Deciphering the Dynamics of Gap Trading

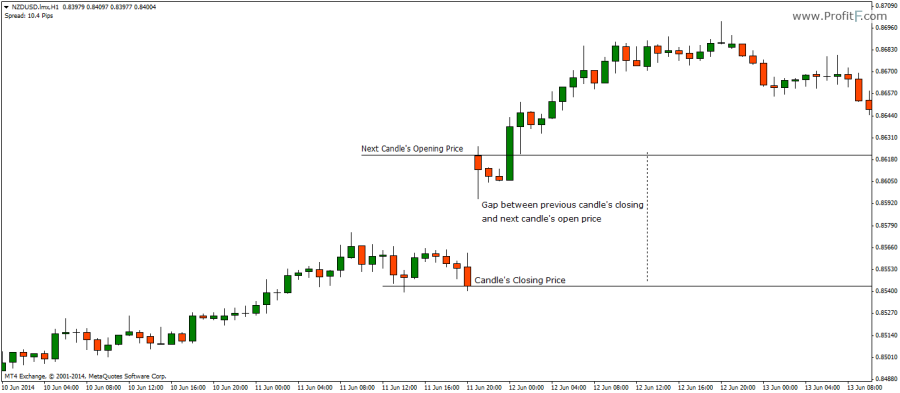

Gap trading, a captivating strategy in the financial realm, offers the potential for substantial rewards. It involves exploiting price gaps that occur when the market opens at a significantly different level from its previous close. These gaps can arise due to unforeseen events, news announcements, or changes in market sentiment. Understanding and effectively leveraging gap trading techniques, particularly in conjunction with options, can empower you to maximize profits while mitigating risks.

Image: www.profitf.com

Unlocking the Mechanism of Gap Trading

Gap trading with options entails identifying gaps in the market and strategically placing trades based on the anticipated direction of the stock’s movement. Options, derivative instruments that grant the holder the right but not the obligation to buy (call option) or sell (put option) a stock at a specified price by a certain date, offer flexibility and controlled risk exposure.

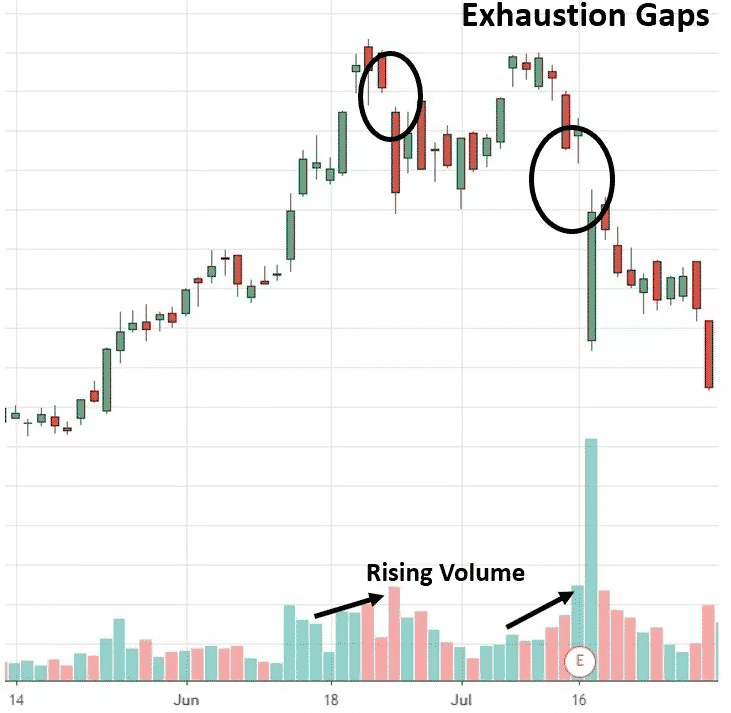

Trading in the Zone: Mastering Gap Trading Strategies

Entering the gap trading arena requires a discerning approach, utilizing a proven strategy tailored to your risk tolerance and market conditions. One widely recognized approach focuses on identifying stocks with high volatility that have created gaps and then entering call or put options based on the expected direction of the stock’s movement. Another popular strategy involves exploiting gaps that form at support or resistance levels, indicating potential opportunities for profitable trades.

Professional Insights: Navigating the Gap Trading Landscape

Harnessing expert guidance can significantly enhance your gap trading acumen. Seek wisdom from seasoned traders and investment advisors who possess in-depth knowledge of this specialized technique. They can provide valuable insights, assisting you in refining your strategies and adapting to evolving market conditions.

Image: optionstradingiq.com

Actionable Tips for Gap Trading Success

-

Meticulously research potential trading opportunities, thoroughly analyzing market conditions, company performance, and industry trends.

-

Maintain a disciplined approach, adhering to predetermined trading rules and risk management principles to avoid impulsive decisions.

-

Leverage technology, utilizing sophisticated trading platforms and analytical tools to optimize trade execution and decision-making.

-

Steer clear of excessive leverage, as amplified exposure can magnify potential losses beyond your risk tolerance.

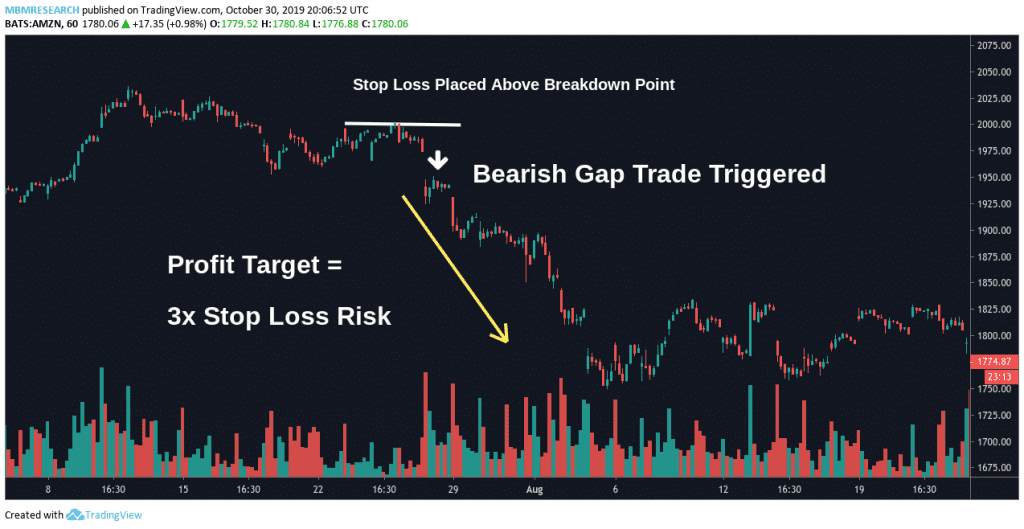

Gap Trading With Options

Image: www.asktraders.com

Conclusion: Empowering Your Financial Journey

Embracing gap trading with options can empower you with the tools to navigate financial markets effectively. Through meticulous planning, discerning strategy execution, and continuous learning, you can unlock the potential of this compelling technique. Remember to trade within the confines of your risk tolerance and continuously seek knowledge to refine your approach. May the markets favor your endeavors as you embark on this exciting path.