Begin by narrating a personal experience that vividly portrays the impact of options in a real-life situation. Pose a rhetorical question that piques the reader’s curiosity about these financial instruments.

Image: www.kagamasumut.org

Options, financial derivatives that bestow the right but not the obligation to buy or sell an underlying asset at a predetermined price on a specific date, offer an array of opportunities and risks in the world of investing. Whether you’re a seasoned trader or a novice seeking to expand your financial horizons, understanding the ins and outs of options derivative trading is paramount. In this comprehensive guide, we’ll embark on a journey to demystify these complex instruments, empowering you to make informed decisions and potentially enhance your investment strategy.

Understanding the Options Landscape

Options contracts are rooted in the concept of risk management and speculation. They provide investors with the flexibility to protect their investments or make strategic bets on the future price movement of an underlying asset, such as stocks, indices, or commodities. The two primary types of options are calls and puts. Call options convey the right to buy the underlying asset, while put options grant the right to sell.

Navigating Call and Put Options

Imagine a scenario where you’re bullish on the stock of a promising tech company. With a call option, you can secure the right to buy a specific number of shares at a set price, regardless of whether the stock’s market value rises or falls. On the other hand, if you anticipate a decline in the stock’s value, a put option allows you to lock in the right to sell your shares at the agreed-upon price, mitigating potential losses.

Benefits of Options Derivative Trading

The versatility of options offers numerous advantages for investors. These include:

-

Hedging: Options provide a valuable tool for managing risk and protecting your portfolio from market volatility.

-

Leveraging: With options, you can control a significant amount of an underlying asset while investing a relatively small amount of capital.

-

Income generation: Selling options can generate income from premiums, even if the underlying asset’s price remains stagnant.

Risks Associated with Options Trading

As with any investment, options trading carries inherent risks:

-

Loss of premium: The premium paid to purchase an option is non-refundable, meaning you could lose this investment if the option expires out of the money.

-

Unlimited risk: Writing (selling) options can result in potentially unlimited losses if the underlying asset’s price moves against you.

-

Time decay: The value of options gradually erodes as the expiration date nears.

Tips from the Experts

To navigate the world of options trading successfully, heed the advice of seasoned professionals:

-

Define your investment objectives and risk tolerance.

-

Conduct thorough research before trading any options contract.

-

Use options as a component of a broader investment strategy.

-

Manage your risk through diversification and hedging techniques.

Conclusion

Options derivative trading offers both opportunities and risks. By embracing a comprehensive understanding of call and put options, their benefits and drawbacks, and the insights of experts, you can harness the power of these financial instruments to potentially enhance your investment strategy. Remember, investing in options is not a foolproof endeavor, and it’s crucial to approach this complex market with knowledge, prudence, and a sound risk management plan.

Image: www.pinterest.co.kr

Option Derivative Trading

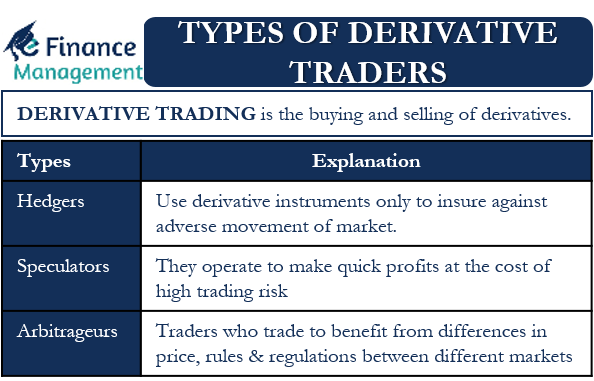

Image: efinancemanagement.com