The world of options trading can feel like a complex labyrinth, filled with exotic terms and intricate strategies. But at its core, it’s about predicting the future direction of an underlying asset. While many factors influence option prices, one crucial element often overlooked by beginners is volume. It’s the invisible hand that can guide traders towards profitable opportunities or warn them of impending risks. As a seasoned options trader, I vividly remember a time when I was completely captivated by an option’s high volume and its implications. It was a call option in a tech company that was on the verge of releasing a groundbreaking product. The volume was off the charts, and it gave me a clear indication of the market’s bullish sentiment. I jumped in, and within weeks, I witnessed a significant hike in the option’s price, resulting in a substantial profit. It was then I realized that understanding volume was not just an option, it was a necessity.

Image: www.youtube.com

Volume, in essence, reflects the degree of activity in an option contract. It quantifies the number of contracts traded during a specific period, whether it’s a day, an hour, or even a minute. This seemingly simple metric holds immense power, providing valuable insights into market sentiment and the potential trajectory of the underlying asset.

Unveiling the Secrets of Volume in Options Trading

The Significance of Volume in Options Trading

Understanding volume in options trading is akin to having a secret decoder ring for the market. It reveals a multitude of factors, from the strength of a trend to the degree of market conviction, and even the timing of potential shifts. Here’s how:

- Market Sentiment: High volume in options contracts often indicates a strong conviction in the market. Buyers are actively acquiring contracts, either bullishly betting on an asset’s rise or defensively hedging against potential losses. Conversely, low volume can be a sign of indecision or a lack of interest.

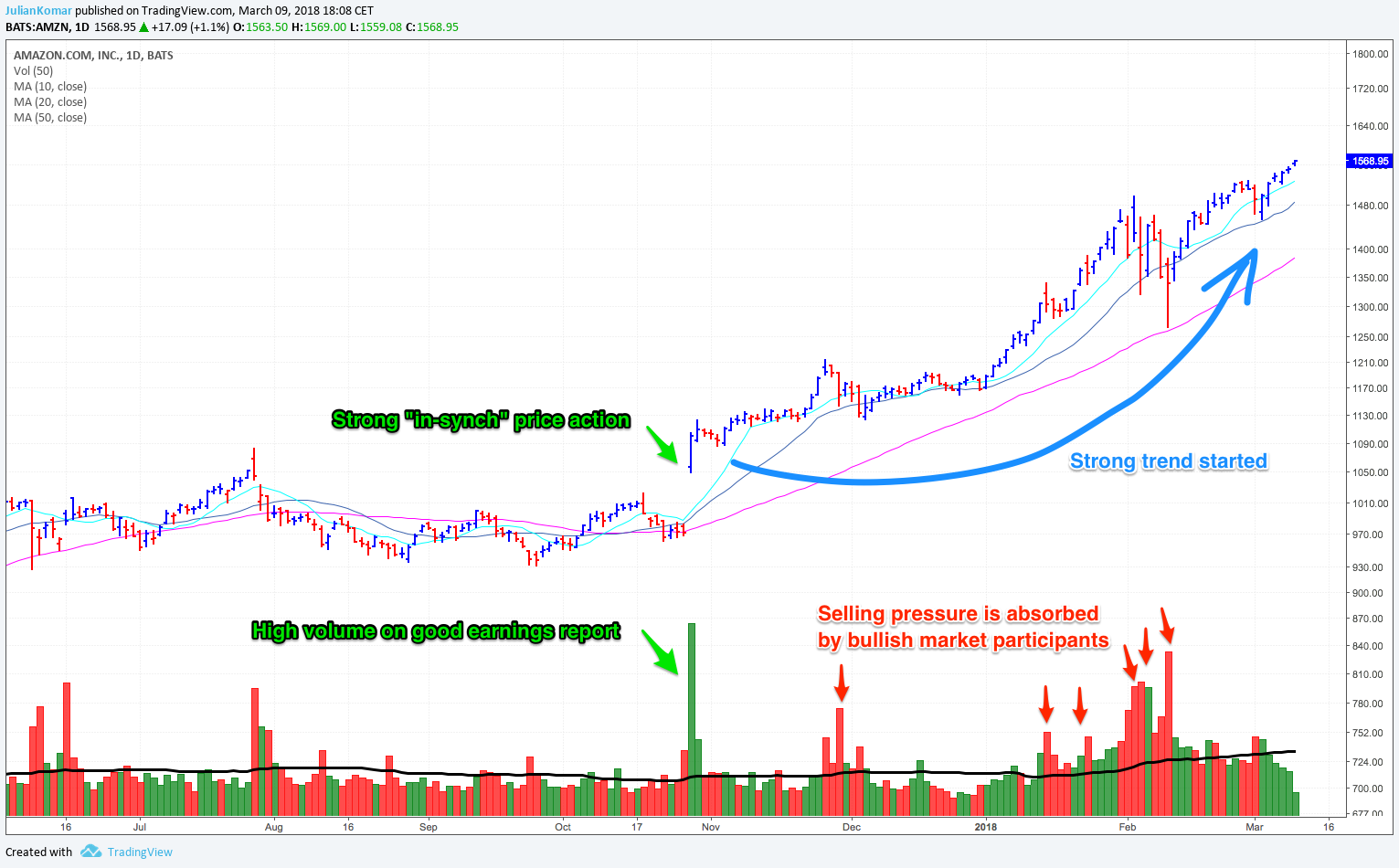

- Trend Confirmation: High volume accompanying a price move can validate a trend. If the price is rising and volume is soaring, it suggests that buyers are driving the upward momentum. Similarly, a strong downtrend with high volume indicates sellers are in control.

- Breakout Signals: Volume surges often accompany significant price movements like breakouts or breakdowns. When a price barriers is broken, a high volume surge can signal a more powerful and sustainable move.

- Volatility: High volume often coincides with higher implied volatility. This is because options traders price in the potential for price swings, and higher activity often indicates a larger range of expected movements.

How Volume Influences Option Prices

Volume plays a pivotal role in shaping option prices. Here’s a simplified breakdown:

- Increased Demand: High volume often translates to increased demand for options contracts. As buyers rush in, they drive up the price of the contract.

- Liquidity: High volume signifies a more liquid market. This means traders can easily buy or sell contracts without significantly impacting the price. High liquidity is generally preferred, as it allows for more efficient execution and reduces slippage.

- Implied Volatility: High volume can indicate an increase in implied volatility. This is because greater trading activity implies a greater range of potential price movements, making options contracts more valuable.

Image: julian-komar.com

Key Metrics and Indicators to Analyze Volume

Volume, by itself, is just a raw number. To truly leverage its power, you need to incorporate it into your analysis alongside other key metrics and indicators. Here are a few:

- Open Interest: This metric measures the total number of outstanding contracts. A significant increase in open interest accompanied by high volume can indicate a strengthening trend.

- Volume-Weighted Average Price (VWAP): This indicator considers both volume and price to provide a more comprehensive picture of price action. Traders often use VWAP as a reference point for buy or sell decisions.

- Volume Profile: This visualization tool displays the volume distribution at various price levels. It helps identify price areas with high concentration of volume, which can act as potential support or resistance levels.

The Latest Trends in Volume Analysis

The field of volume analysis is constantly evolving, with new tools and techniques emerging to help traders capitalize on the insights it provides. Here are some current trends:

- Artificial Intelligence (AI): AI algorithms are increasingly being used to analyze volume data and identify patterns that human traders may miss. AI-powered software can detect subtle changes in volume, providing real-time alerts about potential market shifts.

- Machine Learning (ML): ML models are trained on vast amounts of historical volume data to predict future price movements. This data-driven approach can help traders make more informed decisions based on past patterns and trends.

- Social Media Sentiment: Social media platforms are becoming a valuable source of data for analyzing market sentiment. Tools that track social media mentions and sentiment can provide insights into public opinion, which can influence volume and price movements.

Expert Tips for Utilizing Volume in Your Trading

Harnessing the power of volume requires a blend of technical knowledge and practical application. Here are some expert tips to optimize your volume analysis:

- Focus on Relative Volume: Instead of just looking at absolute volume, compare current volume levels to historical averages. A sudden spike in volume can signal a significant shift, but it’s crucial to understand the context.

- Combine Volume with Other Indicators: Volume alone isn’t a foolproof predictor. Use it in conjunction with technical indicators, such as moving averages, oscillators, and candlestick patterns, for a more comprehensive view.

- Experiment with Different Timeframes: Explore volume data on various timeframes, from intraday to weekly. Different timeframes can reveal different patterns and insights, adding depth to your analysis.

- Use Volume Profile Tools: Volume profile tools offer valuable insights into the distribution of volume at different price levels. Leverage them to identify support and resistance zones.

- Backtest Your Strategies: Develop strategies that incorporate volume data and backtest them rigorously on historical data. This iterative process can fine-tune your approach and optimize your trading decisions.

Explanation of Tips

Focusing on relative volume empowers you to spot anomalies and significant shifts within a specific asset. Comparing current volume with historical averages provides a benchmark for gauging the extent of market activity and its potential impact. For example, a stock with a consistent average daily volume of 1 million shares suddenly trades 5 million shares in a single day. This anomaly could suggest a significant news event, a breakout, or a large institutional trade, all of which could affect the price movement. This emphasizes the importance of analyzing volume in the context of historical data.

Furthermore, combining volume with other indicators creates a more robust and nuanced approach to your trading. If you see high volume alongside a breakout from a long-term trend line, it strengthens the signal and suggests a more sustainable move. However, if high volume coincides with a price decline below a major support level, it could suggest a potential reversal or a stronger bearish trend. It’s about piecing together a bigger puzzle, considering multiple data points to arrive at a well-informed conclusion.

FAQ

- What is the difference between volume and open interest?

- Volume represents the number of contracts traded during a specific period, while open interest measures the total number of outstanding contracts. Volume is a flow metric, while open interest is a stock metric.

- How can I track volume in options trading?

- Most reputable trading platforms provide real-time volume data for options contracts. You can also use specialized charting software that incorporates volume indicators and profilers.

- Is high volume always a good thing?

- Not necessarily. While high volume can indicate a strong trend or a breakout, it can also signal an imminent reversal. Always consider the context and other indicators before making trading decisions based solely on volume.

- How does volume affect implied volatility?

- High volume often leads to increased implied volatility. This is because more trading activity suggests a wider range of potential price movements. Increased implied volatility can make options contracts more expensive.

- What are some good resources for learning more about volume analysis?

- There are numerous books, websites, and online courses dedicated to volume analysis in options trading. You can also find insightful articles and discussions on trading forums and social media platforms.

What Is Volume In Options Trading

Conclusion

Understanding volume in options trading is essential for deciphering the market’s whispers and navigating the complexities of price movements. By learning to interpret volume data, you gain a more informed understanding of the market’s sentiment, trend strength, and potential for future price moves. It’s about more than just numbers; it’s about unlocking the hidden language of the market and making more informed trading decisions. Are you ready to dive deeper into the world of volume analysis and take your options trading to the next level?