Day Trading Explained

Day trading is a popular financial trading strategy that involves buying and selling a stock or option on the same day, profiting from small price fluctuations. It’s a highly speculative endeavor, as it requires predicting the direction of the stock or option’s price within a short time frame. With the advent of high-frequency trading, which uses computer programs to execute trades almost instantaneously, day trading has become increasingly popular.

Image: www.gettogetherfinance.com

Option trading, a subset of day trading, allows investors to bet on the future direction of a stock’s price without directly owning the stock itself. An option is a contract that gives the buyer the right, but not the obligation, to buy (a call option) or sell (a put option) the underlying stock at a specified price (the strike price) by a given date (the expiration date). Since the potential profit is limited to the premium paid for the option, day trading options can offer a way to profit from short-term market movements without tying up a substantial capital.

Option Strategies for Short-Term Day Trading

Scalping: This strategy involves buying and selling options within minutes or even seconds, typically with a small profit target. The goal of scalping is to accumulate many small profits over the course of a day. Scalpers use technical analysis to identify short-term trends in the market and react quickly to price changes.

Range Trading: Range traders identify stocks or options that are trading within a defined price range and place trades at the extremes of the range. They bet that the stock will continue to trade within the range and profit on the rebound when the price hits the upper or lower limit of the range.

Trend Following: Trend following involves identifying the current trend in a market and trading in the direction of the trend. Trend followers enter long positions in uptrends and short positions in downtrends, leveraging the momentum of the trend to generate profits.

News Trading: News traders capitalize on market movements caused by the release of news and events. By closely monitoring news sources and financial calendars, news traders can anticipate how the market may react to upcoming events and trade accordingly.

Spread Trading: Spread trading is a low-risk strategy that involves buying one option and selling another at different strike prices with the same expiration date. The goal is to create a “net” position by profiting from the difference in prices.

Tips for Successful Short-Term Option Trading

Understand Options: Before you start day trading options, it’s essential to have a thorough understanding of options and their different types, including calls, puts, strikes, expirations, and premiums.

Choose Liquid Options: Liquidity refers to the ease with which you can buy or sell an option. When day trading, stick to highly liquid options with a large trading volume. This ensures that you can quickly execute trades at the desired price.

Use a Trading Plan: Develop a well-defined trading plan that outlines your entry and exit strategies, risk management rules, and profit targets.

Manage Risk: Day trading options can lead to significant financial losses. Always manage your risk carefully by using stop-loss orders, limiting trade sizes, and diversifying your portfolio.

Monitor the Market: Keep a close eye on market conditions and monitor real-time data. Use technical analysis and fundamental analysis to make informed trading decisions.

FAQs on Short-Term Option Trading

Q: Is day trading options right for me?

A: Day trading options is a demanding strategy suitable for experienced, knowledgeable, and well-funded traders who are comfortable with short-term risk.

Q: How much money can I make from day trading options?

A: The potential profits from day trading options depend on factors such as market conditions, trading skills, and starting capital. It’s important to set realistic profit targets and understand that significant losses are a possibility in this type of trading.

Q: What are the best platforms for day trading options?

A: Look for a trading platform that supports low-cost options trading, offers advanced charting tools, and provides real-time market data and analysis.

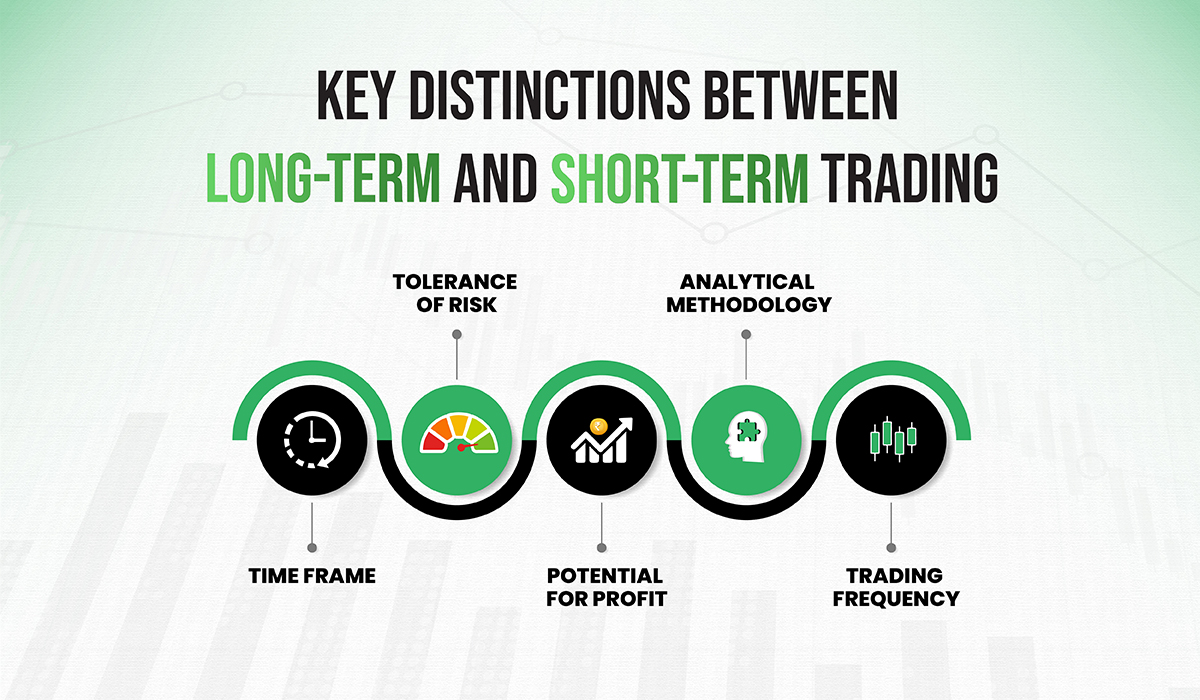

Image: nsbroker.com

Best Short Term Day Trading Option Strategy

Image: tradethatswing.com

Conclusion

Mastering short-term day trading option strategies requires patience, perseverance, and a thorough understanding of how options work.

If you are interested in exploring day trading options, start by educating yourself through online resources, books, and webinars. Paper trading can be a valuable tool to hone your skills in a simulated environment before risking real capital.