Imagine yourself standing in a bustling marketplace, surrounded by the clamor of traders and the allure of potential profits. As you delve into the world of options, you encounter a mystical force known as Gamma – an elusive Greek that holds the power to amplify or dampen your trading gains. Prepare to unravel its mysteries and unlock the secrets of unlocking this powerful market force.

Image: www.pinterest.co.uk

What is Option Trading Gamma?

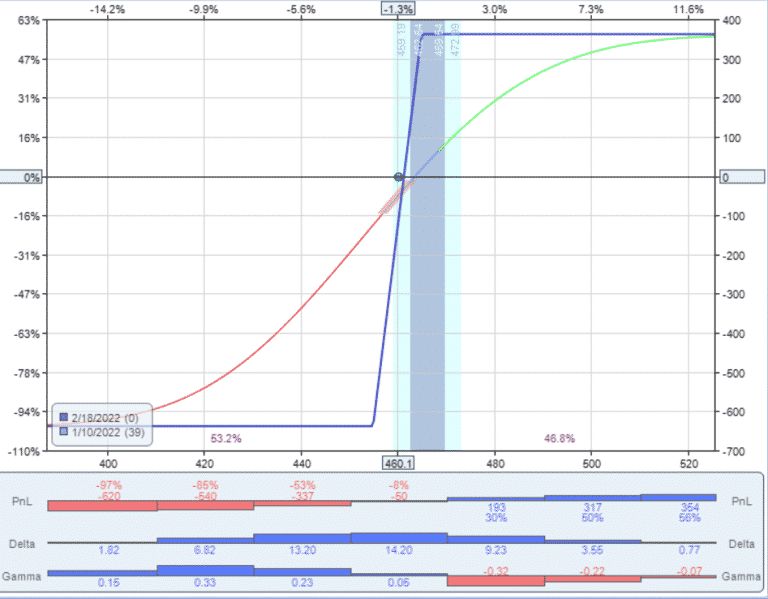

Gamma, the third Greek letter, measures the rate at which an option’s Delta changes in response to underlying price changes. Essentially, it reveals how sensitive an option’s hedging position is to fluctuations in the underlying asset. A positive Gamma indicates that the Delta will increase as the underlying price moves in the option’s favor, while a negative Gamma suggests the opposite.

Understanding Gamma becomes paramount for options traders, particularly in short-term trading strategies. This is because short-term options exhibit higher Gamma values, making them more responsive to underlying price movements.

The Role of Gamma in Hedging

Gamma plays a crucial role in hedging strategies, enabling traders to fine-tune their positions to minimize risk. By understanding Gamma, traders can determine the optimal number of contracts to hold to neutralize Delta exposure effectively.

For instance, if an underlying asset’s price increases, a long option position will experience a positive Delta change, increasing its exposure to bullish movements. To counter this, traders can adjust their hedge ratio by selling additional options, leveraging Gamma’s influence on Delta.

Trading Strategies with Gamma

Harnessing Gamma’s power goes beyond hedging. Traders can actively utilize it to construct sophisticated trading strategies.

-

Gamma Scalping: This strategy involves the rapid buying and selling of options with high Gamma values to capitalize on short-term price movements. The aim is to benefit from the rapid changes in Delta, generating quick profits before the Gamma decays as options approach expiration.

-

Gamma Squeezes: In volatile markets, sudden price swings can trigger a Gamma squeeze, where options buyers aggressively purchase contracts with high Gamma values, leading to a surge in their prices. This can result in substantial profits for those who anticipate and position themselves accordingly.

Image: optionstradingiq.com

Risk Management with Gamma

While Gamma empowers traders with hedging and trading opportunities, it also carries potential risks.

-

Rapid Gamma Decay: As options approach expiration, Gamma decays rapidly, reducing their sensitivity to underlying price changes. This can lead to reduced hedging effectiveness or unexpected position changes.

-

Hedging Inefficiencies: Miscalculating Gamma can result in ineffective hedging strategies, leaving traders exposed to unanticipated risks.

Option Trading Gamma

https://youtube.com/watch?v=JuA0ywkI8k8

Conclusion

Option trading Gamma emerges as a transformative force for traders seeking to master the intricacies of the options market. Its ability to influence Delta positions and enhance hedging strategies proves invaluable in both risk management and profit maximization endeavors. By comprehending the dynamics of Gamma, traders gain an arsenal of refined techniques to navigate the volatile seas of options trading and unlock extraordinary opportunities.