Imagine this: you’ve invested in a promising stock, but the market has taken an unexpected downturn. Your hard-earned investment is now at risk, and panic sets in. But what if there was a way to protect your profits and mitigate losses?

Image: futuresoptionsetc.com

Enter protective put options. A lifeline in the stormy seas of investing, these financial instruments provide a safety net, safeguarding your investments from market volatility. In this comprehensive guide, we will delve into the world of protective put options, empowering you with the knowledge to navigate market risks confidently.

Understanding Protective Put Options

A protective put option is a strategy that involves buying a put option against an underlying security you own. A put option grants the buyer the right, but not the obligation, to sell the underlying security at a specified price (strike price) on or before a particular date (expiration date). By purchasing a protective put option, you are essentially creating a floor price for your investment.

Mechanics of a Protective Put

Assume you own 100 shares of XYZ stock, which is currently trading at $50. To protect your investment from a potential decline in stock price, you purchase a one-month protective put option with a strike price of $45. The premium (cost) of the put option is $2 per share.

If XYZ stock falls below $45 before the expiration date, you can exercise your put option, selling each share of XYZ at the strike price of $45. In this scenario, you would recoup $45 per share ($45 strike price – $2 premium paid), effectively limiting your loss to $5 per share (your original purchase price minus the proceeds from exercising the put option).

Benefits of Protective Put Options

- Protection Against Downside Risk: Protective put options provide a cushion against market downturns, safeguarding your investments from potential losses.

- Flexibility and Control: You can customize the strike price and expiration date of the put option based on your risk tolerance and investment goals.

- Peace of Mind: Knowing that you have a safety net in place can alleviate stress and allow you to weather market volatility with greater confidence.

Image: support.ledgerx.com

Tips and Expert Advice

To maximize the effectiveness of protective put options, follow these tips:

- Set Realistic Strike Prices: Consider the historical volatility of the underlying security when selecting a strike price. Avoid setting the strike price too far out of the money, as the premium can be expensive.

- Monitor the Underlying Security: Keep a close eye on the performance of the underlying security. If the price falls significantly, consider exercising your put option promptly to minimize losses.

- Calculate the Net Price: Factor in the cost of the premium when determining the net price of your investment. Ensure that the premium is not excessive relative to the potential downside risk.

FAQs

- What is the difference between a protective put and a stop-loss order?

Protective puts offer more flexibility than stop-loss orders. While stop-loss orders trigger an immediate sale once the specified price is reached, protective puts allow you to choose when to sell (within the expiration period). - Can I sell a protective put option if I don’t own the underlying security?

No, you must own the underlying security or have a short position in it to purchase a protective put option. - What happens if I don’t exercise my put option?

If the stock price remains above the strike price at the expiration date, the put option will expire worthless, and the premium paid will be lost.

Trading Protective Put Option

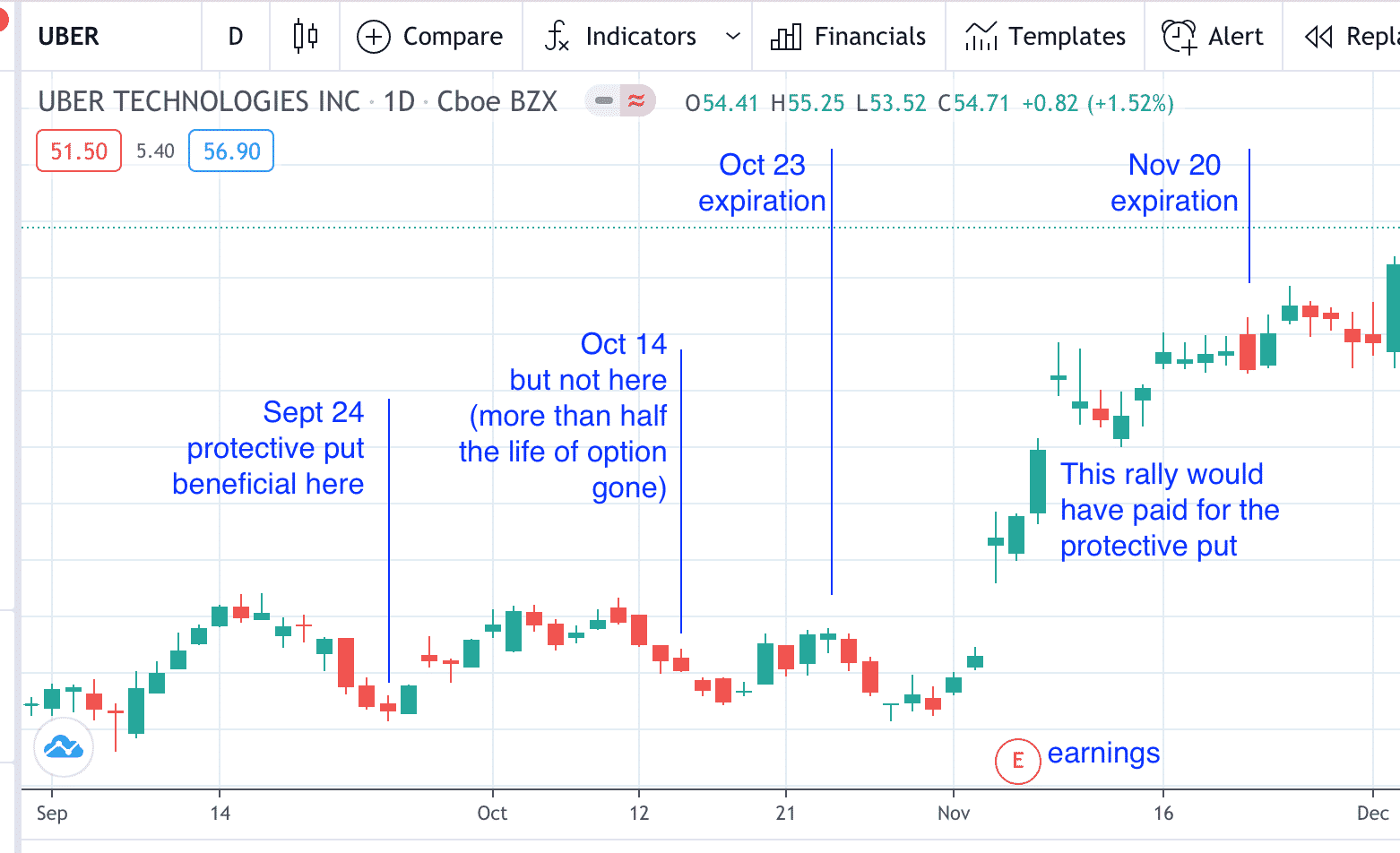

Image: optionstradingiq.com

Conclusion

Trading protective put options is a valuable technique for managing risk and safeguarding your investments. By understanding the mechanics and benefits of these options, you can harness their power to navigate market fluctuations with confidence. Whether you’re a seasoned investor or just starting out, protective puts can provide a sense of security and minimize the impact of downturns.

Are you ready to explore the world of protective put options and empower yourself as an investor? Take the first step towards protecting your hard-earned investments today!