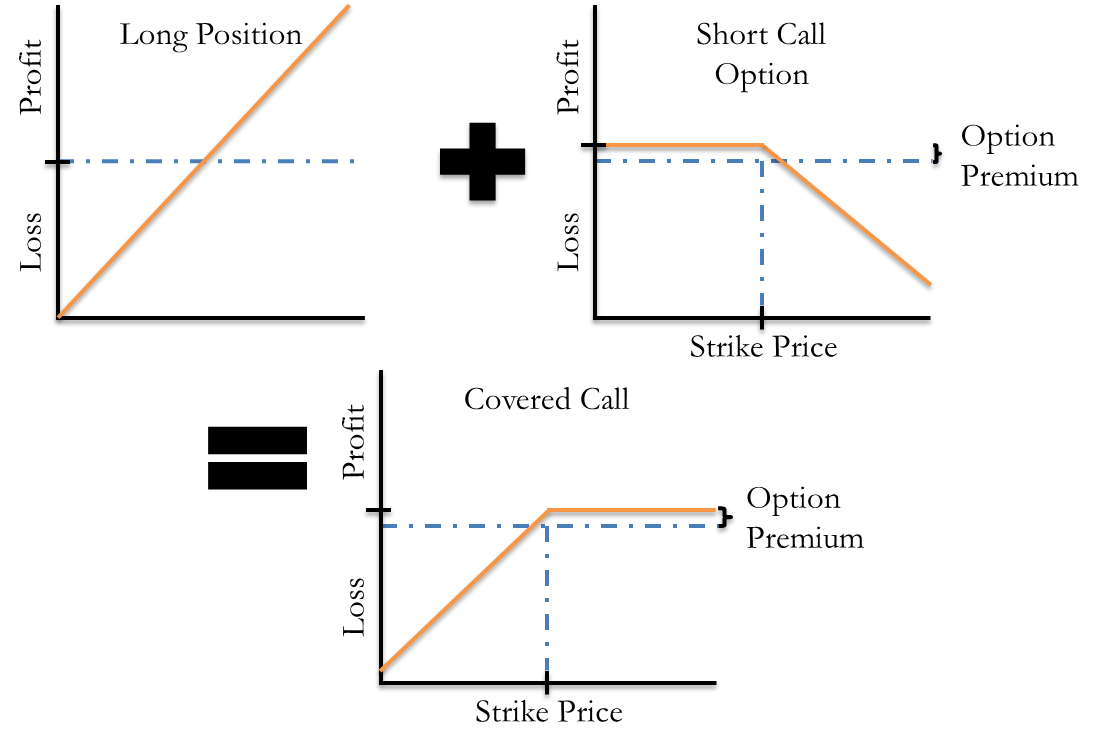

Covered calls are a widely-used options strategy that involves selling (or writing) call options against a stock you own. While traditional covered call strategies focus on generating income from option premiums, alternative covered call strategies take a different approach to unlock additional profit potential. In this comprehensive guide, we delve into the nuances of alternative covered call strategies, empowering you to navigate the options market with finesse and precision.

Image: www.pinterest.com

Understanding the Essence of Alternative Covered Call Strategies

Alternative covered call strategies differ from traditional strategies by incorporating sophisticated techniques that enhance risk management, optimize returns, and adapt to changing market conditions. By incorporating elements such as spreads, hedging, and volatility trading, these strategies seek to augment income generation capabilities while mitigating downside risks. The beauty of these strategies lies in their customizability, allowing traders to tailor the strategy to their unique risk tolerance, investment objectives, and market outlook.

Benefits Unveiled: A Deeper Dive into Advantages

Alternative covered call strategies offer a myriad of advantages, making them a compelling choice for savvy options traders. These strategies provide the potential to:

-

Enhance Premium Income Generation: By employing sophisticated techniques, these strategies harness the power of options spreads to amplify premium income, outpacing traditional covered call strategies.

-

Improved Risk Management: Advanced hedging techniques employed in these strategies mitigate downside risks, offering a level of protection not found in traditional approaches.

-

Flexibility and Adaptability: The customizability of alternative covered call strategies empowers traders to dynamically adjust their positions based on market conditions, ensuring alignment with their investment objectives.

Strategy Variations: A Tapestry of Techniques

Alternative covered call strategies encompass a diverse range of techniques, each tailored to specific market conditions and risk appetites. Let’s explore some popular variations:

-

Bullish Call Spread Covered Call: This strategy combines a bullish call spread with a covered call, amplifying the profit potential in rising markets while capping potential losses.

-

Bearish Put Spread Covered Call: Designed for anticipated market downturns, this strategy utilizes a bearish put spread to hedge against downside risks while generating income through the covered call.

-

Volatility Trading Covered Call: Tapping into volatility, this strategy employs options to capitalize on short-term price swings, enhancing income generation potential.

Image: www.tradingpedia.com

Implementation Essentials: A Practitioner’s Guide

Effective implementation of alternative covered call strategies requires diligent research and adherence to best practices. Traders should:

-

Conduct Thorough Research: Meticulously analyze the underlying stock, options market conditions, and historical data to support informed decision-making.

-

Define Risk Parameters: Clearly establish risk tolerance and investment objectives to guide strategy selection and position sizing.

-

Monitor Market Conditions: Stay abreast of market developments and adjust strategies as needed to align with changing market dynamics.

Alternative Covered Call Options Trading Strategy

Conclusion: Unlocking Profit Potential with Alternative Covered Call Strategies

Alternative covered call options trading strategies offer a sophisticated and customizable approach to maximizing income generation and managing risk. By embracing these advanced techniques, traders can unlock the full potential of the options market. However, it is imperative to approach these strategies with a thorough understanding, diligent research, and a disciplined approach to ensure successful implementation. With knowledge as your compass and strategy as your guide, embark on a journey to elevate your options trading prowess.