Embarking on the Automated Trading Odyssey

In the labyrinthine world of financial markets, time-sensitive decisions often spell the difference between triumph and tribulation. As an avid trader, the relentless need to stay ahead of market fluctuations can be both exhilarating and exhausting. Imagine a world where these decisions can be made effortlessly, where the tedium of manual trading is relegated to the realm of the past. Enter the realm of automated options trading, a transformative realm where Python, a versatile and ubiquitous programming language, emerges as your trusted ally.

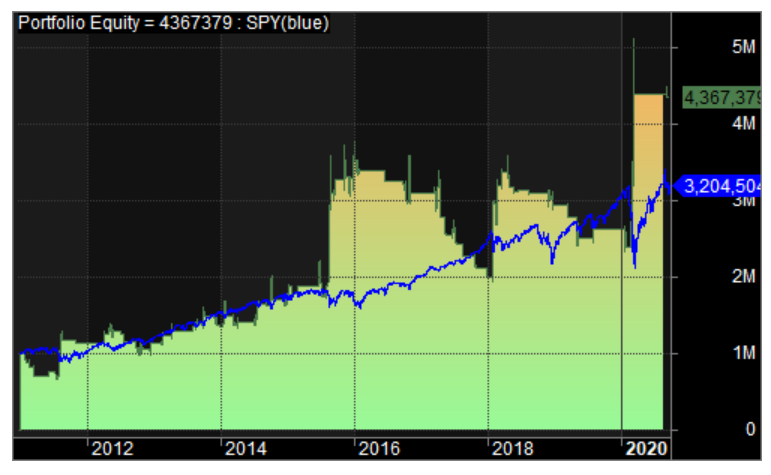

Image: ibridgepy.com

Python and Options Trading: A Match Made in Algorithmic Heaven

Options trading, a complex and nuanced domain, demands rapid execution, strategic planning, and a keen understanding of market trends. Python, with its robust libraries and user-friendly syntax, offers the perfect platform to automate these tasks, empowering you to navigate market complexities with finesse and efficiency. From backtesting strategies to real-time trade execution, Python’s capabilities extend far and wide, opening up a world of possibilities for the savvy trader.

Delving into the Mechanics of Automated Options Trading

The essence of automated options trading lies in the seamless integration of data analysis, algorithmic decision-making, and automated trade execution. Python serves as the conductor, orchestrating this intricate symphony of processes.

-

Data Acquisition and Preprocessing: Python’s prowess in data handling shines in this arena. It swiftly retrieves historical data from exchanges and feeds, cleansing and preparing it for analysis, ensuring the accuracy and integrity of your decision-making.

-

Strategy Development: With Python’s versatility, you’re empowered to develop and refine your trading strategies. Whether it’s technical analysis, fundamental analysis, or a hybrid approach, Python provides the building blocks to construct a strategy that aligns with your risk appetite and investment objectives.

-

Real-Time Analysis and Trade Execution: As the market ebbs and flows, Python stands vigil, continuously monitoring market conditions and executing trades based on predefined triggers. Its ability to process vast amounts of data in real-time ensures that you stay ahead of the curve, seizing opportunities as they arise.

Unveiling the Horizons of Automated Options Trading

The advent of automated options trading has revolutionized the financial landscape, paving the way for a host of transformative benefits:

-

Enhanced Efficiency and Speed: Automation eliminates the need for manual interventions, freeing up your time and allowing you to focus on higher-level tasks. Its lightning-fast execution speed ensures that you never miss a market opportunity and capitalizes on fleeting price movements.

-

Objectivity and Discipline: Automated trading removes the emotional element from decision-making, instilling a sense of discipline and objectivity in your trading approach. It adheres strictly to predefined rules, mitigating the risks associated with human biases and impulses.

-

Optimization and Refinement: Python’s iterative nature allows you to continuously optimize and refine your trading strategies. Through backtesting and simulation, you can identify areas for improvement and fine-tune your approach to maximize profitability.

Image: ami-anderson.gitbook.io

Unlock Your Trading Potential with Expert Insights

Embracing automated options trading is a transformative journey, and seeking guidance from seasoned experts can illuminate your path to success. Here’s a collection of tips and advice to empower your foray:

-

Start Small, Gradually Scale: Begin with a small portion of your capital and gradually increase your exposure as you gain experience and confidence in your automated system. This conservative approach mitigates risks and allows you to refine your strategy incrementally.

-

Continuous Learning and Adaptation: The financial markets are in a perpetual state of flux, demanding an adaptive and open-minded approach. Stay abreast of market trends, research new strategies, and continually refine your algorithms to maintain a competitive edge.

-

Risk Management Paramount: Automated trading should not be equated with risk-free trading. Implement robust risk management protocols, including stop-loss orders, position limits, and diversification, to safeguard your capital.

Frequently Asked Questions: Demystifying Automated Options Trading

Q: Is automated options trading suitable for all traders?

A: While automated trading offers numerous benefits, it’s not a one-size-fits-all solution. New traders may find it more challenging to navigate, and a thorough understanding of trading principles and risk management is essential.

Q: How much capital do I need to get started with automated options trading?

A: The capital required varies depending on the trading strategy and risk tolerance. It’s advisable to start with a small amount and gradually increase exposure as you gain experience and confidence in your system.

Q: How do I ensure the security of my automated trading system?

A: Implement robust security measures, such as utilizing secure cloud platforms, employing strong passwords, and regularly updating your software to safeguard your trading system against unauthorized access or malicious attacks.

Options Trading Autoamted Python

Image: www.youtube.com

Conclusion

Automated options trading with Python presents a transformative opportunity to elevate your trading prowess. By harnessing the power of this versatile language, you can automate tedious tasks, gain objectivity, optimize strategies, and stay ahead of the market’s whims. Remember, the journey to mastery is ongoing, and with dedication and continuous learning, you can unlock the full potential of this transformative technology.

Are you ready to embark on the automated options trading odyssey and elevate your trading journey to new heights?