Introduction

In the fast-paced world of financial markets, traders constantly seek strategies that provide rapid profit potential. Among these strategies, scalping stands out as a popular choice, attracting traders with its promise of swift returns. Option trading scalping, in particular, offers a unique opportunity to capitalize on short-term price fluctuations in the underlying asset. In this comprehensive guide, we will explore the intricacies of option trading scalping, providing insights into its mechanics, benefits, and potential pitfalls.

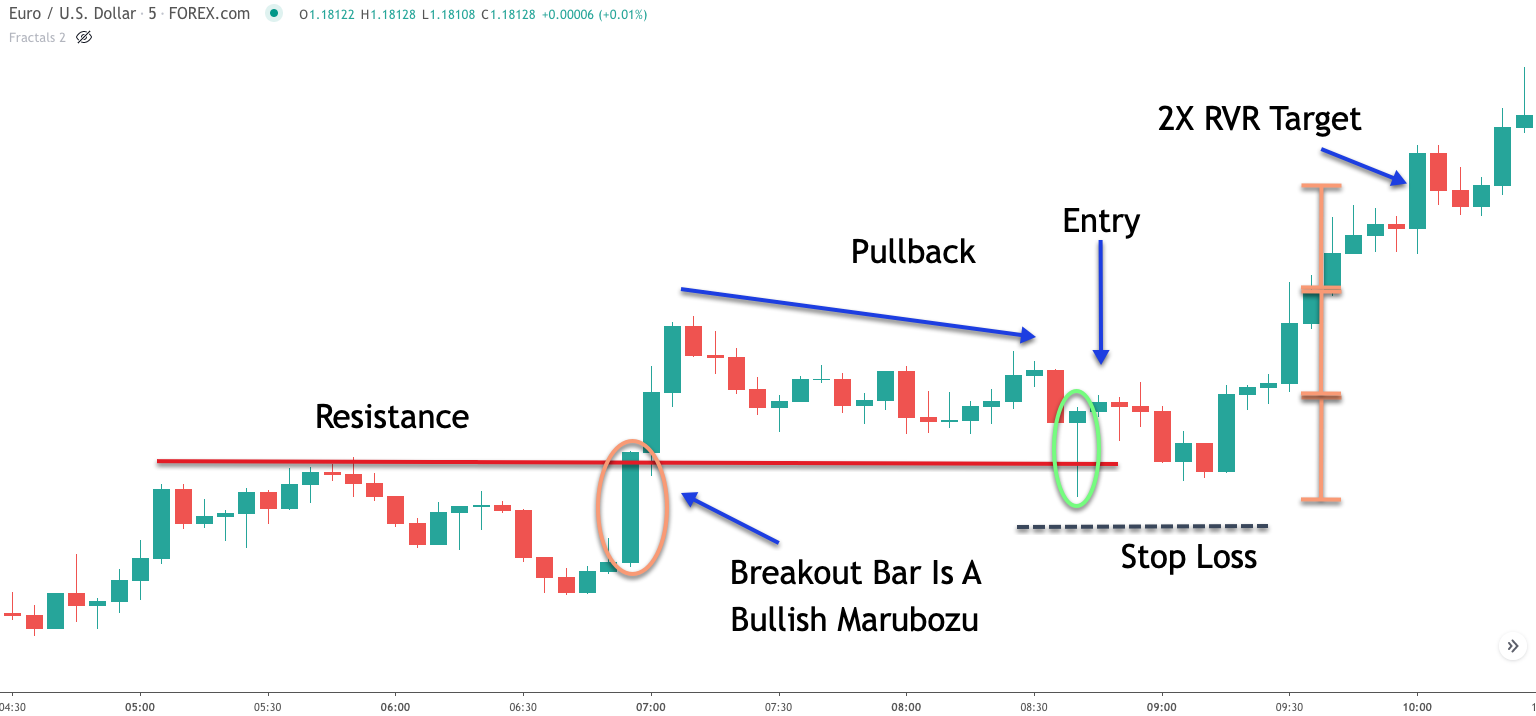

Image: forextraininggroup.com

Understanding Option Trading Scalping

Option trading scalping involves buying and selling options contracts within a short time frame, minutes or even seconds, to capture small price movements. These traders typically enter and exit positions within a single trading session, aiming for quick profits from the bid-ask spread or small price fluctuations. Unlike traditional options traders who hold positions for days or weeks, scalpers focus on capitalizing on intraday price movements.

The Mechanics of Scalping

To execute a successful option scalp, traders employ various techniques. One common approach involves exploiting the bid-ask spread, the difference between the highest bid and lowest ask price. By quickly buying at the bid and selling at the ask, scalpers can secure a profit if the spread is wide enough to cover execution costs. Other techniques include delta neutral trading, where traders aim to maintain a portfolio with zero net delta exposure, and volatility scalping, which capitalizes on changes in option volatility.

Benefits of Option Trading Scalping

Option trading scalping offers several advantages for traders:

- Quick Profits: Scalping allows traders to take advantage of small price changes, generating multiple trades with potential profits throughout the trading day.

- Higher Potential Return: Options offer leverage, allowing traders to magnify their profits compared to trading the underlying asset directly.

- Control over Risk: Scalpers can tightly manage their positions, limiting potential losses by exiting trades quickly.

- Diversification: Options contracts provide diversification benefits, as they are based on a wide range of underlying assets, including stocks, indices, and commodities.

Image: www.youtube.com

Potential Pitfalls

Despite its potential rewards, option trading scalping also carries certain risks:

- Rapid Market Movements: Fast-paced market conditions can lead to unexpected price reversals, resulting in losses for scalpers.

- Execution Costs: Frequent trading can accumulate execution costs, such as brokerage fees, which can eat into potential profits.

- Emotional Trading: The adrenaline rush associated with scalping can lead to emotional decision-making, increasing the likelihood of errors.

- High Skill Level Required: Scalping requires a high degree of trading skill, including an understanding of options pricing, market timing, and risk management.

Getting Started with Option Trading Scalping

If you are tertarik in exploring option trading scalping, consider the following steps:

- Educate Yourself: Thoroughly research option trading principles, scalping techniques, and market analysis.

- Choose a Broker: Select a reputable broker that offers low commissions for frequent trading.

- Develop a Strategy: Formulate a clear scalping strategy, including entry and exit points, risk management parameters, and position sizing.

- Practice: Test your strategies in a simulated trading environment before implementing them in a live market.

- Start Small: Begin with small-sized trades to manage risk and gain experience.

Option Trading Scalping Strategy

https://youtube.com/watch?v=MZkTUi6Tl4M

Conclusion

Option trading scalping presents a promising opportunity for traders seeking swift profit generation. By capitalizing on short-term price movements and utilizing options’ unique characteristics, scalpers can potentially multiply their returns. However, it is crucial to remember that scalping also carries risks and requires a high level of skill. Traders considering this strategy are strongly advised to thoroughly understand the mechanics, benefits, and potential pitfalls discussed in this guide. With proper education, practice, and a carefully planned strategy, option trading scalping can be a valuable tool in your trading arsenal.