Embark on the World of Option Trading

Welcome to the realm of option trading! As a seasoned investor, I have witnessed firsthand the transformative power of utilizing options to navigate the constantly fluctuating markets. In today’s guide, we will delve into the strategies behind option trading, unlocking the secrets to harnessing its potential and maximizing your financial endeavors.

Image: www.cityindex.com

Demystifying Options

Options represent a versatile financial instrument, granting you the right, not the obligation, to buy or sell an underlying asset at a predetermined price. This flexibility allows you to craft tailor-made strategies that align with your risk tolerance and investment goals. Options open up a myriad of possibilities, enabling you to speculate on price movements, hedge against potential losses, and enhance your returns.

Unveiling Option Trading Strategies

The art of option trading encompasses a diverse array of strategies, each designed to cater to specific market conditions and investment objectives. Here are some widely-employed approaches:

-

Covered Call Strategy: This strategy involves owning the underlying stock and simultaneously selling a call option against it. By doing so, you cap your potential upside but generate income from the premium received.

-

Protective Put Strategy: By purchasing a put option, you create a safety net for your underlying stock portfolio. This strategy mitigates downside risk in the event of adverse price movements.

-

Bull Call Spread: This bullish strategy involves simultaneously buying and selling a call option at different strike prices. This approach provides a limited but enhanced profit potential compared to simply buying a call option.

-

Bear Put Spread: Conversely, a bear put spread is a bearish strategy that entails selling a put option and simultaneously buying a put option at a higher strike price. This strategy benefits from declining prices in the underlying asset.

-

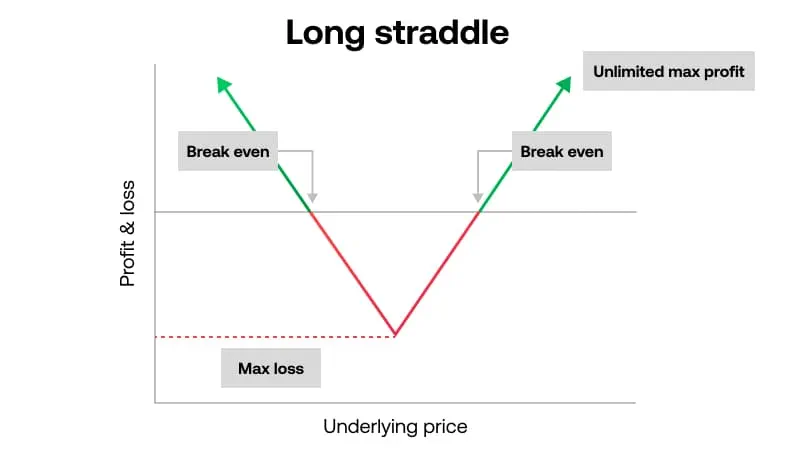

Straddle Strategy: This neutral strategy involves purchasing both a call and a put option on the same underlying asset, both with the same expiration date but different strike prices. It maximizes your return from rapid price movements in either direction.

These strategies represent a mere glimpse into the vast landscape of option trading techniques. Selecting the optimal strategy hinges on the prevailing market conditions, your risk propensity, and investment horizon.

Expert Guidance for Navigating Option Trading

To navigate the complexities of option trading, heed the wisdom of experienced practitioners who have mastered the art of capitalizing on market fluctuations. Their insights can enlighten your journey and guide your decision-making.

-

Embrace Research and Education: The key to unlocking the full potential of option trading is to continuously expand your knowledge base. Immerse yourself in books, attend workshops, and consult reputable sources to sharpen your understanding.

-

Practice with Paper Trading: Before venturing into real-world trading, hone your skills through simulated environments. Paper trading platforms allow you to test your strategies and gain valuable experience without exposing your capital.

-

Manage Risk Prudently: Always prioritize risk management by implementing strategies that align with your risk tolerance. Employ tools like stop-loss orders, margin accounts, and thorough position sizing.

Image: www.pinterest.com

Frequently Asked Questions: Demystifying Option Trading

Q: What are the advantages of option trading?

A: Option trading offers potential income generation, enhanced returns, and effective risk management strategies.

Q: Can option trading be profitable for beginners?

A: While option trading provides vast opportunities, it requires a solid understanding of the strategies and unwavering adherence to risk management principles. Beginners are advised to thoroughly educate themselves and gain sufficient experience before allocating significant capital.

Q: What are the different types of options?

A: The two primary types of options are call options and put options. Call options convey the right to buy, while put options confer the right to sell the underlying asset at a predetermined price.

Q: How are options priced?

A: Option premiums are influenced by various factors, including the underlying asset’s price, strike price, time to expiration, and market volatility.

Illustrate Different Option Trading Strategies Using Live Diagrams

Image: www.pinterest.fr

Conclusion

The world of option trading is a captivating realm, empowering you to amplify your returns and safeguard your capital. By embracing a comprehensive understanding of the diverse strategies, diligently researching market dynamics, and implementing prudent risk management practices, you can harness the potential of this multifaceted investment tool.

As you delve into this article, we invite you to embark on a journey of exploration and discovery. Let us unravel the intricate tapestry of option trading together and unlock the potential for financial success.