Introduction

In the dynamic world of options trading, the quest for success lies in harnessing the power of algorithms and implementing effective strategies. Options trading algo strategies have revolutionized the way traders leverage market data and make informed investment decisions. By automating complex computations and executing trades based on predefined parameters, algos provide a significant edge in this competitive market.

Image: investgrail.com

Understanding Options Trading Algorithmic Strategies

Algorithmic strategies are computer programs that execute trades based on pre-defined rules and market conditions. They allow traders to efficiently analyze vast amounts of data, identify trading opportunities, and execute orders in real-time. Options trading algos leverage the underlying asset price, volatility, time to expiration, and option Greeks to make sophisticated trading decisions.

Historical Evolution of Algo Trading

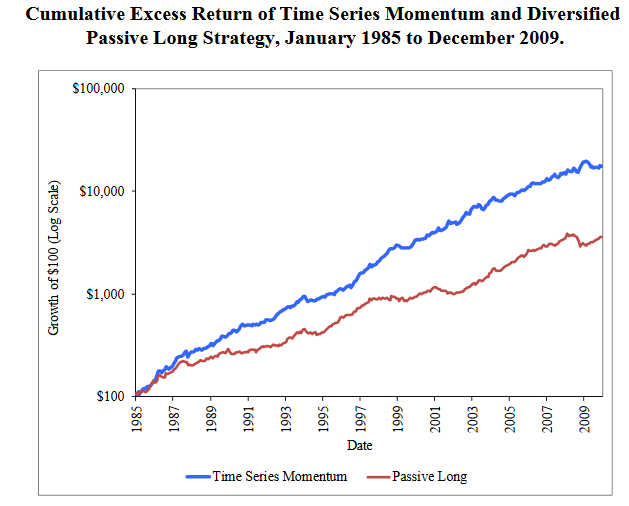

Algorithmic trading has its roots in the early days of computerized trading in the 1980s. Initially confined to institutional traders and hedge funds, it has gained widespread adoption by individual investors in recent years. The advancement of technology and the proliferation of trading platforms have made sophisticated algo strategies accessible to a broader spectrum of traders.

Benefits of Using Options Trading Algos

The use of options trading algo strategies offers numerous advantages:

- Increased Speed and Efficiency: Algos can analyze countless data points and execute trades in milliseconds, enabling rapid decision-making and capturing short-lived opportunities.

- Improved Accuracy: Algorithms eliminate human errors and emotional biases, leading to more accurate and consistent trading decisions.

- Risk Management: Algos can automatically monitor market conditions and adjust positions to manage risk and protect capital.

- Backtesting and Optimization: Algorithmic strategies can be backtested on historical data to optimize parameters and ensure optimal performance.

Image: www.adigitalblogger.com

Common Options Trading Algo Strategies

There are numerous options trading algo strategies, each designed for specific objectives and market conditions. Here are some popular strategies:

- Delta Neutral: Maintains a portfolio with a delta of zero, reducing exposure to price fluctuations.

- Statistical Arbitrage: Identifies price discrepancies between different options contracts and executes trades to capture the spread.

- Volatility Trading: Speculates on the volatility of the underlying asset by buying or selling options at extreme volatility levels.

- Trend Following: Tracks the trend of the underlying asset and buys or sells options in line with the identified trend.

- Pairs Trading: Simultaneously buys and sells two correlated options contracts, betting on the difference in performance.

Keys to Successful Algorithmic Trading

To achieve success with options trading algo strategies, it is crucial to:

- Develop a Comprehensive Trading Plan: Outline specific trading objectives, risk tolerance, and investment horizon.

- Choose the Right Algo: Select an algo that aligns with your trading strategy and risk profile.

- Test and Optimize: Backtest the algo using historical data to optimize parameters and minimize risk.

- Monitor and Control: Continuously monitor the performance of the algo and make necessary adjustments to adapt to changing market conditions.

Options Trading Strategies Algo

Image: kjtradingsystems.com

Conclusion

Options trading algo strategies provide a powerful tool for unlocking the potential of options trading. By automating complex computations and making informed decisions based on real-time data, these strategies empower traders to enhance their accuracy, increase efficiency, and navigate the dynamic options market with confidence. By understanding the benefits, risks, and key considerations involved, traders can harness the transformative power of algo trading to achieve successful investment outcomes.