Introduction

Embark on a transformative trading journey that empowers you to hone your skills and navigate the intricate world of options trading. Paper trading, a simulated trading environment, serves as the perfect testing ground for aspiring traders. This article will delve into the realm of paper trading options, specifically utilizing the robust platform offered by TD Ameritrade. As we traverse this educational expedition, you will gain invaluable insights into the intricacies of option strategies, risk management techniques, and the dynamics of the financial markets.

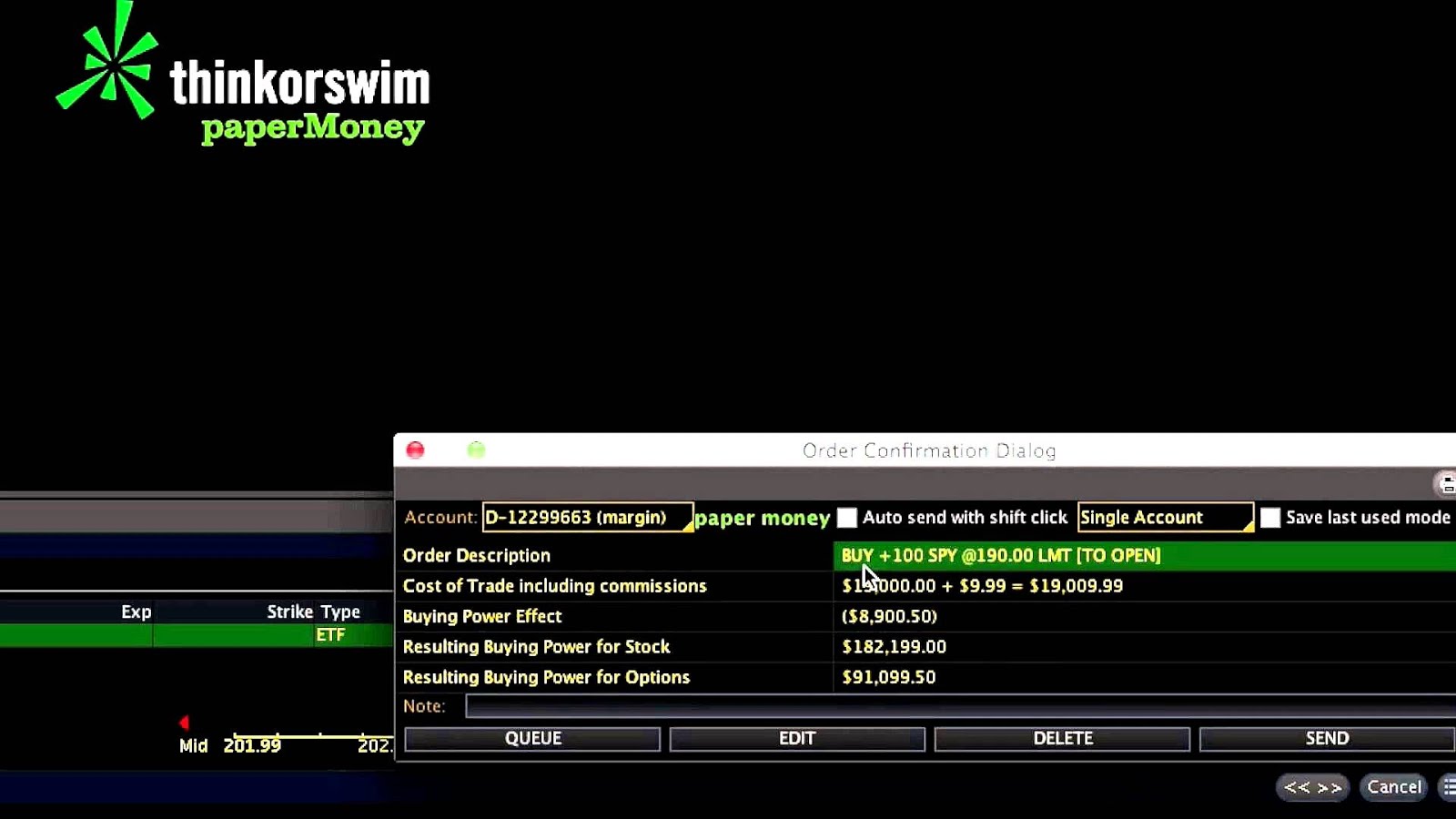

Image: farrrepand85.blogspot.com

The Allure of Paper Trading Options

Risk aversion is a natural instinct, especially when dealing with intricate financial instruments like options. Paper trading provides a safe haven, allowing you to experiment with different strategies and test your trading acumen without risking real capital. With paper trading options, you can explore the complexities of options contracts, their impact on your portfolio, and how to manage risk effectively.

TD Ameritrade: A Champion in Paper Trading Options

TD Ameritrade stands as an industry titan, renowned for its cutting-edge trading platform and a plethora of educational resources. Their paper trading options platform is a testament to their commitment to empowering traders. Within this simulated environment, you have access to real-time market data, comprehensive charting tools, and a vast array of order types. With TD Ameritrade’s paper trading options platform, you can:

- Practice trading options strategies without risking real money

- Test different strategies and fine-tune your approach

- Gain a deep understanding of options pricing and risk management

- Learn from your mistakes and improve your trading skills

Unveiling the Options Trading Universe

Options, a versatile financial instrument, provide a myriad of opportunities for traders of all experience levels. Paper trading options with TD Ameritrade opens a gateway to the following essential concepts:

Image: tradechoices.blogspot.com

Call and Put Options: Two Sides of the Trading Coin

Call options offer a gateway to profit from potential price increases in an underlying asset, while put options empower you to benefit from price declines. Understanding the nuances of each option type is a foundational step toward mastering option strategies.

Options Premiums: The Price of Possibility

Options premiums, the price you pay to enter an options contract, reflect the market’s assessment of an underlying asset’s future price movements. Grasping the factors that influence premiums is crucial for successful option trading.

Exercise and Expiration: Concluding the Options Journey

Options contracts come with a predetermined expiration date, marking the day when you must exercise your right to buy or sell the underlying asset at the agreed-upon strike price. Understanding the mechanics of exercise and expiration is essential for managing open positions and maximizing profits.

Mastering Option Strategies: A Pathway to Success

The world of options trading is vast and complex, but with paper trading options, you can embark on a journey to master a diverse range of strategies. TD Ameritrade’s platform provides a comprehensive learning environment where you can explore the following strategies:

Bullish Strategies: Capitalizing on Market Ascents

When the market sentiment is positive, bullish strategies offer an array of options to capitalize on rising prices. From classic covered calls to sophisticated bull call spreads, paper trading allows you to experiment with various strategies and find those that align with your risk tolerance and financial goals.

Bearish Strategies: Profiting from Market Declines

Even in bearish markets, traders can uncover opportunities to generate profits. Paper trading options empowers you to explore bearish strategies, such as protective puts and bear put spreads, arming you with tools to navigate market downturns and potentially generate positive returns.

Neutral Strategies: Embracing Market Neutrality

Neutral strategies offer a unique way to profit from market stability or limited price movements. These strategies, such as straddles and strangles, can generate income through premium decay or minor price fluctuations, providing a haven for traders seeking less volatile returns.

Risk Management: The Compass in the Trading Storm

Navigating the financial markets requires a keen understanding of risk management principles, which paper trading options with TD Ameritrade allows you to explore in a simulated environment. Fundamental risk management strategies include:

Understanding Your Risk Tolerance: Charting Your Trading Course

Risk tolerance is a cornerstone of successful trading, defining the amount of risk you are comfortable accepting in pursuit of profit. Paper trading options provides a sandbox to experiment with different levels of risk and identify the strategies that suit your risk appetite.

Td Ameritrade Paper Trading Options

Diversification: Spreading Risk Across Horizons

Diversification is a time-honored risk management technique that involves spreading your trades across different assets or strategies. Paper trading options empowers you to test