Trading options can be an exciting yet daunting endeavor, especially when it comes to understanding the intricacies of market behavior. One crucial aspect of options trading that often raises questions is “volume.” In this in-depth exploration, we delve into the depths of what volume means in options trading, empowering you to decode the language of the market and make informed trading decisions.

Image: julian-komar.com

Defining Volume: The Pulse of the Market

Volume, in the context of options trading, refers to the number of contracts that have been traded within a specific period, typically a day or a session. It serves as a potent indicator of market sentiment, providing insights into the level of interest and activity surrounding a particular option contract. A high volume suggests that many traders are participating in the market, signaling strong interest in or speculation surrounding the underlying asset.

Conversely, a low volume can indicate a lack of interest or market apathy. Options with low volume may experience wider bid-ask spreads, making it more challenging to enter or exit trades at favorable prices. By closely monitoring volume levels, traders can gauge the market’s enthusiasm and make more informed decisions.

Volume and Volatility: A Symbiotic Relationship

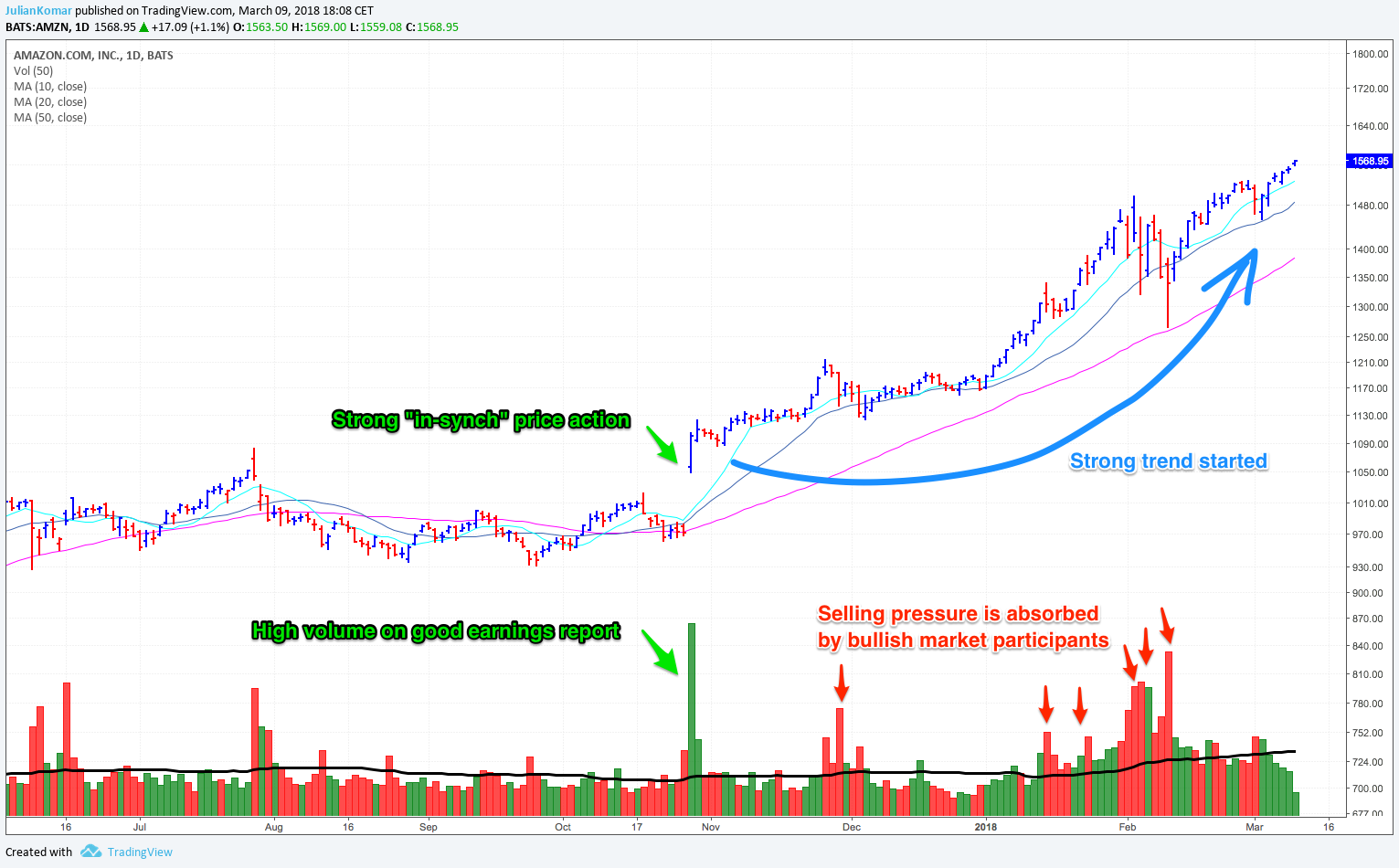

Volume and volatility often go hand in hand. High-volume periods often coincide with increased market volatility, as traders react to news events, economic data, or geopolitical uncertainties. This heightened activity can lead to rapid price fluctuations, creating both opportunities and risks for traders.

Volume can also serve as a precursor to volatility. A sudden spike in volume can alert traders to potential market shifts, providing a heads-up on impending price swings. Savvy traders use volume analysis to anticipate market movements and position themselves accordingly.

Open Interest: A Complementary Metric

Open interest, another crucial metric in options trading, refers to the number of option contracts that are currently outstanding and have not yet been closed or expired. It provides insights into the cumulative positions taken by market participants and can offer additional context to volume analysis.

For instance, a high volume accompanied by increasing open interest suggests that traders are not only actively trading options but also holding onto their positions, indicating strong conviction or market optimism. Conversely, high volume coupled with decreasing open interest could indicate traders exiting their positions, potentially signaling a change in trend.

Image: howtotradeonforex.github.io

What Does Volume Mean In Options Trading

Image: www.schwab.com

Volume Profiles: Unveiling Market Structure

Volume profiles are graphical representations that plot the volume of trades at different price levels over time. These profiles provide a visual representation of the market’s distribution of interest and can help traders identify key support and resistance levels.

Areas with high volume indicate price levels where orders have been concentrated, creating potential barriers to price movement. Conversely, areas with low volume suggest price levels with less resistance, facilitating smoother price transitions. Volume profiles are powerful tools for identifying entry and exit points, as well as identifying potential turning points in the market.

By combining volume analysis with other technical indicators, you gain a more comprehensive understanding of market dynamics, enabling you to make more informed trading decisions and navigate the ever-changing landscape of options trading with confidence. Remember, knowledge is power, and the mastery of volume will empower you with a valuable edge in the pursuit of trading success.