With the rapid advancements in financial technology, options trading has become increasingly accessible to retail investors. Among the various types of options strategies, daily options have gained popularity due to their potential for high returns and the flexibility they offer. In this comprehensive guide, we delve into the intriguing world of daily options trading, providing insights into its history, basic concepts, and real-world applications.

Image: www.youtube.com

Understanding Daily Options

As their name suggests, daily options have an exceptionally short lifespan of just one trading day. Unlike traditional options contracts that expire on a specific date, daily options expire at the end of the trading session on the day they are purchased. This unique feature makes them ideal for traders seeking to capitalize on short-term market fluctuations without the prolonged commitment associated with longer-term options strategies.

Daily options come in two flavors: calls and puts. Call options give the holder the right to buy an underlying asset at a specified price, while put options grant the right to sell. With daily options, traders can speculate on whether the underlying asset’s price will rise or fall above a predetermined level before the end of the trading day.

Historical Evolution of Daily Options

The concept of expiring options at the end of the trading day is not a novel one. Daily settlement options have existed for decades, but their popularity was constrained by the complexities of execution and the high transaction costs involved. With the advent of electronic trading platforms and reduced commissions, daily options have become a viable option for a wider audience.

Unlocking the Potential of Daily Options

The primary allure of daily options lies in their potential for high returns. By targeting short-term market movements, traders can potentially profit from even slight price fluctuations within a single trading session. Additionally, the flexibility offered by daily options allows traders to adjust their positions quickly, reducing the risk of prolonged market exposure.

One noteworthy application of daily options is in hedging strategies. By purchasing daily options with an expiration time aligned with the underlying asset’s holding period, traders can protect their portfolio against adverse market movements. This strategy can mitigate losses while preserving the potential for upside gains.

Image: economictimes.indiatimes.com

Examples of Daily Options Trading

To provide a concrete illustration of how daily options work, let’s consider the following scenario:

Trader A believes that the price of Apple stock (AAPL) will increase on a given day. To capitalize on this belief, they purchase a daily call option with a strike price of $150, meaning they have the right to buy AAPL shares at $150 anytime before the end of the trading day. If AAPL’s stock price rises above $150, Trader A can exercise the option, purchasing the shares at $150 and immediately selling them at the higher market price, generating a profit.

Conversely, if Trader B expects AAPL’s price to decline, they could purchase a daily put option, giving them the right to sell AAPL shares at $150. If the stock price falls below $150, Trader B can exercise the option, selling the shares at $150 and locking in a profit.

Navigating Daily Options Strategies

While daily options provide the opportunity for substantial gains, they also come with inherent risks. Understanding risk management strategies is crucial for successful daily options trading. One effective strategy is to limit the number of contracts traded and to set clear profit and loss targets. Additionally, traders should be aware of the time decay associated with daily options, as their value erodes as the expiration time approaches.

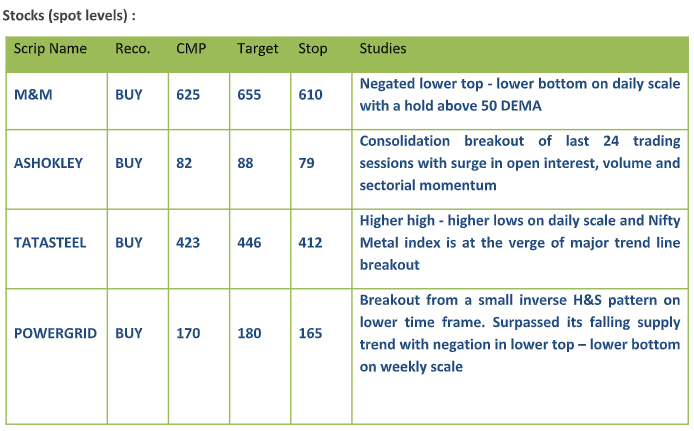

Daily Options Trading Picks

Image: www.slideshare.net

Conclusion

Daily options trading presents both opportunities and challenges for traders seeking to navigate short-term market volatility. By understanding the basic concepts, historical evolution, and real-world applications of daily options, traders can develop informed strategies that align with their risk tolerance and profit goals. With careful execution and risk management, daily options can be a powerful tool for growing capital and achieving financial success.