Introducing Algo Trading for Indian Options Markets

In the fast-paced world of finance, algo trading has emerged as a transformative force. Short for algorithmic trading, algo trading involves using complex algorithms and high-speed computers to execute trades based on predefined strategies. This futuristic approach is revolutionizing the way options are traded in India, offering traders unprecedented automation, efficiency, and potential returns.

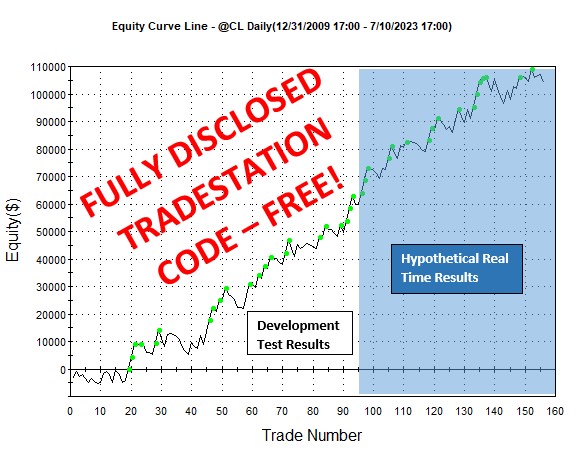

Image: kjtradingsystems.com

Understanding Algo Trading Options

Options trading involves speculating on the future price of an underlying asset, such as a stock or commodity. Algo trading options automates this process by using algorithms to analyze market data, identify trading opportunities, and execute trades based on predetermined rules. These algorithms can be tailored to specific trading strategies, risk tolerances, and market conditions, enabling traders to optimize their returns and mitigate risk.

History and Evolution of Algo Trading Options

The roots of algo trading can be traced back to the early days of computerized trading in the 1980s. However, it was the widespread accessibility of high-speed internet in the late 1990s that propelled algo trading to prominence. Since then, it has become an integral part of the Indian options market, with numerous brokerages and software providers offering algo trading platforms to their clients.

Benefits of Algo Trading Options in India

Algo trading options offers a plethora of advantages to Indian traders, including:

1. Automation and Efficiency: Algorithms execute trades automatically, eliminating the need for manual intervention. This allows traders to save time, focus on strategy development, and capture fleeting market opportunities.

2. Objective and Rule-Based: Algorithms follow predefined rules and strategies, reducing emotional bias and increasing discipline in trading.

3. Reduced Risk: By predefining risk parameters and stop-loss levels, algo trading helps mitigate potential losses and protects trader capital.

4. Backtesting and Optimization: Algo trading allows traders to backtest their strategies on historical data, optimizing their algorithms and increasing their confidence in their performance.

Image: tradingqna.com

Latest Trends and Developments in Algo Trading Options

The Indian algo trading options landscape is constantly evolving, with new technologies and trends shaping its future:

1. Artificial Intelligence (AI): AI-powered algorithms are revolutionizing algo trading by analyzing vast amounts of data, identifying patterns, and making intelligent trading decisions.

2. Cloud Computing: Cloud platforms provide scalable and flexible infrastructure for algo trading, enabling traders to deploy complex algorithms without investing in hardware and IT resources.

3. Mobile Algo Trading: Mobile algo trading platforms allow traders to access and manage their algo strategies from anywhere, anytime.

Tips and Expert Advice for Algo Trading Options

To harness the full potential of algo trading options, it’s essential to follow best practices and seek expert advice:

1. Define Your Strategy: Before automating any trades, it’s crucial to develop a clear and well-defined trading strategy that aligns with your investment objectives and risk tolerance.

2. Test Before Trading: Thoroughly backtest your algorithms on historical data to evaluate their performance and identify areas for improvement.

3. Monitor and Adjust: Markets are constantly evolving, making it essential to continuously monitor your algo performance and adjust your strategies accordingly.

4. Seek Professional Assistance: Consult with experienced algo traders, financial advisors, or brokerage experts to enhance your understanding and derive insights into successful algo trading practices.

Frequently Asked Questions on Algo Trading Options

Q: Is algo trading suitable for beginners?

A: While algo trading can be automated, it’s not suitable for complete beginners. It requires a solid understanding of options trading, strategy development, and risk management.

Q: What are the costs involved in algo trading options?

A: Algo trading typically involves brokerage fees, software costs, data subscription charges, and exchange fees.

…

Algo Trading Options India

Conclusion

Algo trading options is a powerful tool that has transformed the Indian options trading landscape. By leveraging automation, algorithmic analysis, and advanced strategies, algo traders can unlock unprecedented opportunities for passive income and capital growth. However, it’s essential to approach algo trading with a well-informed and cautious mindset, embracing best practices, seeking expert advice, and adapting to the ever-changing financial landscape. By doing so, traders can harness the full potential of algo trading and navigate the complexities of the options market with greater confidence and potential rewards.

Are you ready to dive into the world of algo trading options and unleash the power of automation in your investment strategies?