The world of options trading can be both exhilarating and daunting. For novice traders, navigating this market often feels like a maze fraught with uncertainties. This guide aims to illuminate the path forward, providing a comprehensive overview of options trading, its intricacies, and proven strategies to empower traders with confidence.

Image: www.irafinancialgroup.com

In the realm of financial markets, options stand out as versatile contracts that grant traders the right but not the obligation to buy (call option) or sell (put option) an underlying asset at a predetermined price on or before a specified date. These contracts allow traders to leverage market fluctuations to their advantage, opening doors to both profit-making opportunities and risk mitigation strategies.

Types of Options: Navigating the Options Landscape

The world of options trading encompasses two primary types: call options and put options. Call options empower traders to buy an underlying asset at a predefined price (strike price) on or before a certain date (expiration date). Put options, on the other hand, grant the right to sell an underlying asset at the strike price on or before the expiration date.

Call Options: Seizing Upside Potential

When traders anticipate a rise in the price of an underlying asset, call options become their weapon of choice. By purchasing a call option, traders secure the right to buy the asset at the strike price, regardless of its market value on the expiration date. If the asset’s price indeed climbs above the strike price, the call option holder stands to profit from the difference, minus the premium paid for the option.

Put Options: Hedging Against Downturns

In scenarios where traders foresee a decline in the price of an underlying asset, put options offer a safety net. By acquiring a put option, traders gain the right to sell the asset at the strike price, shielding themselves from potential losses if the market takes a downturn. If the asset’s price falls below the strike price, the put option holder can exercise the option to sell the asset at a price higher than the market value, offsetting potential losses.

Image: www.financiallydigital.com

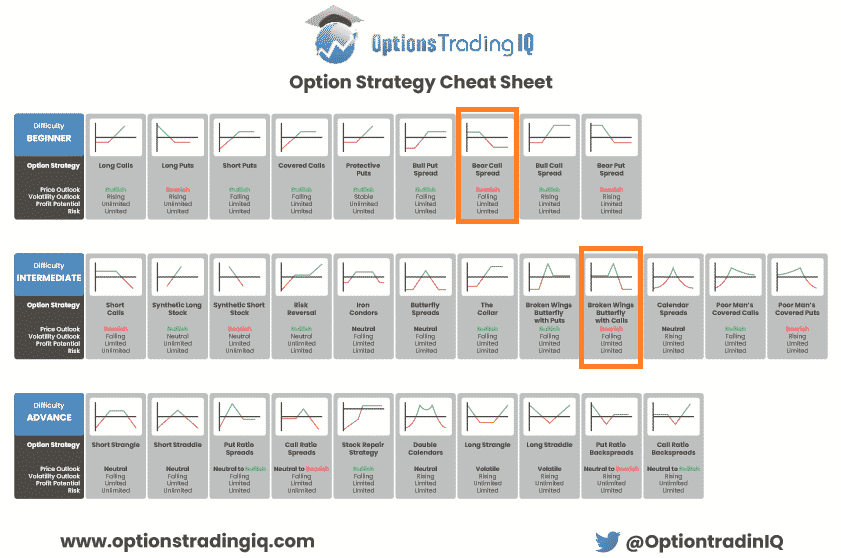

Options Trading Strategies: Unveiling the Paths to Success

Navigating the options market requires a carefully crafted strategy. Traders can choose from a vast array of strategies, each tailored to specific market conditions and risk tolerance levels. Some of the most common strategies include:

Covered Call Strategy: Generating Income in Upward Trends

The covered call strategy is a popular choice for traders seeking to generate income in rising markets. This strategy involves selling (writing) a call option against an underlying asset that the trader already owns. If the asset’s price climbs above the strike price, the trader retains the underlying asset and collects the premium paid by the buyer of the call option. However, if the asset’s price falls below the strike price, the trader may be obligated to sell the asset at a loss.

Cash-Secured Put Strategy: Protecting Investments in Bearish Markets

Traders looking to protect their investments in bearish markets often turn to the cash-secured put strategy. This strategy entails selling (writing) a put option while simultaneously holding cash in a brokerage account to cover potential obligations. If the asset’s price falls below the strike price, the trader is obligated to buy the asset, but the cash held in the account serves as a buffer against losses. However, if the asset’s price rises above the strike price, the trader retains the cash and collects the premium paid by the buyer of the put option.

Latest Trends and Developments in Options Trading

The options market is constantly evolving, with new trends and developments emerging frequently. Some of the most recent developments include:

Rise of Exchange-Traded Funds (ETFs): Expanding Options Trading Horizons

Exchange-traded funds (ETFs) have gained immense popularity in the options market, providing traders with a convenient way to gain exposure to a diversified portfolio of assets through a single option contract. ETFs track the performance of various underlying assets, such as stocks, bonds, or commodities, allowing traders to access a wider range of investment opportunities.

Growth of Binary Options: High-Risk, High-Reward Trading

Binary options have emerged as a controversial but potentially lucrative option trading instrument. Unlike traditional options, binary options offer a fixed payout or nothing at all based on the outcome of a yes/no proposition related to the underlying asset’s price movement. While binary options offer the potential for quick profits, they also carry significant risks due to their all-or-nothing nature.

Expert Tips and Advice for Options Trading Success

To succeed in options trading, it’s essential to heed the advice of experienced traders. Here are some invaluable tips to enhance your trading:

Understand the Risks: Embracing Informed Decision-Making

Options trading carries inherent risks, and it’s crucial to fully grasp these risks before entering the market. Traders should thoroughly research the underlying assets, option strategies, and market conditions to make informed decisions. Remember, the potential for profit is directly proportional to the level of risk involved.

Start Small: Progressing Gradually

When venturing into options trading, it’s wise to start small and gradually increase your trading size as you gain experience. This cautious approach allows traders to minimize potential losses and build confidence in their abilities. Practice trading strategies using paper money before risking real capital.

Frequently Asked Questions (FAQs) about Options Trading

Q: What is the difference between a call option and a put option?

A: Call options grant the right to buy an underlying asset at a predetermined price, while put options confer the right to sell an underlying asset at a predetermined price.

Q: How do I determine the value of an options contract?

A: The value of an options contract is influenced by multiple factors, including the asset’s price, volatility, time until expiration, strike price, and interest rates.

Q: What is the maximum profit potential in options trading?

A: The maximum profit potential in options trading is limited to the premium paid for the option contract. However, losses can be unlimited, especially in uncovered option strategies.

Trading Options Help

Image: optionstradingiq.com

Conclusion

Options trading presents a vast and dynamic landscape of opportunities and challenges. By understanding the types of options, exploring trading strategies, staying abreast of market trends, and implementing expert advice, traders can navigate this complex environment with greater confidence and the potential to reap significant rewards. Embrace the world of options trading with prudence, a thirst for knowledge, and a willingness to embrace both profits and losses as part of the learning journey.

Are you ready to explore the world of options trading? Share your thoughts and experiences in the comments section below!