Introduction

In the intricate labyrinth of financial trading, arbitrage presents itself as a beacon of opportunity, offering adept investors the chance to profit from price discrepancies across various markets. Among the many arbitrage strategies, long-term options trading stands out as a compelling avenue for securing consistent returns. In this comprehensive guide, we delve into the world of arbitrage long-term options trading, exploring its mechanics, strategies, and the insights that can empower you on your journey toward financial success.

Image: tradewise.community

Subtitle: The Allure of Arbitrage

Arbitrage, in its essence, entails exploiting price disparities between markets to generate risk-free profits. In the context of long-term options trading, arbitrage opportunities arise when the combined value of a long position in one option and a short position in another option within the same underlying asset exceeds the price of the underlying asset itself. This premium is created due to market inefficiencies caused by differences in liquidity, volatility, and hedging strategies among participants.

Subtitle: Understanding Long Term Options

Options are financial instruments that confer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) before a specified expiration date. Long-term options have an extended duration, typically ranging from one year to several years, compared to the shorter lifespans of shorter-term options. This protracted timeframe allows ample time to capitalize on market inefficiencies and generate returns.

Subtitle: Strategies for Arbitrage

Arbitrage long-term options trading encompasses a range of strategies tailored to specific market conditions and investor risk tolerance. Some popular approaches include:

-

Merger Arbitrage: This strategy involves purchasing a target company’s stock and simultaneously selling an equivalent amount of the acquirer’s stock, exploiting the price differential that arises during merger and acquisition transactions.

-

Convertible Arbitrage: This advanced technique involves purchasing a convertible bond and hedging the investment with a short position in the underlying stock to capture the convergence in prices when the bond approaches its conversion date.

-

Statistical Arbitrage: This quantitative approach employs statistical models and data analytics to identify inefficiencies in the prices of multiple options and capitalize on recurring price patterns.

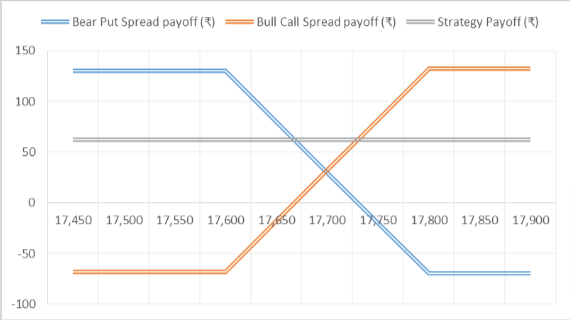

Image: upstox.com

Subtitle: Recent Trends and Developments

The advent of electronic trading platforms and advanced analytics has revolutionized the landscape of arbitrage long-term options trading. High-frequency trading algorithms now account for a significant portion of arbitrage activities, employing sophisticated algorithms to identify and execute trades within milliseconds. Additionally, increased market volatility and regulatory changes have presented both challenges and opportunities for arbitrageurs.

Subtitle: Tips and Expert Advice

-

“Conduct Thorough Research”: Comprehensive analysis of market conditions, underlying assets, and option pricing is crucial.

-

“Manage Risk Effectively”: Implement prudent risk management strategies, including appropriate position sizing and diversification.

-

“Seek Professional Guidance”: Consider consulting with experienced arbitrage professionals to gain valuable insights and support.

Subtitle: Frequently Asked Questions (FAQs)

Q: “What are the potential returns in arbitrage long-term options trading?”

A: “Returns can vary significantly depending on market conditions and the specific arbitrage strategy employed. However, savvy investors can potentially achieve consistent returns ranging from 5% to 15% or more per year.”

Q: “What are the risks involved in arbitrage long-term options trading?”

A: “While arbitrage is generally considered a lower-risk investment strategy, it is not without potential pitfalls. Unforeseen market events, changes in volatility, and model failures can lead to losses.”

Arbitrage Long Term Options Trading Opportunities

Conclusion

Arbitrage long-term options trading presents a compelling opportunity for investors seeking consistent returns in a risk-managed environment. By embracing the principles outlined in this article, leveraging the latest strategies, and actively pursuing professional development, investors can enhance their understanding of this complex market and position themselves for success. As you conclude this enlightening journey, we invite you to delve deeper into the intricate world of arbitrage and explore the potential rewards that await.