Introduction

In the realm of financial markets, where fortunes are made and lost in a heartbeat, options algo trading has emerged as a game-changer. Imagine harnessing the power of algorithms to navigate the labyrinthine world of options trading, with precision and efficiency that human traders can only dream of. This comprehensive article will embark on an intellectual exploration of option algo trading, demystifying its intricacies, unveiling its potential, and empowering you with the knowledge to leverage this transformative tool.

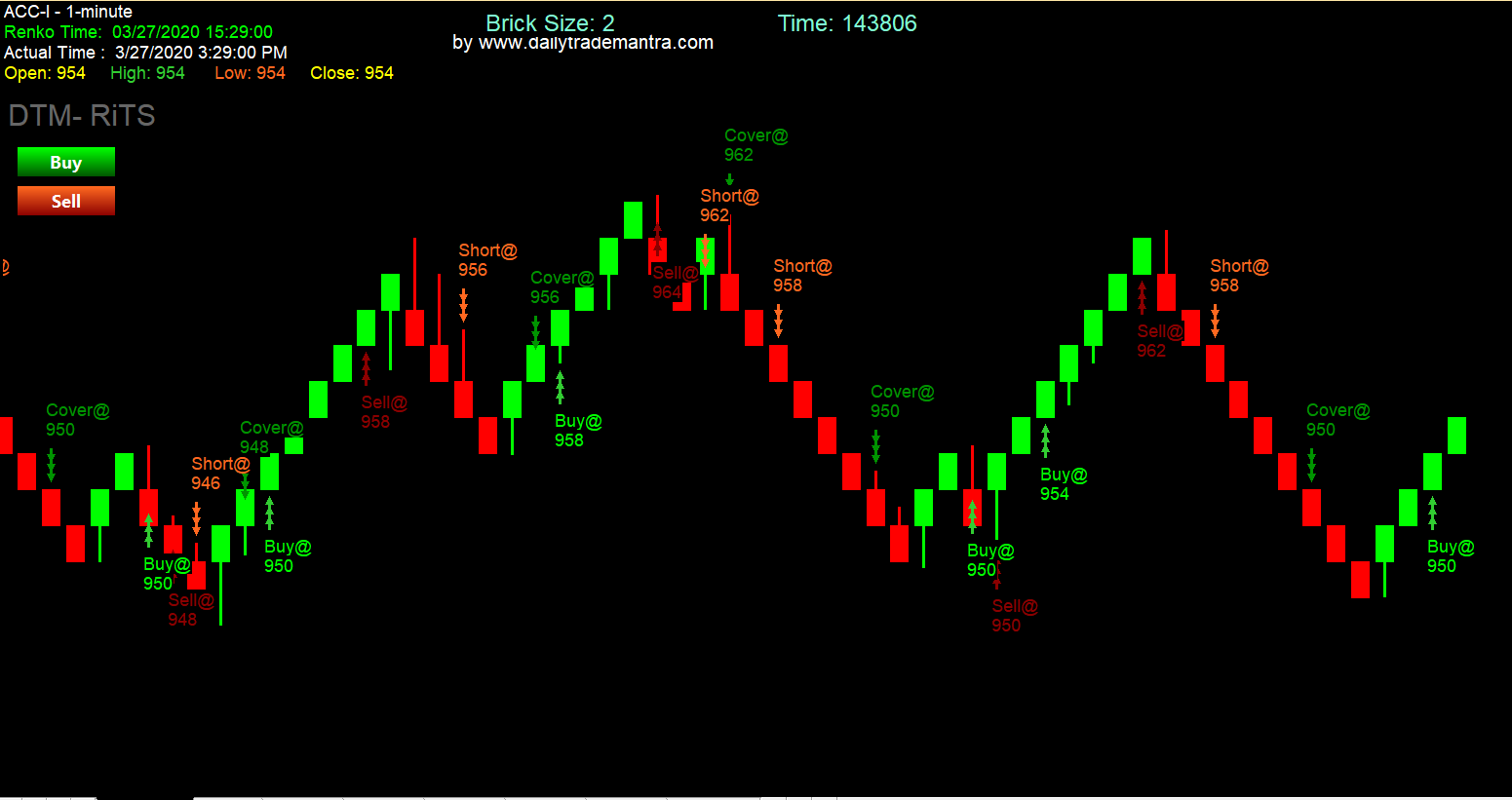

Image: dailytrademantra.com

Laying the Foundation: Comprehending Options Algo Trading

Option algo trading is a sophisticated strategy that employs algorithms to automate the buying and selling of options contracts. These algorithms are meticulously crafted mathematical models that analyze market data, identify trading opportunities, and execute trades with lightning-fast speed. By leveraging the computational power of computers, algo traders can process vast amounts of information and react to market fluctuations in real-time, offering a significant edge over traditional manual trading methods.

The Evolutionary Journey: A Historical Perspective

The genesis of option algo trading can be traced back to the early days of electronic trading platforms in the 1980s. As technology advanced, so too did the sophistication of algorithms, leading to the emergence of high-frequency trading (HFT) in the late 1990s. HFT firms employ lightning-fast algorithms that execute thousands of trades per second, capitalizing on minute market inefficiencies.

Mastering the Art: Key Concepts of Option Algo Trading

Understanding the fundamental concepts of option algo trading is paramount for success. At its core lies the option contract, which grants the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) within a specified time frame (expiration date).

Option algo trading algorithms are built upon various strategies, including delta-neutral trading, volatility trading, and trend following. Delta-neutral trading aims to eliminate price risk by hedging with an equal number of opposite positions. Volatility trading seeks to profit from fluctuations in option volatility, while trend following algorithms capitalize on price momentum.

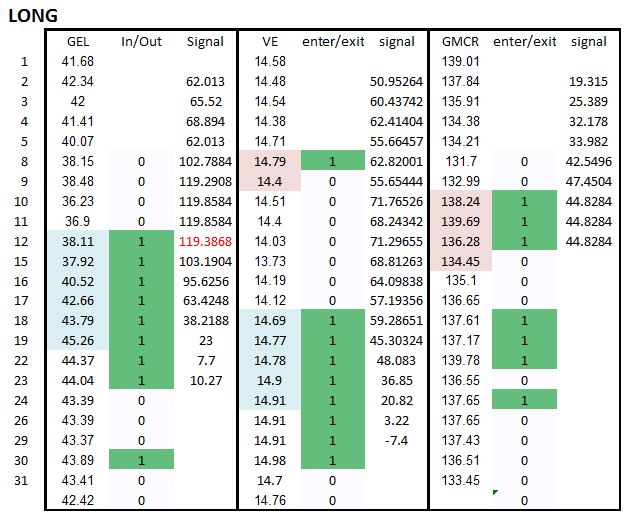

Image: iknowfirst.com

Harnessing the Power: Real-World Applications

The applications of option algo trading are as diverse as the financial markets themselves. From retail investors seeking to enhance their portfolios to sophisticated hedge funds pursuing high-frequency trading, algo trading has revolutionized the way options are traded.

Individual investors can utilize algo trading to implement systematic strategies, backtest different scenarios, and optimize their trades. Hedge funds and institutional investors employ complex algorithms that enable them to execute complex trading strategies, manage risk, and optimize their portfolios in near real-time.

Expert Insights: Guidance from the Masters

Seeking wisdom from seasoned professionals is invaluable in the world of algo trading. “Success in algo trading demands a deep understanding of market dynamics and a relentless pursuit of knowledge,” advises Dr. Mark Meldrum, an acclaimed expert in financial derivatives.

“Discipline and emotional control are paramount,” emphasizes Jane Braver, a renowned hedge fund manager. “The algorithmic approach should complement your trading style, not replace it.”

Navigating the Nuances: Actionable Tips for Success

Embarking on the journey of option algo trading requires meticulous planning and execution. Here are a few key tips to help you navigate the complexities:

-

Define your trading objectives and risk tolerance.

-

Educate yourself thoroughly on algorithmic trading concepts.

-

Backtest your algorithms rigorously before deploying them in live trading.

-

Seek mentorship from experienced professionals in the field.

-

Continuously monitor and refine your algorithms based on market feedback.

Option Algo Trading

Conclusion: Embracing the Future of Trading

Option algo trading has transformed the financial landscape, empowering traders with unprecedented speed, precision, and efficiency. By embracing this transformative technology, investors can unlock new opportunities, enhance their trading performance, and adapt to the ever-evolving markets of tomorrow.

Remember, as with any investment strategy, due diligence and a thorough understanding of the risks involved are essential. As you embark on this exciting journey, let the insights and principles outlined in this article guide your path to success in the captivating world of option algo trading.