Understanding the Break-Even Point in Options Trading

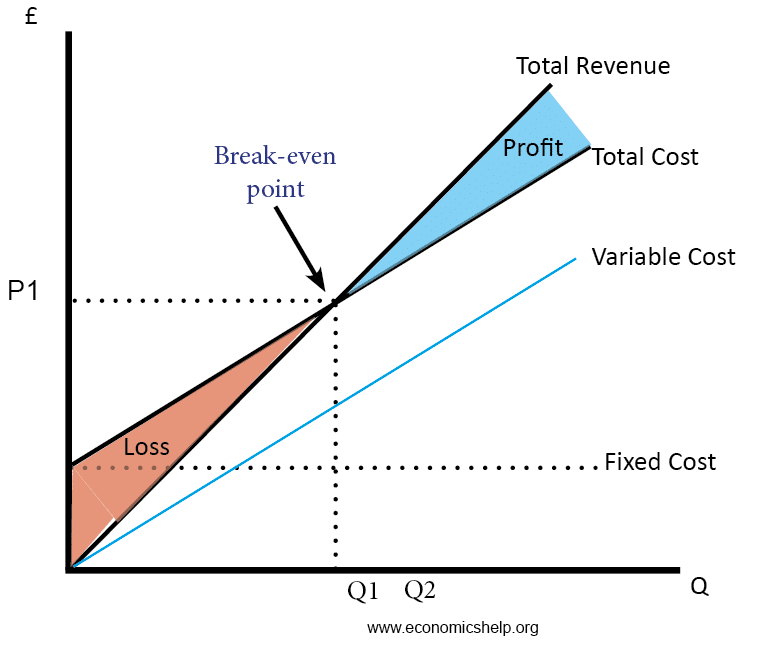

Options trading involves the buying and selling of options contracts, which provide traders with rights but do not obligate them to buy or sell the underlying asset. The break-even point in options trading refers to the price at which the premium paid for the option equals the profit or loss made on the trade. Understanding this concept is crucial for traders to manage risk effectively and enhance their profitability.

Image: www.youtube.com

Components of Break-Even Point in Options Trading

The break-even point in options trading is calculated differently depending on whether the option is a call or a put option:

- Call Option: Break-even point = Strike price + Premium paid

- Put Option: Break-even point = Strike price – Premium paid

Example of Calculating Break-Even Point

Consider the following example:

- You purchase a call option with a strike price of $100 for a premium of $5.

- The break-even point in this case would be $105 (Strike price + Premium paid)

This means that once the stock price rises above $105, you will start making a profit on your option trade.

Impact of Volatility on Break-Even Point

Volatility, which measures the degree of price fluctuations in the underlying asset, significantly affects the break-even point in options trading. Higher volatility results in a wider range of possible outcomes, making the break-even point more flexible. On the other hand, lower volatility leads to a narrower range, making the break-even point more precise.

Image: www.economicshelp.org

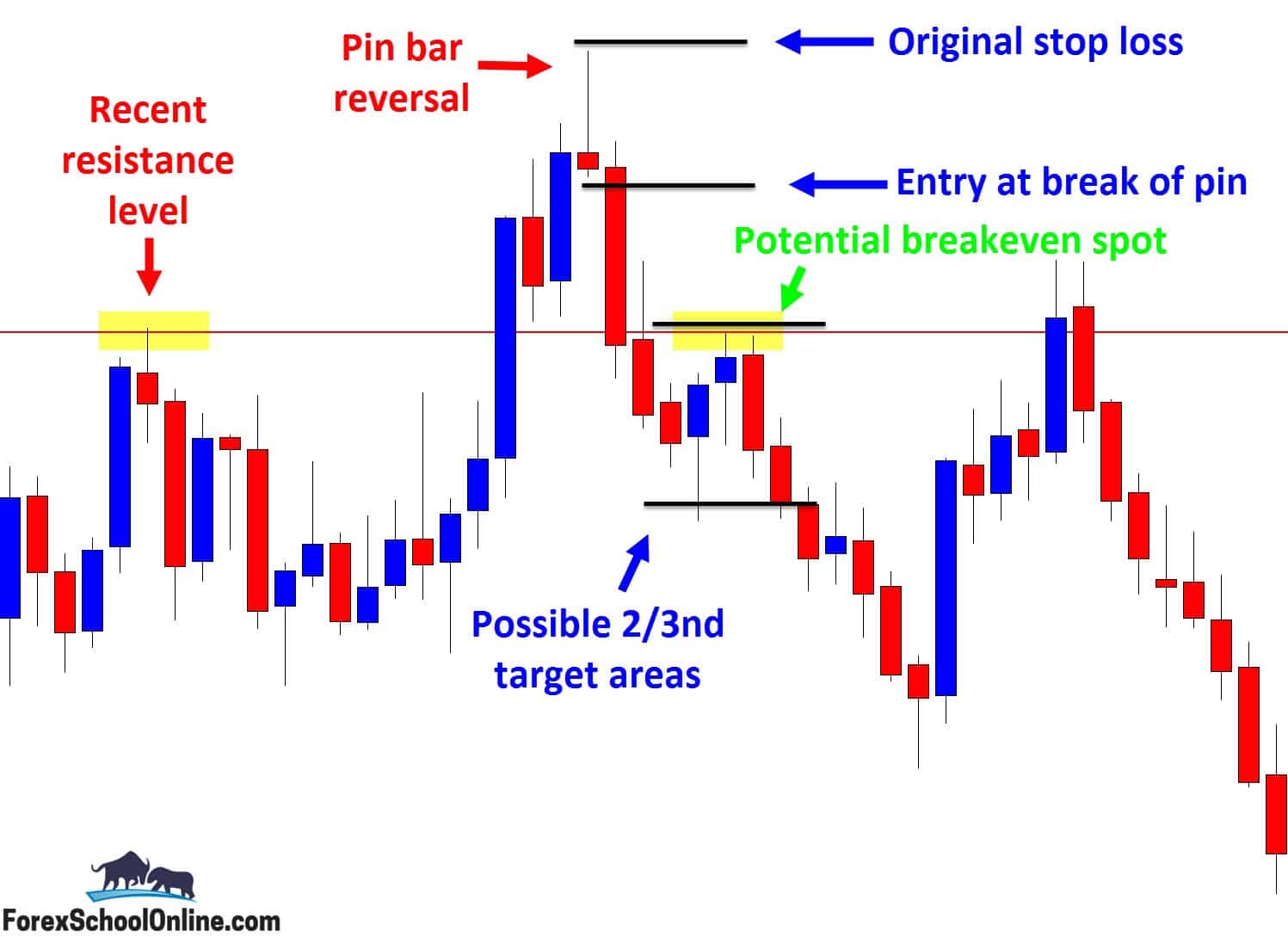

Tips to Enhance Profitability through Break-Even Point Analysis

- Determine the Optimal Entry Point: Analyze the historical volatility of the underlying asset to identify potential trading opportunities at favorable break-even points.

- Plan Exit Strategies: Based on the break-even point, formulate clear exit strategies to manage risk and maximize profits.

- Use Options Chains: Use options chains to identify options contracts with different strike prices and premiums to find contracts that match your break-even point requirements.

- Employ Risk Management Techniques: Incorporate risk management tools such as stop-loss orders and hedging strategies to reduce the potential for significant losses.

Expert Advice

- *“Focus on Relative Value”: Engage in thorough research to identify options chains that offer attractive relative value compared to the implied volatility.” – Robert Parkinson, Options Trading Expert

- *“Trade with Discipline”: Consistently adhere to established trading plans based on break-even point analysis to maintain discipline and avoid emotional decision-making.” – Karen Irvine, Options Trading Coach

FAQ on Break-Even Point in Options Trading

Q: What factors influence the break-even point in options trading?

A: Premium paid, strike price, volatility, time to expiration, and interest rates.

Q: Is the break-even point fixed throughout the life of the option?

A: No, the break-even point changes as the price of the underlying asset fluctuates.

Q: What happens if the stock price remains below the break-even point?

A: You will lose the premium paid on the option.

Q: What is the significance of volatility in break-even point analysis?

A: Higher volatility expands the potential range of outcomes, affecting the precision of the break-even point calculation.

Options Trading Break Even

Image: www.forexschoolonline.com

Conclusion

Understanding the concept of the break-even point is essential for options traders to make informed trading decisions. By analyzing the components and impact of volatility, traders can enhance their profitability and manage risk more effectively. Remember, mastering this concept is a journey that requires continuous learning and disciplined execution.

Are you ready to delve deeper into the world of options trading and leverage break-even point analysis to your advantage? Engage in further research, practice your strategies, and seek guidance from experts to refine your skills and unlock its full potential.