Unlocking the World of Derivative Options

In today’s bustling financial landscape, the realm of derivative options offers tremendous potential for seasoned traders and intrigued beginners alike. With the right strategies, these instruments empower investors to hedge risks, amplify returns, and explore a vast spectrum of investment opportunities. Understanding the intricacies of derivative option trading strategies is paramount for harnessing their full potential. This comprehensive guide will delve into the concepts, applications, and nuances of these captivating tools, equipping you with the knowledge necessary to navigate the markets with confidence.

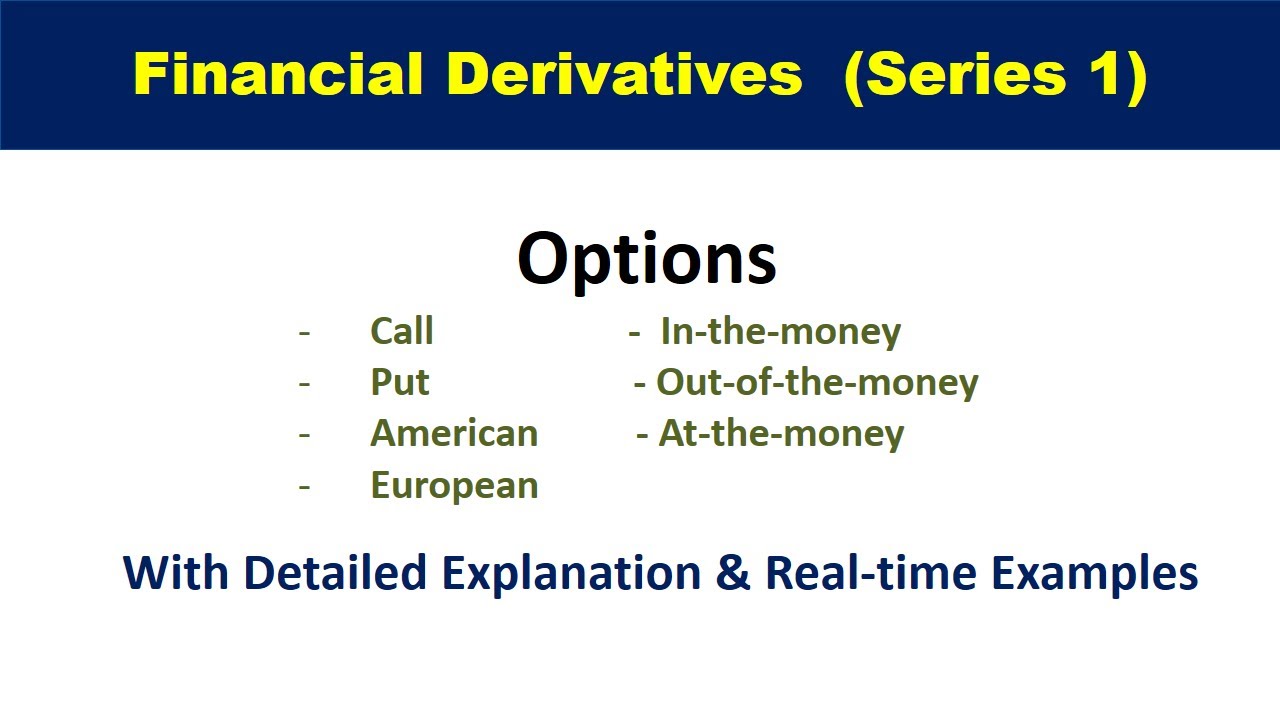

Image: www.kagamasumut.org

Navigating the Complexities of Derivative Options

At its core, a derivative option is a contract that accords the buyer the right, but not the obligation, to either buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a predetermined price, known as the strike price, on or before a certain date, known as the expiration date. These contracts derive their value from the underlying asset, which can span a wide range of instruments, including stocks, bonds, commodities, and currencies.

Striking the Right Balance: Understanding Call and Put Options

One of the crucial aspects of understanding derivative options is distinguishing between call options and put options. Call options confer upon the buyer the right to purchase the underlying asset at the strike price. They prove advantageous when the trader anticipates an escalation in the asset’s value. Conversely, put options grant the buyer the right to sell the underlying asset at the strike price and are utilized when the trader expects a decline in the asset’s value.

Mastering the Art of Option Trading Strategies

The realm of derivative option trading strategies is vast and diverse, encompassing both fundamental and advanced approaches that cater to varying risk appetites and investment objectives. Some of the most prevalent strategies include:

Image: www.youtube.com

• Covered Call Strategy:

This strategy involves selling (or writing) a covered call option against an equivalent number of shares of the underlying asset already owned by the trader. The primary objective is to generate additional income or premium while maintaining exposure to potential upside gains in the stock’s value.

• Protective Put Strategy:

In contrast to the covered call strategy, the protective put strategy entails purchasing a put option on an underlying asset that the trader already owns. This serves as an insurance policy against potential declines in the asset’s value, limiting potential losses to the premium paid for the put option.

• Bull Call Spread Strategy:

A bull call spread strategy involves the simultaneous purchase of a call option with a lower strike price and the sale of a call option with a higher strike price on the same underlying asset. This strategy is employed when the trader believes the underlying asset will experience a moderate increase in value.

• Bear Put Spread Strategy:

The bear put spread strategy is the reverse of the bull call spread strategy, involving the purchase of a put option with a higher strike price and the sale of a put option with a lower strike price on the same underlying asset. It’s suitable when the trader anticipates a modest decline in the underlying asset’s value.

Harnessing the Potential of Derivative Options

Leveraging derivative option trading strategies can propel your investment endeavors to new heights by presenting numerous advantages:

• Risk Management:

Options offer a powerful tool for risk management, enabling traders to hedge against potential losses in unfavorable market conditions.

• Income Generation:

Selling (or writing) options can provide a consistent stream of income, particularly during periods of low market volatility.

• Enhanced Flexibility:

Options provide traders with remarkable flexibility, allowing them to tailor strategies to specific risk-return profiles and investment goals.

• Speculation:

For those with a higher risk tolerance, options facilitate speculative trading, providing opportunities to potentially amplify returns, albeit with increased risk.

Derivative Option Trading Strategies

Image: navi.com

Conclusion

The world of derivative options trading strategies is a boundless realm of opportunity and complexity. By mastering the fundamental concepts, applying proven strategies, and exercising prudent risk management, you can harness the immense potential of options to enhance your investment performance. Remember that thorough research, continuous learning, and a disciplined approach are indispensable for navigating the dynamic markets and making informed decisions. Embrace the challenge, delve into the intricacies of derivative options, and unlock a world of financial possibilities.