Introduction:

Image: www.pasitechnologies.com

In the fast-paced world of investing, advanced options trading has emerged as a sophisticated and lucrative strategy for experienced traders. As an alternative to traditional stock trading, options contracts offer unique opportunities for capital growth and the potential to mitigate risk. However, navigating the complexities of options trading requires a keen understanding of underlying concepts, trading strategies, and the ability to evaluate their efficacy. This comprehensive guide will delve into the intricacies of advanced options trading, empowering you to analyze and evaluate trading strategies with precision, maximizing your chances of success.

What is Advanced Options Trading?

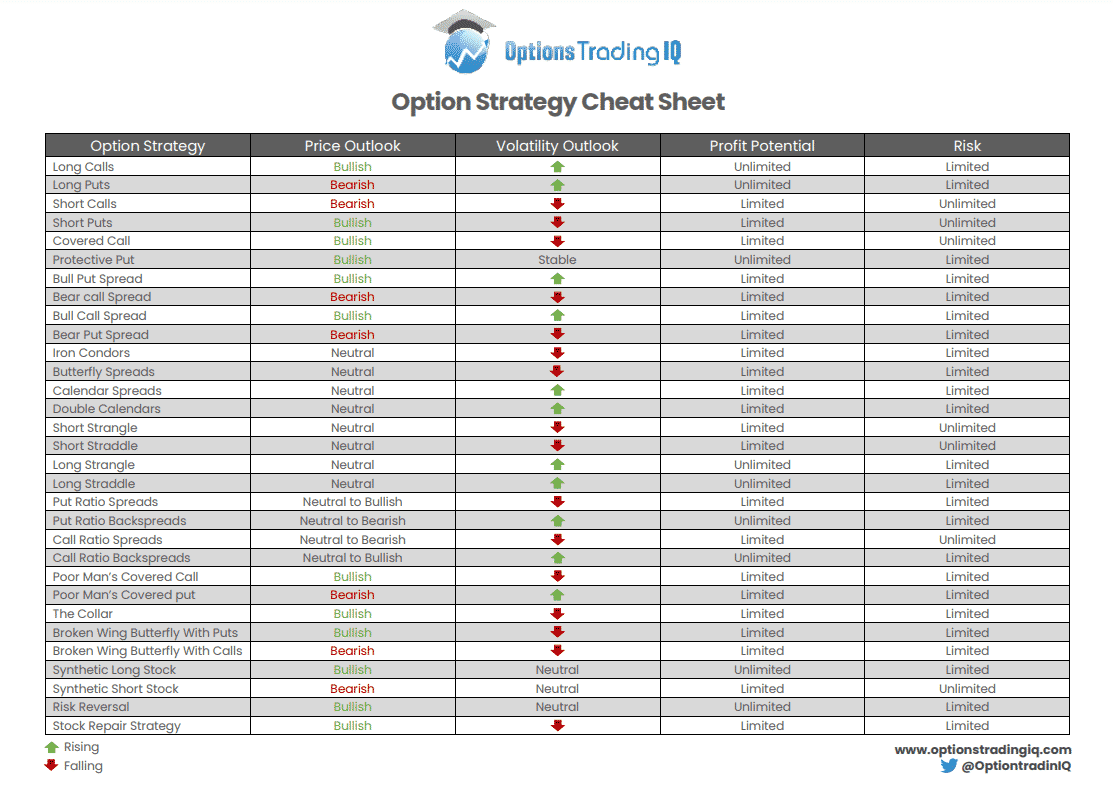

Advanced options trading goes beyond the basics of buying and selling call and put options. It involves employing advanced strategies, such as spreads, combinations, and multi-leg trades, to enhance returns while managing risk. By combining different types of options with varying strike prices and expiration dates, traders can create sophisticated positions that capitalize on specific market conditions.

Analyzing and Evaluating Trading Strategies:

The key to successful advanced options trading lies in the meticulous analysis and evaluation of trading strategies. This involves examining several crucial aspects:

-

Historical Performance: Backtesting a strategy against historical data can indicate its potential profitability and consistency. Analyze parameters such as win rate, average profit, and risk-reward ratio.

-

Market Conditions: Identify the market scenarios for which the strategy is designed. Consider volatility, interest rates, and sector trends to determine the suitability of the strategy for current market conditions.

-

Risk Tolerance: Assess the risk profile of the strategy, including potential drawdown, maximum loss, and margin requirements. Align the strategy with your own tolerance for risk.

-

Trading Style: Evaluate whether the strategy aligns with your trading style, including time horizon, trade frequency, and preferred market conditions. Choose strategies that complement your preferences and risk tolerance.

Expert Insights and Actionable Tips:

To gain an edge in advanced options trading, seek guidance from renowned experts. Attend webinars, read industry publications, and consult with experienced traders. Incorporate their insights into your own strategy development.

-

Start Small: Begin with small trades to gain practical experience and confidence. Gradually increase position size as you develop proficiency and comfort with the strategies you employ.

-

Manage Risk Effectively: Utilize advanced risk management techniques such as stop-loss orders, position sizing, and margin monitoring. Protect your capital by minimizing potential losses.

Conclusion:

Advanced options trading offers the potential for substantial returns in the financial markets. By understanding the concepts, analyzing and evaluating trading strategies, and seeking expert advice, you can navigate the complexities of this sophisticated investment domain. Remember, the key to success lies in ongoing learning, diligent analysis, and disciplined risk management. Embrace the challenges of advanced options trading, empowering yourself with knowledge and strategies to unlock the transformative power of this exceptional investment approach.

Image: optionstradingiq.com

Advanced Options Trading The Analysis And Evaluation Of Trading Strategies