Options trading has become increasingly popular in recent years, with many individuals seeking to capitalize on the potential for substantial returns. Among the various options trading strategies, one that has gained significant attention is known as trading options on implied volatility (IV) WSB.

Image: www.ydeho.com

In this comprehensive guide, we’ll delve into the world of trading options on IV WSB, exploring its fundamentals, strategies, risks, and rewards. Whether you’re a seasoned trader or a beginner looking to start your options trading journey, this article will provide you with the essential knowledge and insights to navigate this exciting yet volatile market.

What is Trading Options on IV WSB?

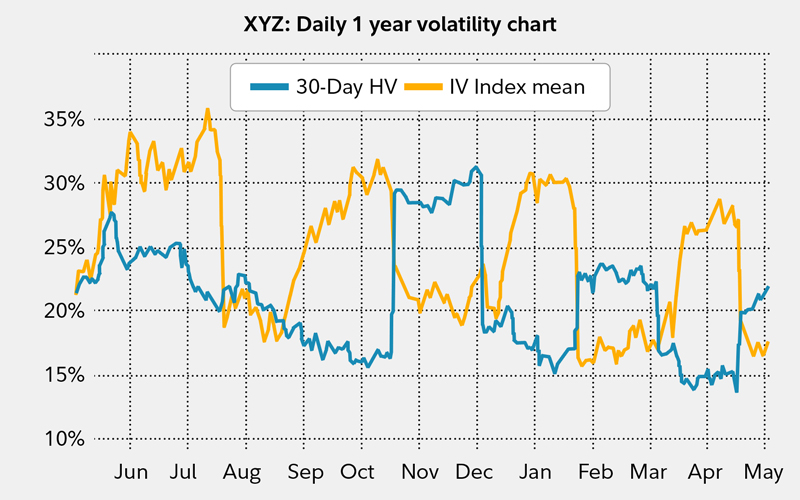

Trading options on IV WSB involves buying or selling options contracts with the aim of profiting from changes in implied volatility (IV). IV represents the market’s expectation of future price fluctuations in the underlying asset, such as a stock or index. When IV is high, it means the market anticipates significant price movements, while low IV indicates expectations of relatively stable prices.

WSB, or WallStreetBets, is a popular subreddit where traders share trading ideas and insights. Options trading on IV WSB often involves identifying stocks or assets with high IV and betting on whether the volatility will increase or decrease in the future. This can be a highly speculative strategy, but it can also yield significant returns if executed successfully.

Understanding Implied Volatility (IV)

Implied volatility is a key factor to consider when trading options on IV WSB. IV is calculated using a complex formula that takes into account various factors, including the current market price of the underlying asset, time to expiration, and risk-free interest rates.

Higher IV indicates that the market expects significant price fluctuations in the underlying asset, while lower IV suggests expectations of relatively stable prices. Traders who believe that IV will continue to rise can buy call options or sell put options. Conversely, those who anticipate a decline in IV can sell call options or buy put options.

Strategies for Trading Options on IV WSB

Image: www.reddit.com

1. IV Crush Strategy

The IV crush strategy involves profiting from the decay of IV over time. When IV is high, options contracts tend to be more expensive. As the expiration date approaches, IV typically declines, causing the value of these options to decrease as well.

Traders who employ the IV crush strategy typically sell call options or buy put options when IV is high. They aim to hold these contracts until close to expiration, benefiting from the decline in IV and the resulting decrease in options premiums.

2. IV Breakout Strategy

The IV breakout strategy seeks to identify stocks or assets that are experiencing a sudden increase in IV. This can be caused by unexpected news, events, or market conditions. Traders who believe that the IV breakout will continue can buy call options or sell put options.

The key to success with the IV breakout strategy is to identify stocks with genuine catalysts for increased volatility. Traders should also have a clear exit strategy in place, as IV spikes can be short-lived.

Tips and Advice for Options Trading on IV WSB

Trading options on IV WSB requires a thorough understanding of the market and a disciplined approach. Here are some tips and advice to help you navigate this challenging terrain:

- Research and due diligence: Before trading any options, it is crucial to conduct thorough research on the underlying asset, the IV, and the specific strategy you plan to use.

- Start small: Options trading can be a high-risk activity. It is always advisable to start with small positions and gradually increase your exposure as you gain experience and confidence.

- Use leverage wisely: Options can provide significant leverage, but this can also magnify potential losses. Use leverage judiciously and ensure you have a sound risk management strategy in place.

- Stay informed: The options market is constantly changing. Stay up-to-date with the latest news, events, and market trends that could impact your positions.

Frequently Asked Questions (FAQs)

Q: How risky is options trading on IV WSB?

A: Options trading on IV WSB can be a highly speculative activity with significant potential for losses. The market is volatile, and even experienced traders can suffer setbacks.

Q: What is the best strategy for trading options on IV WSB?

A: The best strategy depends on market conditions and individual risk tolerance. The IV crush and IV breakout strategies are two popular approaches, but there is no one-size-fits-all strategy.

Q: Can I make quick money trading options on IV WSB?

A: While it is possible to make substantial profits trading options on IV WSB, it is not a get-rich-quick scheme. Success requires a combination of skill, experience, and a measured approach.

Trading Options On Iv Wsb

Image: thewaverlyfl.com

Conclusion

Trading options on IV WSB offers the potential for significant returns but also carries a high degree of risk. By understanding the fundamentals of implied volatility, employing effective strategies, and following sound advice, traders can navigate this market with greater confidence and potentially reap the rewards of this exhilarating trading arena.

Are you ready to embark on your options trading journey? Remember to approach it with a sense of excitement and a willingness to learn, adapt, and persevere. The world of trading options on IV WSB beckons, and with the right knowledge and strategies, you can seize the opportunities and navigate the challenges it presents.