Introduction

As a seasoned trader in the ever-evolving financial markets, I’m often intrigued by innovative strategies that can potentially enhance my returns. One such strategy that has recently captured my attention is scalping trading options.

Image: www.youtube.com

Scalping is a short-term trading technique that involves holding positions for a brief period, typically within a few minutes or even seconds. It aims to accumulate small but consistent profits by exploiting short-term price movements. While it can be challenging, scalping options can offer lucrative opportunities for experienced traders who can execute trades swiftly and efficiently.

Understanding Scalping Trading Options

Scalping trading options involves buying and selling options contracts within a short time frame, aiming to profit from small price fluctuations. Options contracts provide traders with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price known as the strike price. By purchasing an option, the trader bets on the direction of the underlying asset’s price movement while limiting their potential loss to the premium paid for the option contract.

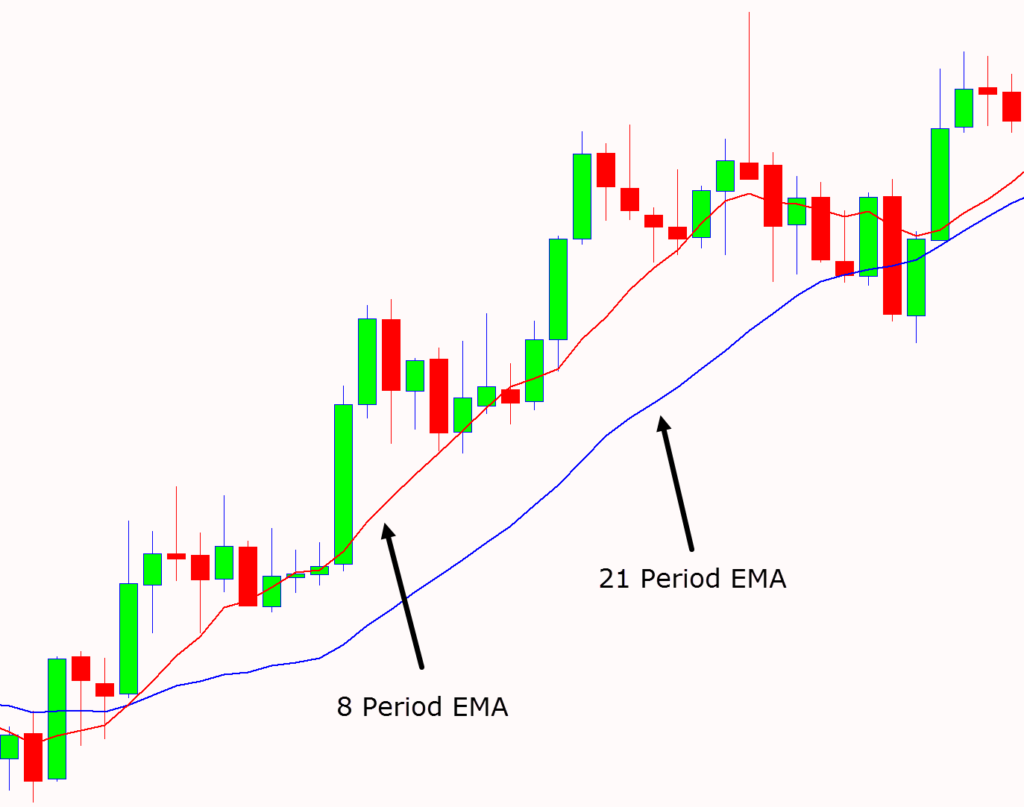

Scalpers typically trade liquid options with high volume and open interest to ensure they can quickly enter and exit positions at favorable prices. They leverage technical analysis, such as candlestick patterns and support and resistance levels, to identify potential trading opportunities.

The Process of Scalping Options

The process of scalping options can be summarized as follows:

- Identify a potential trading opportunity based on technical analysis.

- Enter a trade by buying or selling an options contract with a short time horizon.

- Monitor the trade closely and adjust your position size or exit the trade if necessary.

- Secure profits or minimize losses by exiting the trade at the desired target or stop-loss level.

Scalpers constantly monitor market conditions and adjust their strategies based on the ever-changing market dynamics.

Tips and Expert Advice for Scalping Options

To succeed in scalping trading options, consider the following tips and expert advice:

- In-depth Market Knowledge: Gain a thorough understanding of options trading concepts, including option pricing models and volatility.

- Technical Analysis Proficiency: Develop strong technical analysis skills to identify trading opportunities and manage risk.

- Risk Management Discipline: Implement a robust risk management strategy that limits potential losses and protects your capital.

- Swift Execution: Leverage high-speed trading platforms and data feeds to execute trades efficiently in fast-paced market conditions.

- Emotional Control: Maintain emotional discipline and avoid making impulsive trades based on fear or greed.

Image: learnpriceaction.com

FAQs on Scalping Trading Options

Q: What is the average holding period for scalping options?

A: Scalpers typically hold options contracts for a few minutes or even seconds, seeking to profit from short-term price fluctuations.

Q: What factors should be considered when selecting options contracts for scalping?

A: Scalpers prioritize options with high liquidity, open interest, and low time decay to ensure quick entry and exit.

Scalping Trading Option S

Image: www.pinterest.com

Conclusion

Scalping trading options can be an exciting and potentially rewarding strategy for experienced traders with strong analytical skills and a firm grasp of options trading. By following the strategies outlined above and seeking professional advice when necessary, you can increase your chances of success in this fast-paced and challenging market.

Please let me know if you have any questions or would like to explore this topic further. Let’s engage in a meaningful dialogue about scalping trading options and the potential opportunities it presents.