Introduction:

Trading financial instruments, such as futures and options, holds the potential for significant financial returns. Zerodha, a prominent Indian brokerage firm, has recently introduced a platform tailor-made for this type of trading. However, navigating this complex landscape may seem daunting, especially for beginners. This comprehensive article aims to unravel the intricacies of futures and options trading on Zerodha, equipping you with the knowledge and strategies to succeed in this exciting arena.

Image: www.cfajournal.org

Understanding the Basics:

Futures and options are derivative contracts that allow traders to speculate on the future price movements of an underlying asset. Futures are agreements to buy or sell the asset at a predetermined price on a set date, while options provide the right, but not the obligation, to do so. Futures trading involves taking delivery of the asset on the specified date, while options trading settles in cash, allowing traders to capture gains or limit losses within a specified time frame.

Navigating the Zerodha Platform:

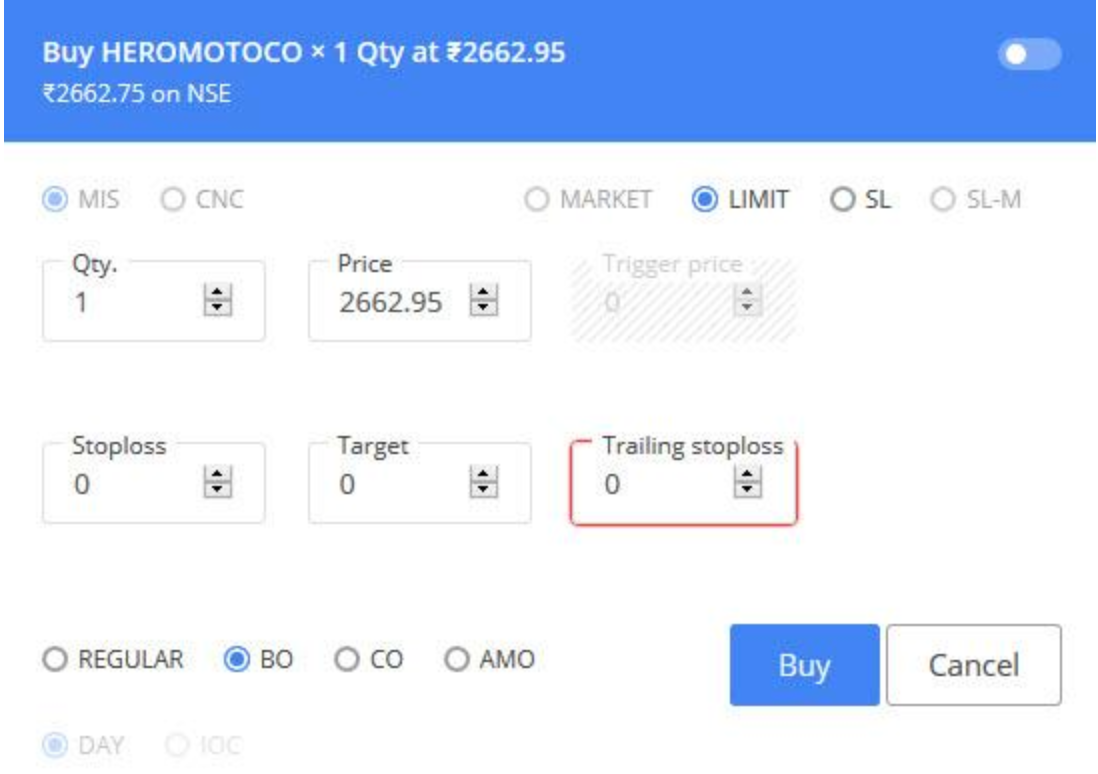

Zerodha’s user-friendly platform, Kite, features an intuitive interface designed to streamline futures and options trading. It offers real-time market data, charting tools, and advanced order placement capabilities. To commence trading, you must first open an account with Zerodha and link it to your bank account. Once your account is funded, you’re ready to embark on your trading journey.

Strategies for Success:

Success in futures and options trading hinges upon adopting sound strategies that align with your risk tolerance and financial goals. One popular strategy involves identifying trends using technical analysis and placing trades accordingly. Another approach focuses on fundamental factors, such as economic news events, to gauge market sentiment and make informed decisions. Additionally, position sizing and risk management techniques, like using stop-loss orders, are crucial to protect your capital from unforeseen market fluctuations.

Image: www.adigitalblogger.com

Expert Insights and Guidance:

To further enhance your understanding and sharpen your trading skills, consider seeking advice from seasoned professionals. Zerodha provides a wealth of resources, including webinars, articles, and expert blogs, to aid your learning. Online forums and social media platforms also offer valuable insights and perspectives on current market conditions and trading strategies.

Frequently Asked Questions:

Q: What is the difference between futures and options?

A: Futures require the physical delivery of an asset, while options provide the right, but not the obligation, to buy or sell.

Q: What are the risks associated with futures and options trading?

A: Leverage can amplify both profits and losses, so it’s crucial to manage risk effectively using proper position sizing and stop-loss orders.

Q: Can you provide tips for beginners starting out in futures and options trading?

A: Start with paper trading to simulate real-world conditions, gain a thorough understanding of the underlying assets, and develop and refine your trading strategies before risking real capital.

How To Do Futures And Options Trading In Zerodha

Image: brokerchooser.com

Conclusion:

Futures and options trading in Zerodha offers exciting possibilities for both seasoned traders and those seeking to venture into this dynamic financial arena. By leveraging Zerodha’s intuitive platform, accessing expert guidance, and implementing prudent risk management techniques, you can unlock the full potential of these financial instruments.

Are you ready to embark on your futures and options trading journey? Explore Zerodha’s platform and harness the knowledge and strategies presented here to navigate the markets with confidence and aim for financial success.