Introduction

In the dynamic world of financial markets, the quest for innovative strategies to maximize returns and mitigate risk never ceases. Gamma trading in FX options stands out as a sophisticated technique that allows traders to harness the power of option gamma to achieve these goals. Gamma, a Greek letter representing the measure of an option’s sensitivity to changes in underlying volatility, plays a crucial role in this strategy. By astutely manipulating gamma, traders can position themselves to capture significant profits while managing downside risks.

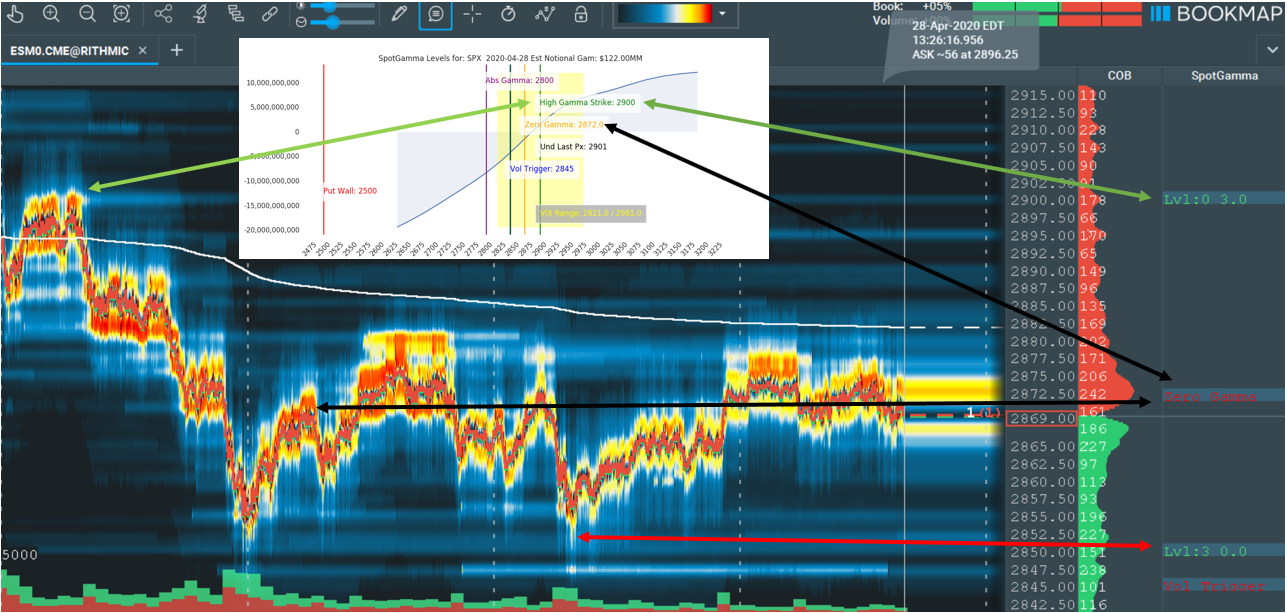

Image: spotgamma.com

Understanding the intricacies of gamma trading can empower traders to navigate the ever-evolving financial landscape and achieve their investment objectives. This article delves into the intricacies of gamma trading in FX options, providing a comprehensive guide to its history, fundamental concepts, real-world applications, recent advancements, and long-term prospects.

The Concept of Gamma Trading

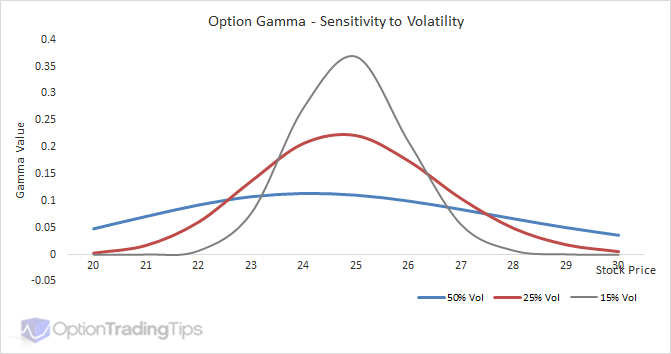

Gamma, the second derivative of an option price with respect to the underlying volatility, measures the rate of change in an option’s delta. A positive gamma signifies a long option (a call bought or a put sold) becoming more sensitive to volatility increases and less sensitive to declines. Conversely, a negative gamma characterizes a short option (a call sold or a put bought), indicating its reduced sensitivity to both increases and decreases in volatility.

Gamma trading exploits this volatility sensitivity by strategically buying or selling options with positive or negative gamma to profit from anticipated changes in implied volatility. By understanding the interrelation between gamma and volatility, traders can position themselves to benefit from a surge in volatility or hedge against its adverse effects.

Applications in FX Markets

Gamma trading finds extensive application in FX markets, where currency volatility plays a significant role in determining option premiums. Traders closely monitor macroeconomic news, technical indicators, and market sentiment to gauge potential shifts in volatility and adjust their gamma positions accordingly.

For instance, anticipating an imminent increase in currency volatility, a trader can buy a currency call option with positive gamma. The rationale behind this strategy is that as volatility rises, the option’s delta will increase, potentially leading to substantial gains if the underlying currency appreciates. Conversely, if volatility declines, the trader can hedge their long gamma position by selling a currency put option with negative gamma, mitigating potential losses.

Quantifying Gamma and Risk Management

Quantifying gamma is essential for effective risk management. The formula for gamma is ∂²V/∂σ², where V is the option price and σ represents implied volatility. A higher gamma value indicates greater sensitivity to volatility changes, which can magnify both profits and losses if volatility moves in an unfavorable direction.

To manage gamma risk, traders employ various strategies, including delta hedging and gamma scalping. Delta hedging involves offsetting the gamma exposure of long positions by selling an appropriate number of delta-equivalent shares of the underlying currency. Gamma scalping, on the other hand, involves buying and selling options with different gammas to create a portfolio with a net gamma that aligns with the trader’s market outlook.

Image: www.optiontradingtips.com

Advanced Techniques and Recent Innovations

The evolution of gamma trading has witnessed the emergence of sophisticated techniques and trading strategies. One notable innovation is the development of volatility-targeted gamma trading, where traders target specific volatility levels and adjust their gamma exposure dynamically to capitalize on volatility spikes or downturns.

Additionally, advanced quantitative models have been developed to optimize gamma trading decisions, incorporating factors such as historical volatility patterns, correlation between currency pairs, and market sentiment. These models enable traders to make more informed and data-driven gamma trading strategies.

Gamma Trading Fx Options

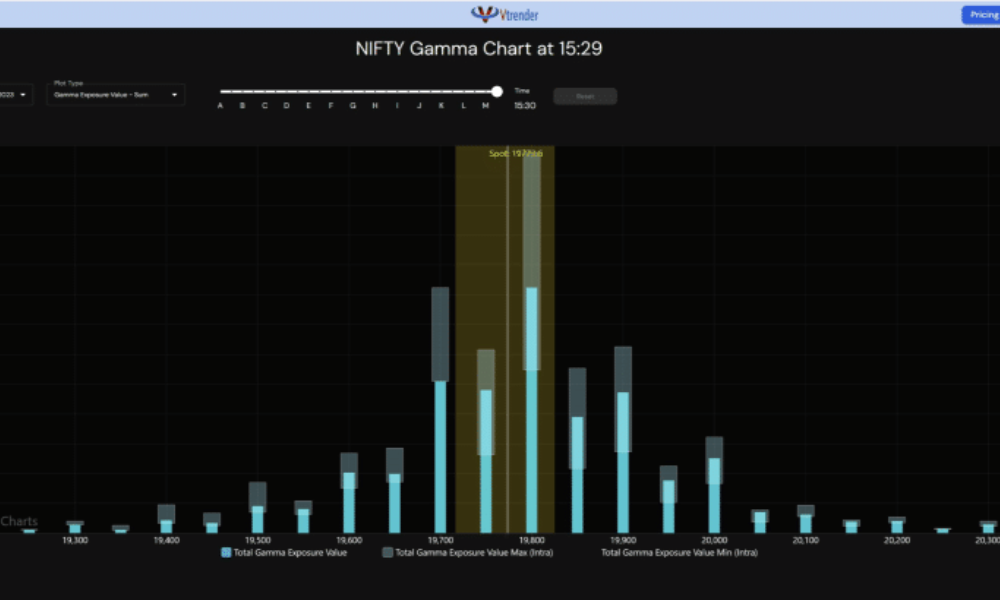

Image: vtrender.com

Conclusion

Gamma trading in FX options presents a powerful tool for maximizing returns and mitigating risk in the dynamic currency markets. By understanding the concept of gamma and its applications, traders can develop effective strategies to capture opportunities and protect their capital. As the financial landscape continues to evolve, the importance of gamma trading in FX markets will only grow, empowering traders to navigate volatility and achieve their investment goals.

To further enhance your knowledge of gamma trading and its application in FX markets, consider exploring reputable financial publications, attending industry conferences, and consulting with experienced traders. Continuous learning and adaptation are key to mastering the intricacies of gamma trading and reaping its benefits.