Are you getting impatient with your binary trading outcomes? Do you often find yourself on the losing end more than winning? If so, then you may need to rethink your strategy. Trend trading is a popular technique that can help you improve your odds of success.

Image: www.youtube.com

In this article, we will dive into the concept of trend trading and how to apply it to your binary options trading. We will also provide you with some tips and expert advice to help you get started.

What is Trend Trading?

Trend trading is a trading strategy that involves identifying and trading in the direction of a trend. The goal is to profit from price movements that are part of a larger trend. For example, if the price of an asset is rising, a trend trader would buy the asset in the hopes that it will continue to rise.

Identifying Trends

The first step in trend trading is to identify a trend. There are a number of ways to do this, but some of the most common methods include:

- Technical analysis: Technical analysis is the study of historical price data to identify trends and patterns. There are a number of technical indicators that can help you identify trends, such as moving averages, Bollinger Bands, and parabolic SAR.

- Fundamental analysis: Fundamental analysis is the study of economic and financial data to identify trends. This data can include things like interest rates, GDP, and inflation.

Trend Trading Strategies

Once you have identified a trend, you can start to develop a trading strategy. There are a number of different trend trading strategies, but some of the most common include:

- Breakout trading: Breakout trading involves buying an asset when it breaks above a resistance level or selling an asset when it breaks below a support level.

- Pullback trading: Pullback trading involves buying an asset when it pulls back from a high or selling an asset when it pulls back from a low.

- Trend following: Trend following involves buying an asset when it is in a trend and selling it when the trend reverses.

Image: forexmt4systems.com

Tips and Expert Advice

Here are some tips and expert advice to help you get started with trend trading:

- Choose the right assets: Not all assets are suitable for trend trading. Some assets, such as stocks, are more volatile than others, which can make it more difficult to identify trends.

- Use stop-loss orders: Stop-loss orders can help you protect your profits if the market turns against you.

- Manage your risk: Trend trading can be a risky strategy, so it is important to manage your risk carefully. Set a trading plan and stick to it, and don’t trade with more money than you can afford to lose.

FAQs

Here are some frequently asked questions about trend trading:

- What is the best time to trade trends? The best time to trade trends is when the market is trending. This is usually during periods of high volatility.

- How long should I hold a trend trade? The length of time you hold a trend trade is up to you. Some traders prefer to hold trends for short periods of time, while others prefer to hold them for longer periods.

- What is the difference between trend trading and swing trading? Trend trading is a strategy that involves trading in the direction of the trend, while swing trading is a strategy that involves trading in the opposite direction of the trend.

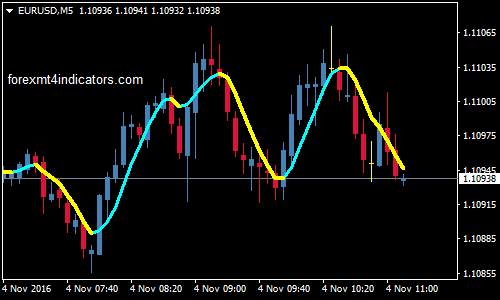

Trend Trading Strategy Binary Options

Image: www.forexmt4indicators.com

Conclusion

Trend trading is a powerful strategy that can help you improve your odds of success in the binary options market. By following the tips and advice in this article, you can get started with trend trading today.

Are you interested in learning more about trend trading? Leave a comment below and let us know.