Introduction

Have you ever wondered how to determine the point at which your option trading strategy becomes profitable? Understanding the concept of break-even in option trading is essential for any trader seeking success in this complex market. In this comprehensive guide, we will delve deep into the intricacies of break-even, providing you with the knowledge and tools to optimize your trading decisions.

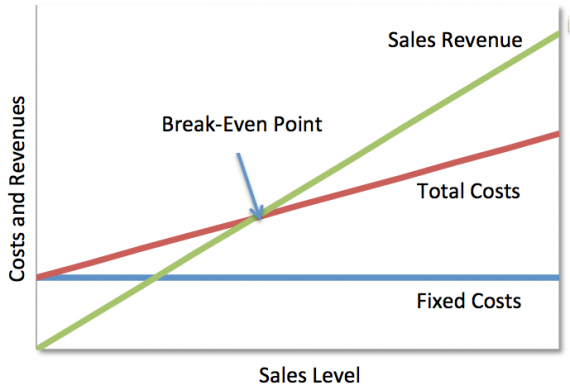

Image: www.onpulson.de

What is Break Even in Option Trading?

In option trading, break even represents the stock price at which the trader’s profit or loss equals zero. It is calculated by considering the option’s premium paid, the strike price, any commissions incurred, and the underlying asset’s price at expiration. Reaching break-even means that the trader has recovered the initial investment made in the option.

Calculating Break Even

The break-even price for a call option can be calculated using the following formula:

Break-even price = Strike price + (Premium paid - Commissions) / 100Similarly, for a put option, the formula is:

Break-even price = Strike price - (Premium paid - Commissions) / 100Factors Affecting Break Even

Several factors influence the break-even price, including:

- Option premium: The amount of money paid to acquire the option.

- Strike price: The price at which the trader has the right to buy (call option) or sell (put option) the underlying asset.

- Underlying asset price: The price of the underlying stock, index, or currency against which the option is traded.

- Time to expiration: The length of time until the option contract expires.

- Volatility: The level of price fluctuations in the underlying asset.

- Commission: Fees charged by the brokerage firm for executing the trade.

Image: www.excel-pmt.com

Significance of Break Even

Understanding break-even is crucial for option traders because it allows them to:

- Set realistic profit targets: By knowing the break-even point, traders can determine the minimum price movement required to achieve profitability.

- Assess risk: Calculating break-even helps traders manage risk by identifying the point at which they will start incurring losses.

- Make informed decisions: With a clear understanding of break-even, traders can make sound trading decisions based on market trends and their own risk tolerance.

Tips and Expert Advice

To maximize profitability in option trading, consider these expert tips:

- Research thoroughly: Gain a deep understanding of the underlying asset and market conditions.

- Choose options with appropriate risk-reward ratios: Balance potential profit with the potential for loss.

- Manage your risk: Use stop-loss orders and position sizing to limit potential losses.

- Consider the time-value component: Understand the decay of an option’s value over time.

- Stay updated with market news and analysis: Monitor market trends to make informed trading decisions.

Frequently Asked Questions

Q: How do I know if my option trade is profitable?

A: Compare the stock price at expiration with the break-even price. If the stock price is above break-even for a call option or below break-even for a put option, your trade is profitable.

Q: What happens if the stock price is below break-even for a call option?

A: In this case, you will lose the premium paid for the option.

Q: Can I adjust my break-even price after the trade has been executed?

A: No, once the trade is executed, the break-even price is fixed.

What Is Break Even In Option Trading

Conclusion

Break even is a fundamental concept in option trading that empowers traders to make informed trading decisions, set realistic profit targets, and manage risk. By incorporating break-even analysis into your trading strategy, you can increase your chances of success in this dynamic and challenging market.

Are you interested in learning more about the fascinating world of option trading? Explore our website and social media channels for a wealth of resources, expert insights, and community support. Join us as we navigate the intricate landscapes of the options market together.