The options market is a vast and complex landscape, filled with numerous strategies and techniques to profit from market movements. Among these, options gap trading stands out as a specialized and potentially lucrative strategy. This article delves into the intricacies of options gap trading, providing a comprehensive guide for understanding its concepts, implementation, and potential rewards.

Image: thewaverlyfl.com

What is Options Gap Trading?

Options gap trading involves identifying and capitalizing on gaps in the option chain. These gaps occur when there is an absence of options at a particular strike price, creating a price discontinuity. By exploiting these gaps, traders can potentially profit from the implied volatility and expected price movements.

Historical Roots and Evolution

Options gap trading has its origins in the early days of options trading when the market was less efficient and liquidity was limited. The lack of continuous pricing at various strike prices led to the formation of price gaps. Over time, as the options market evolved and became more sophisticated, the occurrence of significant gaps became less frequent. However, opportunities still arise, particularly in volatile markets or during periods of rapid price movements.

Basic Concepts and Strategies

Fundamental to understanding options gap trading is the concept of implied volatility. Implied volatility measures the market’s expectation of future price volatility and is reflected in the premiums of options contracts. Traders identify gaps in the option chain where the implied volatility is relatively high, indicating that the market expects a substantial price movement.

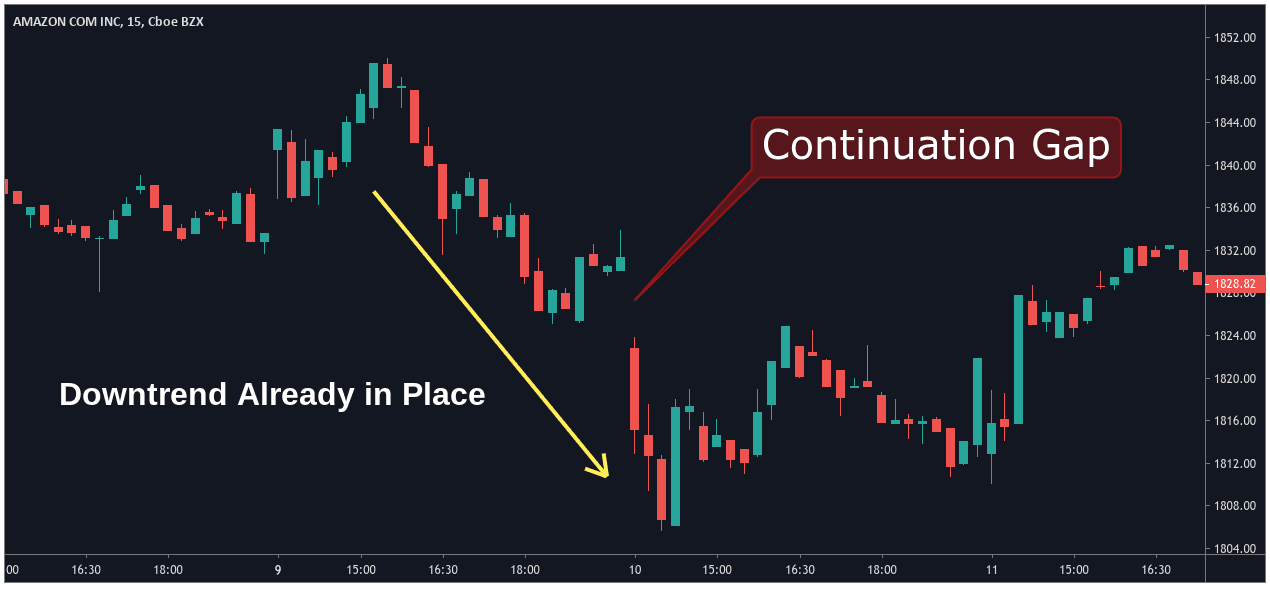

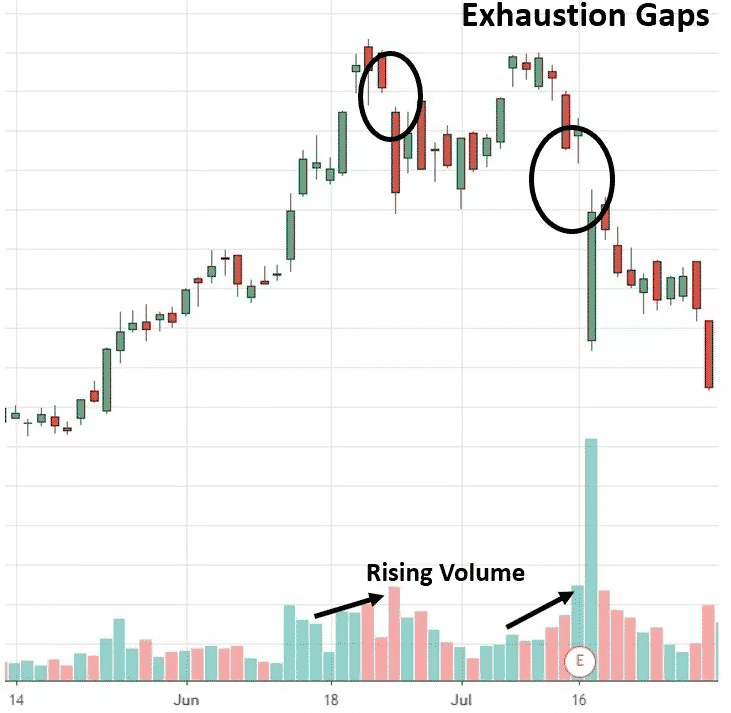

There are two primary strategies employed in options gap trading: gap filling and gap continuation. Gap filling involves purchasing options at the strike price of the gap in anticipation that the price will move to fill the gap. On the other hand, gap continuation involves selling options at the strike price of the gap with the expectation that the price will continue moving in the same direction.

Image: www.asktraders.com

Real-World Applications and Examples

Consider a stock trading at $50 per share. Suppose there is a gap in the option chain between the $49 strike price and the $51 strike price. A trader who believes the stock price will fall might purchase the $49 put option to profit from the gap being filled. Conversely, if the trader anticipates the stock price to rise, they could sell the $51 call option to benefit from the continuation of the uptrend.

Identifying and Exploiting Gaps

To identify potential gaps, traders use specialized software or platforms that analyze the option chain. These tools provide a real-time view of the available options and highlight any price discontinuities. Key factors to consider include the width of the gap, the implied volatility of the underlying option, and the overall market conditions.

Risks and Considerations

Like all trading strategies, options gap trading carries inherent risks. The most significant risk is that the gap may not be filled, resulting in a loss. Other risks include high transaction costs, the time decay of options premiums, and potential for large losses if the market moves against the trader’s position.

Recent Trends and Developments

In recent years, options gap trading has gained renewed interest due to the proliferation of advanced trading platforms and the increased volatility in the equity markets. The emergence of algorithmic trading and artificial intelligence has also made it easier for traders to identify and capitalize on trading opportunities, including gaps in the option chain.

Options Gap Trading

Image: optionstradingiq.com

Incorporating Gap Trading into Your Strategy

For experienced traders, options gap trading can be a valuable addition to their trading arsenal. However, it is crucial to approach this strategy with a deep understanding of options trading, a risk management framework, and meticulous analysis. By carefully evaluating market conditions, identifying gaps, and implementing appropriate trading strategies, traders can potentially unlock the profit opportunities presented by gaps in the option chain.