Introduction: Unveiling the Power of Limit Prices

Imagine yourself stepping into the exhilarating world of options trading, where every decision can shape the course of your financial journey. Amidst the vast array of strategies, one concept stands out: the limit price. This powerful tool, when wielded wisely, can unlock doors to both profits and protection. In this comprehensive guide, we’ll delve into the intricacies of limit prices, empowering you to navigate the options market with confidence and precision.

Image: www.projectfinance.com

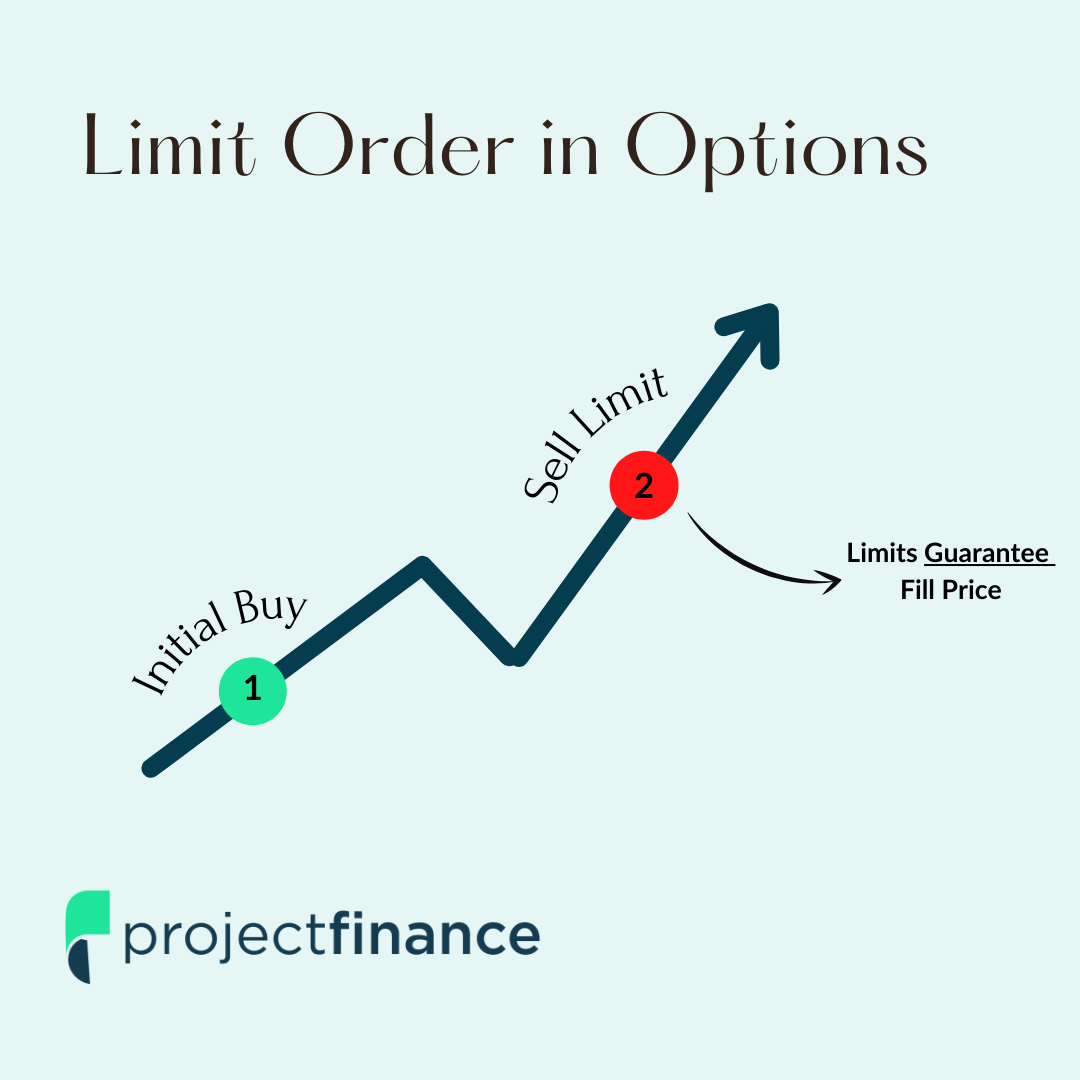

What is Limit Price?

In options trading, a limit price is the maximum or minimum price you’re willing to pay or receive for an option contract. When buying an option, setting a limit price prevents you from overpaying, ensuring you secure the desired premium within your predetermined range. Conversely, when selling an option, a limit price guards against selling below your desired price, safeguarding your potential profit.

Types of Limit Orders

Limit orders fall into two categories: buy limit orders and sell limit orders.

-

Buy Limit Order: This order instructs your broker to purchase an option contract at or below a specified limit price. It prevents you from paying a higher premium than the one indicated.

-

Sell Limit Order: This order directs your broker to sell an option contract at or above a predetermined limit price. By doing so, you avoid selling your option at a price lower than the desired minimum.

Benefits of Using Limit Prices

Limit prices offer a multitude of advantages in options trading, empowering you to:

-

Control Pricing: Limit prices give you the upper hand in pricing your trades, allowing you to target specific premium levels for both buying and selling options.

-

Prevent Emotional Decisions: When emotions run high during volatile market conditions, limit prices serve as a guiding light, preventing impulsive and potentially detrimental trades.

-

Execute Precision Trades: Limit orders let you specify the exact price at which you wish to enter or exit a trade, eliminating the risk of executing at unfavorable prices.

-

Manage Risk: By setting limit prices, you define your maximum loss or minimum profit, enabling effective risk management.

Image: bestpricedvdplaybd.blogspot.com

Using Limit Prices Effectively

Mastering the use of limit prices requires a combination of understanding and strategy:

-

Consider Market Volatility: The volatility of the underlying asset influences the effectiveness of limit prices. In highly volatile markets, setting tight limit prices may result in missed opportunities, while overly wide limits increase exposure to adverse price swings.

-

Research and Patience: Thoroughly analyze the historical price action of the underlying asset and the implied volatility of the option to determine appropriate limit prices. Patience is crucial, as executing trades immediately might not always align with your desired price levels.

-

Monitor Live Quotes: Stay informed of real-time market quotes to make informed decisions about your limit prices. By observing the price movement, you can adjust your limits accordingly.

-

Use Advanced Options Strategies: Explore advanced options strategies, such as combination orders, that incorporate limit prices to enhance profitability and mitigate risk.

Expert Insights

“Limit prices are crucial for disciplined and strategic options trading. By setting them proactively, you eliminate emotional decision-making and maintain control over your trades,” advises Mark Douglas, a renowned trading psychologist.

“Limit prices provide a safety net, especially in fast-moving markets. They protect you from executing trades at unfavorable prices and enable precise profit-taking,” adds Maryanne Barone, a seasoned options trader and educator.

What Is Limit Price In Options Trading

Image: www.ezyeducation.co.uk

Conclusion: Empowering Traders with Limit Prices

In the ever-evolving landscape of options trading, limit prices stand as indispensable tools for both seasoned investors and aspiring individuals seeking to navigate the markets with precision and confidence. By embracing the knowledge and insights presented in this comprehensive guide, you’ll unlock the potential of limit prices, enhancing your ability to make informed trades, manage risk, and achieve financial success. Remember, as you embark on your options trading journey, let limit prices serve as your compass, guiding you toward the realization of your financial goals.