In the ever-evolving financial landscape, options trading stands as a potent force, empowering investors with the potential for remarkable gains. Among the vast array of trading strategies, triumph option trading stands apart as a method that can transform the trajectory of your financial endeavors. This comprehensive guide delves into the intricacies of triumph option trading, deciphering its essence, unraveling its strategies, and unraveling the secrets to its success.

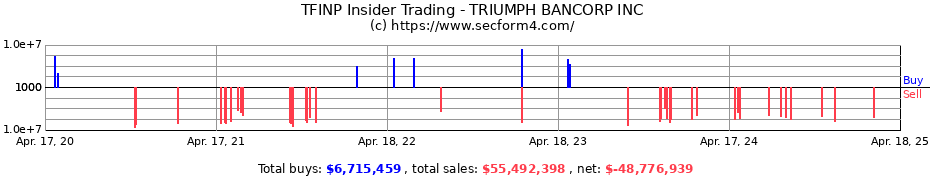

Image: www.secform4.com

Deciphering the Enigma of Triumph Option Trading

Option trading, in essence, entails purchasing or selling contracts that grant the holder the right, but not the obligation, to purchase or sell an underlying asset at a predetermined price on a specified date. Triumph option trading is an advanced technique that leverages specific strategies to identify and capitalize on triumph options—options with a high probability of success. This approach harnesses sophisticated analytical tools and a deep understanding of market dynamics to select options poised to yield substantial returns.

Unlocking the Keys to Triumph

Triumph option trading hinges on a multifaceted approach that encompasses:

-

Diligent Research: Meticulously studying historical data, market trends, and news events is paramount to identifying potentially lucrative opportunities.

-

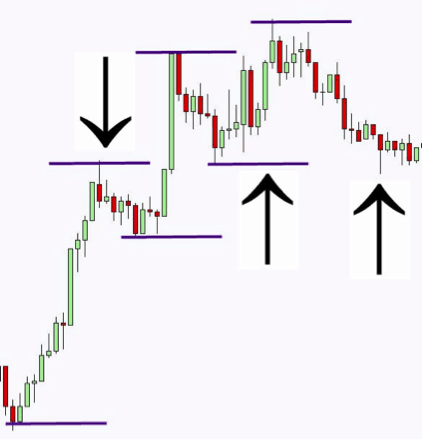

Technical Analysis Savvy: Utilizing technical indicators, such as moving averages and support/resistance levels, can enhance market forecasting and pinpoint potential triumph options.

-

Understanding of Market Forces: Keenly comprehending factors that influence market behavior, including economic indicators, geopolitical events, and supply/demand dynamics, is essential for making informed decisions.

-

Risk Management Discipline: Triumph option trading, while alluring, carries inherent risks. Prudent investors adhere to strict risk management principles, allocating funds wisely and employing strategies that mitigate potential losses.

Strategies for Triumph

Numerous strategies can pave the path to triumph option trading success. Some popular approaches include:

-

Covered Calls: A conservative strategy where an investor owns the underlying asset and sells an out-of-the-money call option against it.

-

Cash-Secured Puts: Another low-risk strategy where an investor has enough cash in their account to purchase the underlying asset if the option is exercised.

-

Bull Put Spread: A combination of a long out-of-the-money call option and a short out-of-the-money call option, designed to profit from significant price increases.

-

Iron Condor: A non-directional strategy that involves buying and selling both call and put options at different strike prices to profit from low volatility.

Image: www.netpicks.com

Triumph Option Trading

Image: www.quora.com

The Triumphant Path to Success

Investing in triumph options, while potentially rewarding, demands a concerted effort, a thirst for knowledge, and unwavering discipline. By meticulously researching, sharpening technical analysis skills, and comprehending market forces, you can position yourself to identify profitable opportunities. Moreover, adopting proven strategies and adhering to sound risk management principles will equip you to navigate the complexities of option trading with greater confidence. Embrace the path to triumph option trading, and you will unlock the potential for extraordinary financial success.