Imagine a scenario where you’re offered a unique opportunity to enhance your investment strategies and potentially amplify your returns. Enter the realm of options brokerage trading, a specialized form of trading that empowers investors with a versatile tool to navigate market fluctuations. This guide will take you on an immersive journey, providing a comprehensive overview of options brokerage trading, its history, concepts, and strategies.

Image: www.youtube.com

Delving into the Nuances of Options Brokerage Trading

Options, in the world of investing, represent contracts that grant buyers (holders) the right, but not the obligation, to exercise certain actions. These contracts provide investors with the flexibility to adapt to market movements and pursue specific investment goals. Through options, investors can leverage their existing capital to control a larger number of shares, stocks, or other underlying assets.

Options brokerage trading empowers investors with a unique set of advantages. Firstly, options offer a shield against potential losses, providing a safety net in volatile market conditions. Additionally, they amplify the potential for returns, especially when market movements align with investors’ predictions. Options provide a dynamic investment tool, allowing strategic adjustments and tailored hedging strategies to address uncertain market landscapes.

The Symphony of Options Trading: Understanding the Mechanics

Options trading involves two primary types of transactions: buying and selling. When buying an option, an investor acquires the right to exercise the option’s specified action, such as buying (call option) or selling (put option) a particular asset at a set price (strike price) on or before a specific date (expiration date). In contrast, selling an option entails granting another party the same rights and obligations.

Options trading requires a deep understanding of market dynamics, as it involves making informed predictions about future price movements. Investors must analyze factors such as market trends, economic indicators, political events, and company performance to assess the potential profitability of options trades.

The Significance of Options Brokers: Your Guiding Light in the Trading Arena

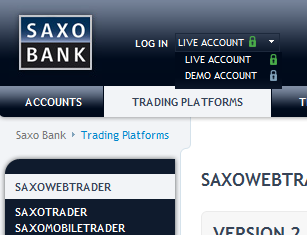

In the vibrant world of options brokerage trading, the role of options brokers holds immense significance. Options brokers act as intermediaries between investors and the options market, facilitating trades and providing crucial support. They offer a multitude of services, ranging from account management and trade execution to educational resources and market analysis.

Choosing the right options broker is paramount for success. Considerations include the broker’s reputation, trading platform, fees, and customer service. Reputable options brokers prioritize investor protection, implement robust security measures, and provide exceptional customer support.

Image: www.simple-stock-trading.com

Mastering the Symphony: Strategies for Maximizing Returns

Options brokerage trading encompasses a diverse array of strategies tailored to various investment objectives and market conditions. Some of the commonly employed strategies include:

-

Covered Call: A strategy utilized when investors anticipate modest market growth. It involves selling (writing) a call option against a stock they own.

-

Cash-Secured Put: A strategy designed for conservative investors seeking income generation. It involves selling a put option while holding enough cash to purchase the underlying asset if the option is exercised.

-

Bull Call Spread: A strategy employed when investors expect significant market growth. It entails buying a lower-strike-price call option and selling a higher-strike-price call option.

-

Bear Put Spread: A strategy employed when investors anticipate a market decline. It involves selling a lower-strike-price put option and buying a higher-strike-price put option.

Each of these strategies carries its unique characteristics, risks, and potential rewards. Prudent investors conduct thorough research, assess their risk tolerance, and consult with experienced options brokers to determine the most appropriate strategies for their investment goals.

Options Brokerage Trading

Image: viver-de-trade.blogspot.com

The Evolving Landscape of Options Brokerage Trading: Embracing Innovation

In recent years, the advent of digital platforms and advancements in trading technology have significantly transformed options brokerage trading. Online trading platforms provide greater accessibility, convenience, and advanced analytical tools, empowering investors to make informed decisions.

Artificial intelligence (AI)-driven technologies are also reshaping options trading. AI algorithms assist investors in trade analysis, risk management, and market forecasting. As technology continues to push boundaries, options brokerage trading is poised for further evolution, offering even greater opportunities for investors to navigate market complexities.

In summation, options brokerage trading presents investors with an unparalleled tool to amplify returns and mitigate risks. By understanding the concepts, strategies, and complexities involved, investors can harness the power of options to enhance their investment portfolios and pursue financial success.