“In the intricate realm of market trading, options serve as powerful financial tools that enable investors to navigate risk and pursue potential profits. And among the intricate elements shaping options’ behavior, implied volatility (IV) stands out as a beacon of significance.”

Understanding Implied Volatility: A Guiding Light

Implied volatility, a cornerstone of options trading, represents an anticipated market forecast of an asset’s future price volatility. It captures the collective expectations of traders, reflecting their estimations of the potential price swings over a specified period. Unlike historical volatility, which measures past price fluctuations, IV is a forward-looking metric that informs traders’ assessments of risk and return.

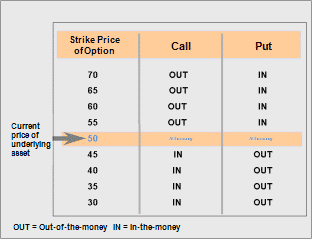

Image: optionstradingiq.com

IV is an extremely dynamic measure, constantly fluctuating in response to market conditions, news events, and economic data. High IV indicates heightened expectations of significant price movements, often associated with periods of uncertainty or market turmoil, while low IV suggests a relatively stable market environment with limited anticipated price fluctuations.

The IV-Price Relationship: A Symbiotic Dance

The relationship between IV and option prices is a delicate dance, one influencing the other in a continuous feedback loop. Higher IV typically translates into higher option premiums, as traders demand compensation for taking on greater risk. Conversely, lower IV often leads to lower premiums. This symbiotic relationship highlights the importance of IV in determining the value and appeal of options contracts.

Expert Insights: Navigating IV’s Impact

Seasoned traders and analysts emphasize the crucial role of IV in crafting effective options strategies.

- Consider IV when selecting options: Options with higher IV tend to be more expensive but offer the potential for greater returns if market volatility meets or exceeds expectations.

- Monitor IV changes: Tracking IV fluctuations allows traders to anticipate market shifts and adjust their positions accordingly.

- Utilize IV in risk assessment: IV provides insights into potential market turbulence, enabling traders to calibrate their risk tolerance and implement appropriate risk management strategies.

FAQ: Demystifying Option IV

Q: How is IV calculated?

A: IV is derived from option prices using complex mathematical models that factor in market sentiment and supply and demand dynamics.

Q: What factors influence IV?

A: IV is influenced by a host of variables, including market conditions, time to option expiration, liquidity, and market sentiment.

Q: Can IV be a misleading indicator?

A: While IV serves as a potent tool for market analysis, it’s essential to recognize its limitations. IV is a subjective measure that can be influenced by excessive speculation or temporary market dynamics.

Image: aapleincome.blogspot.com

Market Trading Options Iv Number Means

Image: www.pinterest.com

Conclusion: Empowering Traders with IV Mastery

Implied volatility stands as an indispensable metric in the arsenal of market trading options. By understanding and leveraging IV, traders gain an edge in deciphering market sentiment and optimizing their trading strategies. Whether you’re a seasoned veteran or just beginning your options journey, mastering IV’s complexities can elevate your trading prowess.

Do you resonate with the allure of market trading options and seek to expand your understanding of IV? Engage with us, pose additional inquiries, and let’s delve deeper into the fascinating world of options trading.