Introduction

In the dynamic realm of investing, where opportunities abound and risks lurk, options trading has emerged as an alluring path for discerning minds. Amidst the myriad options markets, SMB options trading stands out as a captivating arena, offering immense potential for strategic investors.

Image: ebookfee.com

Venture into the world of SMB options, where smaller companies with market capitalizations ranging from $50 million to $2 billion present unique and potentially lucrative investment possibilities. This comprehensive guide will equip you with the foundational knowledge and actionable insights necessary to navigate the complexities of SMB options trading, maximizing your chances of success.

SMB Options Trading: A Foundation

SMB options are contracts that grant the holder the right, but not the obligation, to buy or sell a specific number of shares of an underlying stock at a predefined price, known as the strike price, within a specific time frame, called the expiration date. By leveraging these contracts, investors can amplify their exposure to specific stocks, speculate on stock price movements, or hedge against potential losses.

Understanding the different types of options and their respective strategies is paramount for effective SMB options trading. Call options bestow the right to buy the underlying stock, while put options赋予出售标的股票的权利. The choice between a call or a put option depends on the investor’s market outlook and investment goals.

Unveiling the Strategies of SMB Options

The versatility of SMB options enables the execution of diverse trading strategies, tailored to suit individual risk appetites and market conditions. Covered calls involve selling call options for stocks that the investor already owns, generating additional income while limiting potential gains. Protective puts offer downside protection by purchasing put options for stocks in an existing portfolio, mitigating the impact of potential price declines.

Iron condors represent a neutral strategy, combining the sale of an out-of-the-money call and put option with the purchase of an at-the-money call and put option. This strategy generates income through the sale of options and benefits from volatility in either direction. By mastering these strategies and adapting them to the dynamics of the SMB market, investors can enhance their trading prowess.

Expert Advice for Astute SMB Options Traders

Seasoned experts in the realm of options trading recommend prudent risk management practices. Disciplined position sizing, strategic diversification, and continuous monitoring are crucial for mitigating potential losses and maximizing returns. Moreover, thorough research, meticulous due diligence, and ongoing market analysis are indispensable elements in the pursuit of successful SMB options trading.

Image: www.smbtraining.com

Smb Options Trading

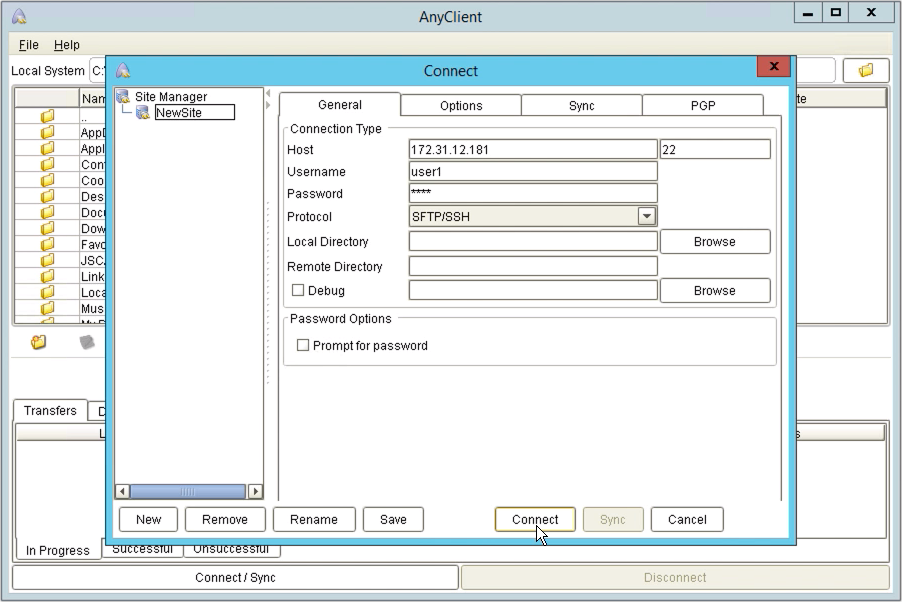

Image: www.jscape.com

Unlocking the Potential of SMB Options Trading

Embracing SMB options trading unveils a world of possibilities for investors. The ability to amplify returns, hedge against risks, and execute diverse strategies empowers investors with greater control over their financial destinies. However, it is imperative to exercise caution, embrace continuous learning, and seek expert guidance when necessary.

As you embark on this transformative journey, heed the wisdom of experts, stay abreast of market dynamics, and never cease to explore the ever-evolving landscape of SMB options trading. With dedication and discipline, you can unlock its full potential and forge a path towards financial prosperity.