Immerse yourself in the dynamic world of future and option trading with Zerodha, a renowned Indian brokerage firm that empowers traders with cutting-edge platforms and comprehensive support. By delving into the intricacies of futures and options, you unlock the potential for lucrative returns while navigating the inherent risks associated with these financial instruments. This comprehensive guide will equip you with a step-by-step understanding of future and option trading in Zerodha, empowering you to confidently navigate this exhilarating realm.

Image: www.youtube.com

Delving into the Realm of Futures Trading: A Primer

Futures contracts are agreements to buy or sell a specific quantity of an underlying asset, such as a commodity or stock, at a predetermined price on a future date. By engaging in futures trading, investors can hedge against price fluctuations and speculate on future market movements. Zerodha provides access to a wide range of futures contracts, including those for commodities like gold, silver, and crude oil, as well as equity indices like Nifty and Bank Nifty.

Unveiling the Enigma of Options Trading: A Crucible of Strategies

Options contracts grant the holder the right, but not the obligation, to buy or sell an underlying asset at a set price on or before a specific date. They empower investors to devise sophisticated strategies that cater to varying risk appetites and market conditions. Zerodha offers a diverse array of option contracts, enabling traders to craft tailored trading plans based on their investment goals.

Step-by-Step Guide to Navigating the Zerodha Platform: A Path to Empowerment

- Establishing an Account: The Foundation of Your Trading Journey

Create a Demat and trading account with Zerodha, which will act as the gateway to your financial endeavors. Provide the necessary documentation to complete the process.

- Funding Your Account: Fueling Your Trading Ambitions

Transfer funds into your Zerodha trading account to provide the capital for your trades. Utilize various payment options to effortlessly fund your account and kick-start your trading journey.

- Understanding Trading Platforms: Your Command Center

Familiarize yourself with Zerodha’s user-friendly trading platforms, Kite and Pi. These platforms provide real-time market data, charting tools, and advanced order placement mechanisms.

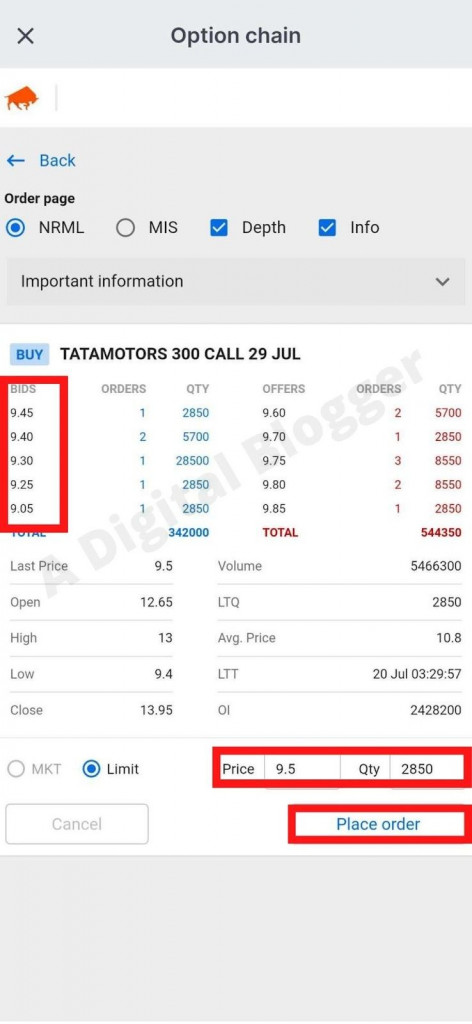

- Executing Trades: Transforming Strategies into Actions

Once you have identified trading opportunities, execute your trades with precision and confidence using Zerodha’s trading platforms. Monitor your positions in real-time to stay abreast of market developments.

- Managing Risk: The Cornerstone of Prudent Trading

Implement prudent risk management strategies to safeguard your capital against potential market fluctuations. Utilize stop-loss orders, position sizing, and other techniques to mitigate risks and enhance your trading outcomes.

Image: www.adigitalblogger.com

Additional Enriching Resources for a Comprehensive Understanding

- Zerodha Varsity: An Educational Haven for Traders

Explore Zerodha Varsity, a comprehensive educational platform that provides in-depth knowledge and insights into future and option trading. Access articles, videos, and courses tailored to traders of all experience levels.

- Community Forums and Social Media: Tapping into Collective Wisdom

Engage in online forums and social media groups dedicated to Zerodha users. Connect with fellow traders, share experiences, and glean valuable insights from the collective wisdom of the community.

- Zerodha Support: A Reliable Guide throughout Your Journey

Leverage Zerodha’s exceptional customer support to resolve queries, seek assistance, and enhance your overall trading experience. Access support via email, phone, and live chat to ensure a seamless and hassle-free trading journey.

How To Do Future And Option Trading In Zerodha

Image: learn.financestrategists.com

Conclusion: Embracing the Thrill of Future and Option Trading with Zerodha

Future and option trading with Zerodha empowers you to explore the dynamic world of financial markets and potentially multiply your wealth. By grasping the nuances of these financial instruments, you unlock the opportunity to hedge risks, speculate on market movements, and craft tailored strategies that align with your investment objectives. As you navigate the thrilling realm of futures and options trading, remember to prioritize risk management, continuously seek knowledge, and embrace the challenges and rewards that this multifaceted financial landscape presents.