading fundamentals, strategies, and risk management is crucial before initiating any trades. Educate yourself relentlessly through books, online resources, and webinars.

**Manage Risk Prudently**

The allure of options trading lies in its potential for outsized gains. However, it is essential to exercise prudence and manage risk diligently. Start small, gradually increase your position sizes, and employ strategies that align with your tolerance for setbacks.

**Frequently Asked Questions (FAQs)**

Below are some frequently asked questions regarding options trading, addressed with clear and concise answers:

- Q: What is the difference between a call and a put option?

- A: A call option conveys the right to buy, while a put option confers the right to sell the underlying asset.

- Q: How is the option premium determined?

- A: The premium is influenced by various factors, including the underlying asset’s price, volatility, time to expiration, and interest rates.

- Q: What is the profit potential of options trading?

- A: The profit potential is theoretically unlimited, but losses can also exceed the initial investment.

Kim Kromas Options Trading

Image: aapleincome.blogspot.com

**Conclusion**

Options trading, under the tutelage of master trader Kim Kromas, presents a compelling avenue for both novice and experienced investors seeking to enhance their financial acumen. Whether you are captivated by the potential for amplified returns or intrigued by the intellectual challenge, the concepts and strategies explored in this article will equip you with a solid foundation for embarking on this transformative journey.

Tell us, esteemed reader: are you ready to dive into the electrifying realm of options trading and unleash the potential within?