Introduction

In the labyrinth of financial markets, where fortunes are won and lost, options trading stands out as a uniquely powerful tool. Implied volatility, the underlying force shaping these options, is the key to unlocking their full potential. Embark on a captivating journey as we explore the intricacies of implied volatility, empowering you with the knowledge to harness its power and mitigate risk in your trading endeavors.

Image: www.warriortrading.com

Delving into Implied Volatility

Imagine a world where the future is not set in stone, where uncertainty reigns supreme. This is the realm of options trading, where contracts are bought and sold based on expectations of future price movements. Implied volatility is the market’s projection of just how uncertain these future movements might be. It represents the anticipated level of price fluctuations embedded within an option’s premium.

However, implied volatility is not merely a speculative number; it has tangible implications. Options with higher implied volatility are more expensive to purchase, as investors demand compensation for the perceived risk. Conversely, options with lower implied volatility carry a lower premium. Understanding the factors that influence implied volatility is crucial for both option buyers and sellers.

Understanding the Determinants

Implied volatility is a symphony of market forces, swayed by various factors. First and foremost is the underlying asset’s historical volatility. Markets with a history of large price swings tend to have higher implied volatility, as investors anticipate future turbulence. News and events also play a significant role. Unexpected developments, be they economic, political, or even natural disasters, can send implied volatility soaring.

Furthermore, supply and demand dynamics can influence implied volatility. When buyers eagerly seek options, their scarcity can drive up premiums and hence implied volatility. On the flip side, periods of low demand can lead to depressed implied volatility levels. Seasonality too has an effect, with year-end holidays and earnings seasons often witnessing elevated implied volatility.

Leveraging Implied Volatility for Profit

Traders can harness the power of implied volatility to enhance their returns. Volatility strategies involve capitalizing on the disparity between actual and implied volatility. If actual volatility remains within anticipated levels, options with higher-than-expected implied volatility may present opportunities for profit. Alternatively, options with lower implied volatility can yield attractive returns if actual volatility exceeds market expectations.

However, volatility trading is not without risk. Misjudgments can lead to substantial losses, so it’s crucial to approach such strategies with utmost prudence. Careful analysis, sound risk management techniques, and expert guidance are essential for success in this demanding arena.

Image: www.youtube.com

Expert Insights and Practical Tips

Navigating the treacherous waters of implied volatility demands wisdom gleaned from experienced traders and market veterans. Embrace their strategies and insights to bolster your trading acumen:

- Monitor historical and implied volatility levels: Track the underlying asset’s volatility patterns and compare them to current implied volatility levels.

- Stay abreast of market news: News and events can significantly impact implied volatility. Be well-informed and monitor developments closely.

- Assess supply and demand: Analyze the option market’s supply and demand dynamics to gauge market sentiment and potential price movements.

Trading Options With Implied Volatility

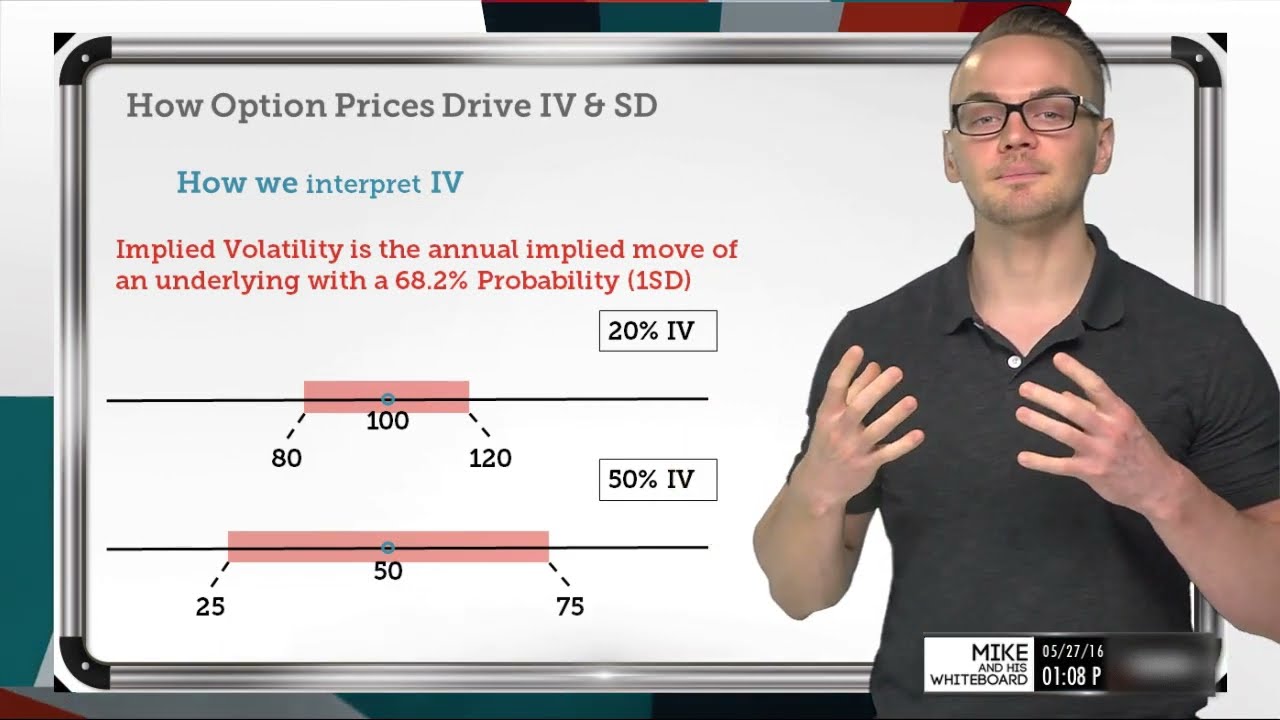

Image: www.youtube.com

Conclusion

Trading options with implied volatility is an art and a science, a delicate balance between risk and reward. By delving into the mechanics of implied volatility, traders can unlock the potential of options trading, strategically navigate market uncertainty, and enhance their financial aspirations. Approach this endeavor with a thirst for knowledge, a keen eye for opportunity, and an unwavering commitment to prudent risk management. May the winds of volatility propel your trading endeavors toward success.